Key Takeaways

- The S&P 500 has gained nearly 25% each of the past two years; will the trend continue?

- Vanguard S&P 500 ETF, iShares Core S&P 500 ETF and SPDR S&P 500 ETF Trust all have benefited from the rise.

- Register now to see our 7 Best Stocks for the Next 30 Days report – free today!

The S&P 500 was up about 24% in 2023 and has similarly gained 24.9% this year. Cooling inflation, a less-hawkish Fed, an AI boom, a tech rally and an improvement in corporate earnings have led the key Wall Street stock index to log more than 20% gain in back-to-back years. But will the rally continue in 2025?

Probably not. At least, Wall Street experts believe so.

Inside Wall Street Experts’ Forecasts

Morgan Stanley has increased its 12-month base case price target on the S&P 500 to 6,500, the firm’s equity strategist Michael Wilson and other strategists wrote in a note on Monday. This equates to around 10% of the current level.

BMO Capital set next year’s S&P 500 target at 6,700, or a 14% gain from here. UBS sees S&P rising to 6,400 in 2025, about 9% from here. Goldman’s 2025 stock market forecast calls for the S&P 500 to gain 11% (read: How to Play Wall Street Stocks in 2025? ETF Strategies in Focus).

Investors should note that if the S&P 500 is able to deliver another 20% gain in 2024, it would be the first time since 1998-1999 that the index experienced successive years of such high growth, per Yahoo Finance.

The End of Outsized Returns?

If we believe those strategists, we see that the exceptional returns of the past two years may not continue into 2025. Per BMO, periods of slower growth are normal and healthy for bull markets. BMO Capital also believes that 2025 will bring a more balanced performance across sectors, sizes and styles. It also noted that year three of a bull market typically yields returns below the gains of the first two years and underperforms the historical average return for the S&P 500.

Inside the Bullish Thesis

Morgan Stanleyexpects the recent broadening in U.S. earnings growth to continue in 2025 as the Federal Reserve is likely to cut interest rates next year and business cycle indicators improve further.Republican Donald Trump has won a second term as U.S. president. Trump’s previous term proved solid for U.S. stocks.

Most strategists agree that the Federal Reserve’s expected interest rate cuts and strong U.S. economic growth could broaden the rally beyond mega-cap tech stocks. We also do not expect a massive economic downturn as the primary risk to the markets next year.

The S&P 500 Earnings Big Picture

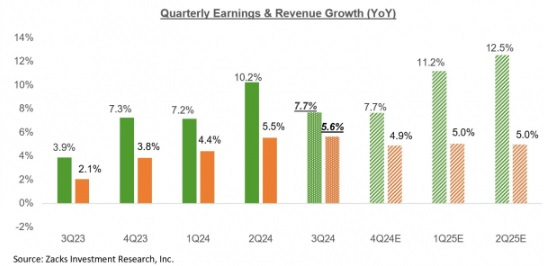

Looking at Q3 as a whole, total earnings for the S&P 500 index are expected to be up 7.7% from the same period last year on 5.6% higher revenues. Excluding the contribution from the famous Mag 7 group, Q3 earnings for the rest of the 493 S&P 500 members would be up only 2.3% instead of 7.7%.

For the last quarter of the year (2024 Q4), total S&P 500 earnings are expected to be up 7.7% from the same period last year on 4.9% higher revenues. Unlike the unusually high magnitude of estimate cuts that we had seen ahead of the start of the Q3 earnings season, estimates for Q4 are holding up a lot better,

Earnings growth is expected to go up entering into 2025 with first two quarters likely to produce 11.2% and 12.5% growth rate, respectively, on 5% higher revenues each quarter. Also, note that on a calendar-year basis, the 7.9% expected earnings growth this year (2024) will be followed by double-digit gains in 2025 and 2026.

Image Source: Zacks Investment Research

Weak Consumer Spending Expected in 2025?

Analysts warn a trend of cooling inflation could quickly reverse if President-elect Donald Trump implements his proposed tariffs of 10-20% on all imports and up to 60% on Chinese goods. The Peterson Institute for International Economics (PIIE) estimates these tariffs could cost the average American household an additional $2,600 annually, as quoted on Yahoo Finance. A slowdown in consumer spending could act as a risk to the market’s strength in 2025.

Is Valuation Ripe?

Bank of America believes that the S&P 500 is statistically expensive by almost every measure. The estimated price/earnings (P/E) ratio for the S&P 500 Index is 26.58X (as of Nov. 19, 2024). The S&P 500’s last 10 years’ P/E average is 18.32X, while the 20-year average is 15.80X. For this reason, the current P/E can be considered expensive.

S&P 500’s price/book (P/B) ratio was 5.20X as of Nov. 19, 2024, way higher than the minimum of 1.78X recorded in March 2009 and even higher than the maximum of 5.06X recorded in March 2000. Current price/sales (P/S) ratio for the S&P 500 is 3.09X, again way above the minimum of 0.80X recorded in March 2009. The figure is also above the maximum of 3.04X recorded in December 2021.

However, the S&P 500 has considerable exposure to the Mag-7 group, which boasts rich valuation due to its focus on the booming artificial intelligence space. We do not expect this exposure to hurt the S&P 500 ETFs.

S&P 500 ETFs in Focus

Against this mixed backdrop, investors may track S&P 500 ETFs like Vanguard S&P 500 ETF VOO, iShares Core S&P 500 ETF IVV and SPDR S&P 500 ETF Trust SPY. Investors can also play the growth part of the index with SPDR Portfolio S&P 500 Growth ETF SPYG and the value part of the index with SPDR Portfolio S&P 500 Value ETF SPYV.

SPDR Portfolio S&P 500 High Dividend ETF Fund SPYD is a good bet for the dividend plays of the index. Investors can also bet on the leveraged S&P 500 ETFs like Direxion Daily S&P 500 Bull 3X Shares SPXL and ProShares Ultra S&P500 SSO, if the index manages to record some gains in 2025. If the S&P 500 falls, inverse ETF ProShares Short S&P500 ETF SH will rise.

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week.

SPDR S&P 500 ETF (SPY): ETF Research Reports

Direxion Daily S&P 500 Bull 3X Shares (SPXL): ETF Research Reports

ProShares Ultra S&P500 (SSO): ETF Research Reports

Vanguard S&P 500 ETF (VOO): ETF Research Reports

ProShares Short S&P500 (SH): ETF Research Reports

SPDR Portfolio S&P 500 High Dividend ETF (SPYD): ETF Research Reports

iShares Core S&P 500 ETF (IVV): ETF Research Reports

SPDR Portfolio S&P 500 Growth ETF (SPYG): ETF Research Reports

SPDR Portfolio S&P 500 Value ETF (SPYV): ETF Research Reports