When contemplating investment decisions, Wall Street analysts play a pivotal role in shaping investors’ sentiments. The sway of the brokerage assessments on the stock market dance floor is substantial. But, do these recommendations truly hold the key to wise investments?

Before we untangle the threads of brokerage recommendations and how investors can leverage them, let’s decipher the Wall Street melody surrounding Agnico Eagle Mines AEM.

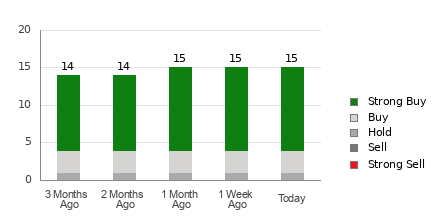

At present, Agnico boasts an average brokerage recommendation of 1.33, positioned between the realms of Strong Buy and Buy on a scale stretching from 1 to 5. This calculation is a confluence of actual recommendations (Buy, Hold, Sell, etc.) emanating from 15 brokerage firms.

Within the ensemble of 15 recommendations steering the current Average Brokerage Recommendation (ABR), 11 chant the anthem of Strong Buy, while three croon the tune of Buy. Together, Strong Buy and Buy melodies harmonize to form 73.3% and 20% of the symphony.

Navigating Through the Brokerage Recommendation Currents for AEM

The ABR suggests a serenade towards acquiring Agnico, yet swaying solely on this ballad may not lead to a harmonious investment. Research echoes a chorus wherein brokerage framers’ recommendations hold minimal sway in guiding investors towards stocks poised for ascension in price.

The underlying reason? The vested stakes of brokerage entities in the market performers they dissect often orchestrate a rhapsodic bias, with analysts spinning in a favorable circle around stocks they cover. In our symphony of research, a “Strong Sell” sits lone among five “Strong Buy” notes, revealing the intrinsic dissonance present.

In essence, the brokerage realm’s alignment might not always play in tandem with the retail investor’s compass, seldom charting the course of a stock’s price trajectory. Thus, these recommendations could serve as a validating harmony to your personal research or a signal post proven adept at foreseeing a stock’s dance moves.

The Zacks Rank, our prized stock evaluation tool impeccably audited externally, categorizes equities into quintiles, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), offering a prophetic gaze into a stock’s impending price performance. Hence, utilizing the ABR to echo the Zacks Rank could metamorphose into a profitable investment overture.

Distinct Notes: The Zacks Rank vs. ABR

While both the Zacks Rank and ABR chime in within a 1-5 tempo, their tunes emanate from disparate instrumental ensembles.

Broker veredicts form the bedrock for the ABR’s composition, generally scored in decimals (e.g., 1.28). Conversely, the Zacks Rank fashions itself as a melodic quantitative model, attuned to the symphony of earnings estimate revisions. Its score swings in whole notes – 1 through 5.

The age-old tale still rings true; brokerage analyst sonnets are skewed favorably, akin to an elaborate ruse. Conversely, in the Zacks Rank sonnet, the essence of earnings estimate revisions plays the lead, showcasing a profound correlation with immediate price jouneys.

Moreover, the Zacks Rank melody distributes its notes uniformly among all stocks adopting brokerage analysts’ earnings wisdom for the current fiscal year, ensuring a harmonious balance persists even in the crescendo of market volatility.

Another sonnet in the ode of discrepancies between the ABR and Zacks Rank is the element of temporal grace. The ABR, often trailing behind in its recital, narrates an earlier verse. Contrarily, the Zacks Rank waltz whisks in the essence of time, swirling in synchrony with analysts revising their earnings cacophony, ensuring a timelier tale of future price portraits.

Setting the Stage: Should You Invest in AEM?

Gleaning through the whispering winds of earnings estimate variations for Agnico, the Zacks Consensus Estimate for the ongoing year has ascended by 4.1% in the past moon’s glow to $3.88.

Analysts’ burgeoning sunshine over the company’s earnings future, mirrored in a unison of higher EPS prognosis revisions, could be a justifiable cause for the stock to pirouette towards the stars in the immediate tango.

The magnitude of the latest metamorphosis in the consensus estimate, coupled with three other elements harmonizing earnings whispers, has birthed a Zacks Rank #1 (Strong Buy) decree for Agnico.

Hence, the Buy-equivalent ABR for Agnico could serve as a compass to guide investors through the sonorous symphony of investing decisions.

© 2024 Benzinga.com. Benzinga does not proffer investment counsel. All privileges held.