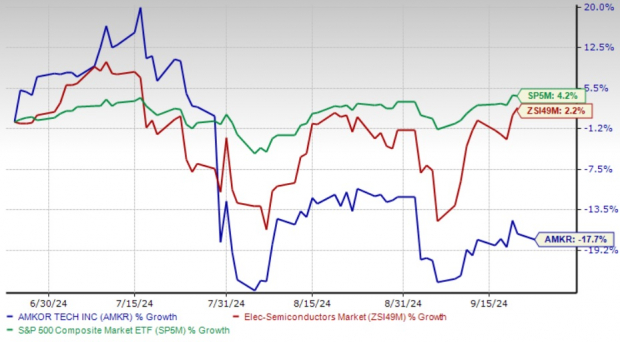

Amkor Technology (AMKR) shares have experienced a significant 17.7% decline over the last three months. This performance lags behind both the Zacks Electronics – Semiconductors industry and the S&P 500 index, which have shown returns of 2.2% and 4.2%, respectively, during the same period. The company’s struggles can be attributed to a myriad of challenges plaguing investor confidence.

Over the past year, Amkor has grappled with supply chain disruptions due to geopolitical tensions, as well as macroeconomic hurdles resulting from high inflation and interest rates. Furthermore, the shortage of semiconductors has posed challenges for the outsourced semiconductor packaging and test services (OSAT) leader, constraining its revenue and profit margins.

Within the previous quarter, AMKR reported ongoing difficulties stemming from the slow recovery in the automotive and industrial sectors, compounded by weak demand from traditional data center clients. Several of Amkor’s factories are reported to be operating below full capacity, negatively impacting its revenue growth.

The company is facing decreased demand for its 2.5D integrated circuit, primarily due to inventory adjustments in the automotive and industrial segments. Additionally, rising operating expenses related to the construction of a new factory in Vietnam have further weighed on its profitability.

Amkor Technology Three Month Performance

Image Source: Zacks Investment Research

Amkor’s Competitive Landscape in the OSAT Market

Amkor holds a significant position in the OSAT sector, offering innovative packaging and test solutions with a strong focus on high-volume manufacturing. Its widespread presence across multiple countries in Asia and Europe establishes it as a global player in the industry. The company boasts partnerships with tech giants such as Apple, Qualcomm, Intel, Broadcomm, and AMD.

In late 2023, Apple engaged in a strategic partnership with Amkor, designating the latter as its primary supplier for chip packaging solutions at Amkor’s Peoria facility. This collaboration has flourished over a decade-long association.

Despite its strong market presence, Amkor faces fierce competition in the OSAT domain from Taiwan Semiconductor Manufacturing Company (TSM) and ASE Technology Holding (ASX). Both TSM and ASX operate globally within the OSAT sector, with their own fabrication facilities and unique product offerings.

Despite the headwinds, AMKR anticipates third-quarter fiscal 2024 revenues to range between $1.785-$1.885 billion, with a Zacks Consensus Estimate at $1.84 billion. The awaited fiscal 2024 revenue estimate stands at $6.51 billion, signaling a modest 0.15% year-over-year growth.

Final Thoughts on Amkor’s Outlook

Amkor continues to grapple with macroeconomic challenges, escalating operational expenses, stiff competition, and a sluggish growth trajectory attributed to the slow revival in its key markets. Presently, AMKR holds a Zacks Rank #5 (Strong Sell), suggesting that investors may want to consider divesting their holdings.

For those seeking additional insights, exploring the full list of Zacks’ #1 Rank (Strong Buy) stocks may offer further investment opportunities.