Verizon Communications saw a flurry of activity following the release of its mixed third-quarter financial results – a concoction of sweet and sour. The telecom giant beat earnings estimates but left investors longing for more as it fell short on revenue. Akin to a jazz musician hitting the right notes but missing the overarching crescendo, Verizon’s adjusted earnings per share dipped slightly but managed to outperform the analysts’ projected figure.

In a not-so-pleasant surprise, the company’s operating revenues decided to stay put, failing to make the leap expected by the market pundits. Yet, amidst this financial seesaw, Verizon showcased some notable resilience in its strategic operations.

Verizon’s Wireless Subscribers Flourish in a Competitive Landscape

Verizon’s wireless division emerged as a beacon of hope in the tumultuous sea of financial figures. Fueled by attractive promotional schemes and bundled packages that blend 5G services with streaming offerings like Netflix, Verizon saw its wireless subscribers surge beyond the realms of expectation.

The adoption of its versatile myPlan service, allowing users to tailor their plans with additional streaming services such as Hulu and Max for a supplementary cost, played a pivotal role in this success. The company’s net addition of wireless phone subscribers in the third quarter surpassed analysts’ predictions, marking a significant improvement from the previous quarter’s performance.

While the wireless segment celebrated growth, Verizon’s broadband realm faced a slight hiccup as net additions witnessed a dip. Nevertheless, the company’s total broadband subscriber base remained robust, reflecting a stable foothold in this competitive market.

Verizon Maintains Its Strategic Demeanor for FY24

With a visionary outlook, Verizon’s management reiterated its forecast for fiscal year 2024, projecting a healthy growth trajectory in wireless revenue and adjusted earnings. The company’s commitment to growth remains unwavering, with wireless revenue poised to scale new heights and adjusted earnings expected to fall within a specified range, indicating a fortified financial stance.

Unlocking the Mystery: Verizon’s Target Price

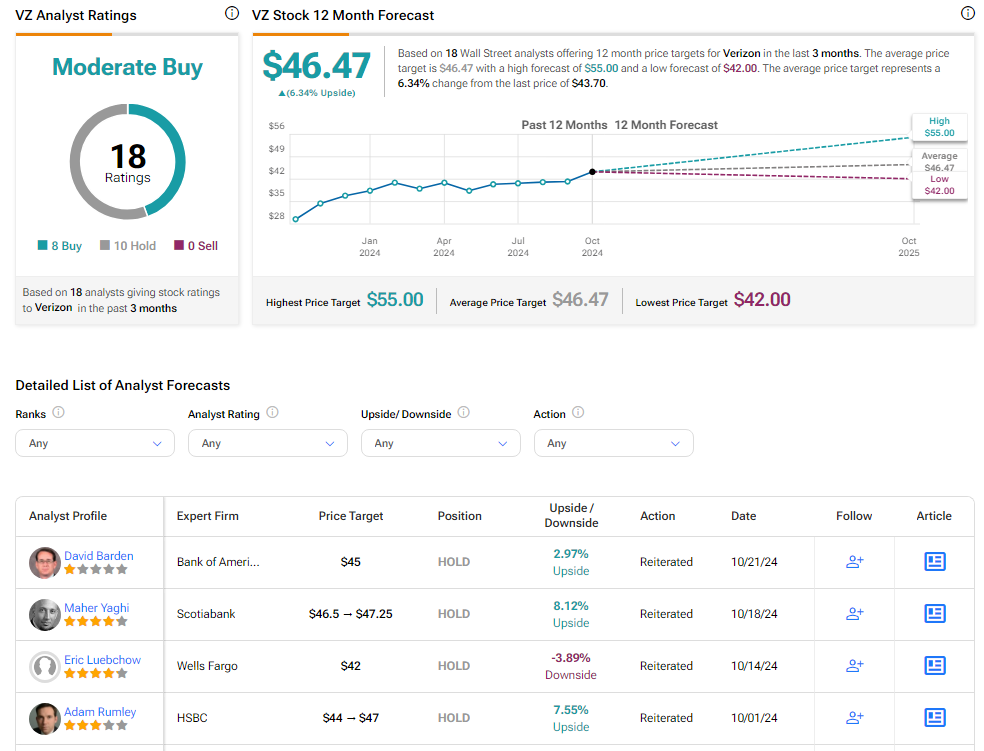

Peering into the crystal ball of market predictions, analysts harbor cautious optimism towards Verizon’s stock, driving a Moderate Buy consensus rating. Despite the financial fluctuation, the company has made significant strides over the past year, marking a notable surge in stock value. The projected price target for VZ anticipates a promising upside potential, offering investors a glimmer of hope amidst the complex maze of financial assessments.

For stakeholders seeking more nuanced insights, a deeper dive into Verizon’s analyst ratings may unravel the underlying intricacies of this evolving financial narrative.