By Ronald Tech

The cannabis sector faces challenges, exemplified by a 15.24% decline in the MSOS ETF following the DEA’s rescheduling delay to December 2nd. This uncertainty compounds market volatility, especially with divergent cannabis policies ahead of the U.S. presidential election. Despite this, select cannabis penny stocks, cheaper than a McDonald’s Big Mac, remain steadfast.

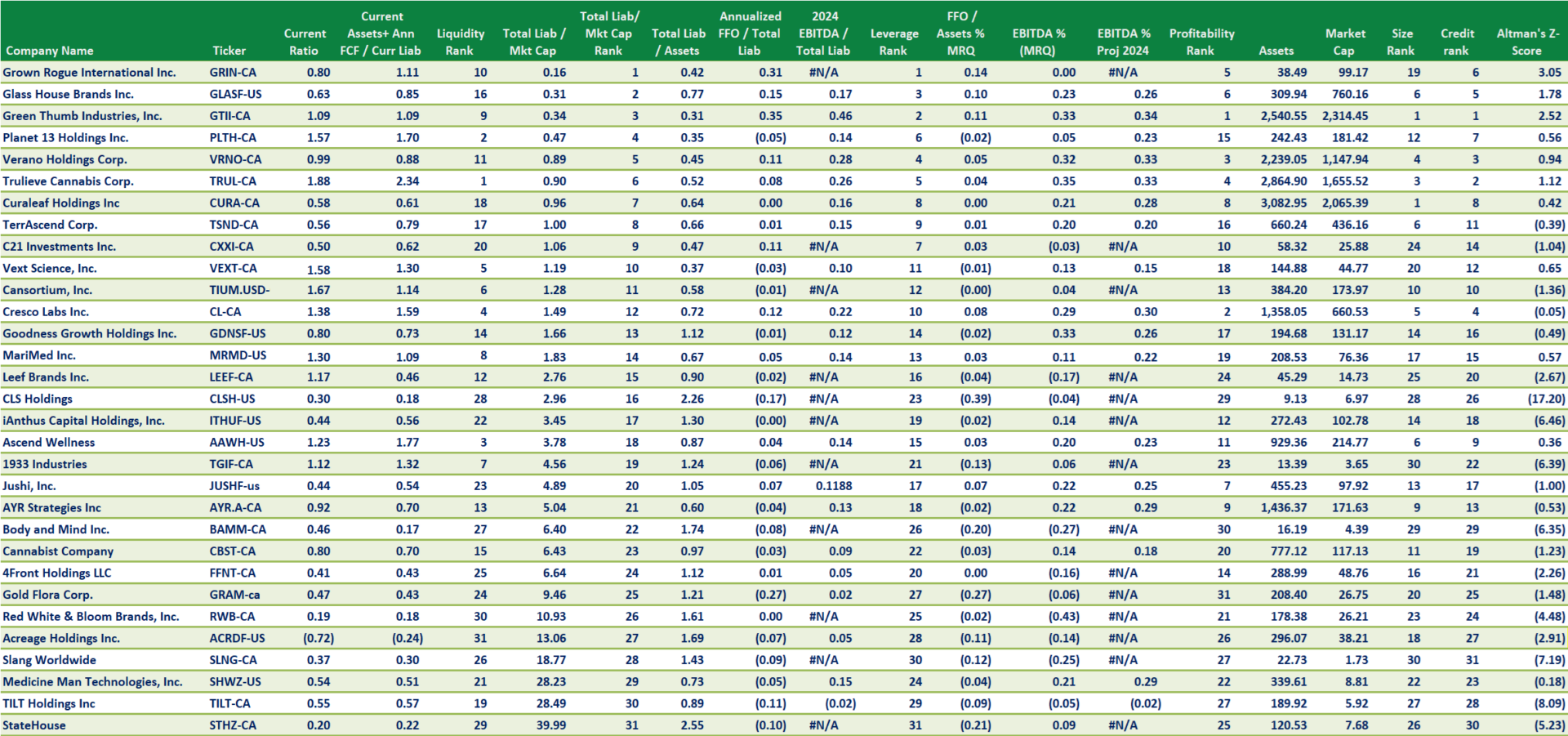

Sector-Wide Financial Overview

Viridian Capital Advisors data unveils a median debt-to-EBITDA ratio of 2.98 in the cannabis sector, meeting debt sustainability criteria amid regulatory hurdles such as the 280e tax code. Yet, the top quartile displays leverage ratios hinting at prolonged financial instability.

The Resilient Few

Companies like Vext Science, C21 Investments, and iAnthus Capital Holdings showcase market resilience through strategic financial management, leveraging market fluctuations:

- Vext Science stock declined to $0.16 (-5.88%), but operational efficiencies in Arizona and expansions in Ohio hint at future growth, backed by Q2 2024’s positive adjusted EBITDA of $1.08 million.

- C21 Investments saw a 11.5295% stock rise to $0.2399 with commendable operational cash flows amidst inflationary pressures, reporting a revenue increase and maintaining robust transaction volumes.

- iAnthus Capital Holdings recorded a stock price drop but showcased financial strength with improved credit metrics and revenue growth, backed by a rise in cash reserves to $16.55 million, signaling prudent financial management.

Credit Concerns for Other Players

Not all companies fared well, as firms like TerrAscend, AYR Strategies, MariMed, Red White & Bloom, Acreage, and Slang Worldwide faced credit rating setbacks. Concerns loom for those with total liabilities to market cap ratios exceeding 10, indicating financial distress.