Taiwan Semiconductor Manufacturing Co TSM will acquire new high-precision equipment by year-end, enhancing its chipmaking capabilities.

The Dutch supplier ASML Holding NV ASML will provide Taiwan Semiconductor with high numerical aperture extreme ultraviolet (high NA EUV) lithography machines, each valued at around $350 million, Nikkei Asia reports.

Analyst Ming-Chi Kuo forecasted a potential pricing standoff in the semiconductor sector in October. Kuo noted that ASML may plan to raise equipment prices for major customer Taiwan Semiconductor, but the Taiwanese contract chipmaker is likely to counter with demands for price reductions.

ASML is also battling geopolitical tensions similar to those of Taiwan Semiconductor. The U.S. urged ASML to restrict its technology to China, citing national security threats.

ASML CEO Christophe Fouquet expects the U.S. to increase pressure on ASML to limit semiconductor technology sales to China.

At the Bloomberg Tech Summit, Fouquet highlighted the U.S.’s push to curb China’s chip advancements through export controls.

Fouquet noted that ASML’s focus in China remains on mature chips, away from the advanced AI-related semiconductors central to U.S. concerns.

ASML expects 2025 net sales of 30 billion euros and 35 billion euros ($32.7 billion—$38.2 billion), down from the prior 30 billion euros-40 billion euros, reflecting weaker demand for semiconductor manufacturing equipment.

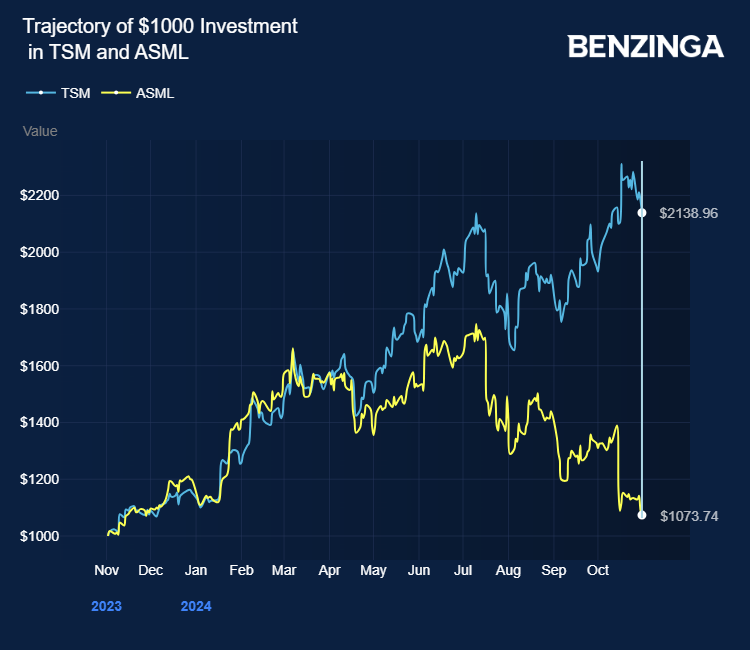

Price Actions: TSM stock is up 2.50% at $195.31 at the last check on Friday. ASML is up 0.76%.

Also Read:

Photo via ASML

Market News and Data brought to you by Benzinga APIs