President Donald Trump arrived in the United Kingdom (UK) on Tuesday for a three-day trip that included billions of dollars of investment pledges, royal pageantry, and protests.

Trump’s second trip to the UK entailed a state banquet with King Charles III with around 150 guests. Nvidia (NASDAQ:NVDA) CEO Jensen Huang and OpenAI CEO Sam Altman attended the royal event. Trump made toast to “one of the highest honors of my life.”

The president’s visit sparked protests, with people carrying placards and Palestinian flags as they marched through London. The Stop Trump Coalition organized the march against Trump’s state visit.

Trump’s visit witnessed a bilateral tech deal and investment pledges from some of America’s most prominent tech leaders. The UK secured £150 billion of inward investment from US companies, the British Department for Business and Trade said.

Palantir Technologies Inc. (NASDAQ:PLTR), Microsoft Corp., Google, Coreweave Inc., Salesforce Inc., and BlackRock Inc. announced UK investment plans. Blackstone Inc. plans a £100 billion investment over the next decade.

“These deals will create more than 7,600 high-quality jobs, revitalize communities, and accelerate growth in sectors of the future,” the British Prime Minister’s office said in a statement. “The companies will help boost the UK’s AI infrastructure and cutting-edge tech, from data centers to computer chips, the processing power behind AI.

UK Market Is a Compelling Story for Foreign Capital

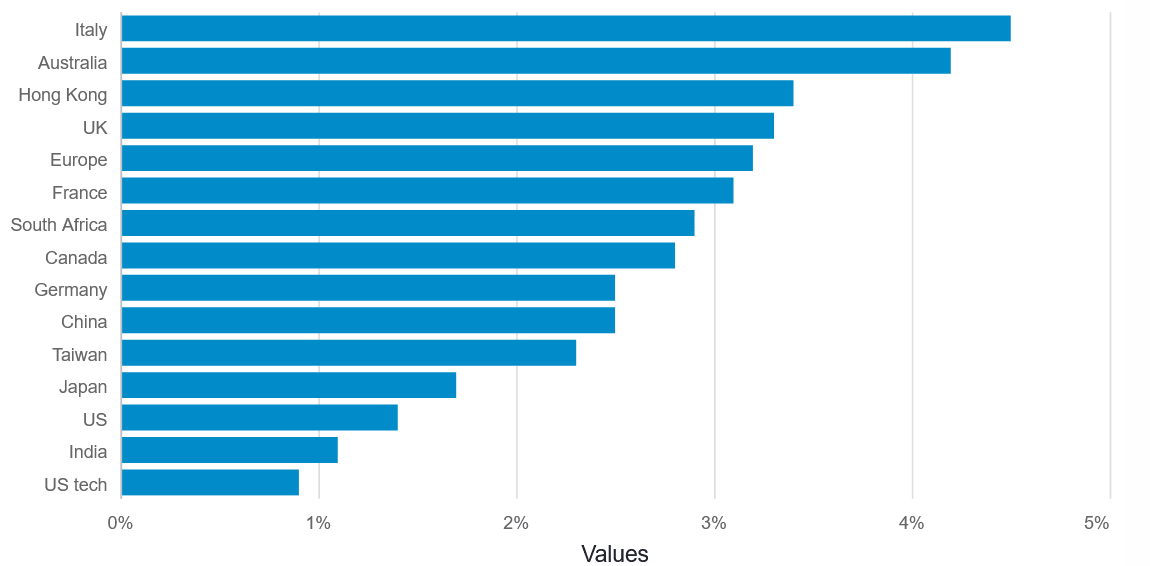

The UK market is a compelling story for foreign capital. It has the fifth-lowest price-to-earnings ratio of key markets and the fifth-lowest price-to-book ratio. It has the fourth-highest dividend yield, which is a lucrative opportunity in the rate-cutting environment.

Attracting interest may require policy adjustments. The latest report from the Council on Geostrategy tackles these problems.

Its author, senior research fellow, Mann Virdee, proposed a five-year reduced tax rate of 10% for greenfield investments in critical areas. He recommended 100% first-year capital allowances.

He called for reduced bureaucracy, new energy market solutions, and alignment with international benchmarks.

Trump, Starmer Sign ‘Landmark’ Tech Prosperity Deal

Trump and …

Full story available on Benzinga.com