Navigating the stock market demands patience, and while the emphasis is often on the long-term and buy-and-hold approach, it’s essential to note that being patient doesn’t equate to being a passive investor. Quite the contrary.

Today, let’s delve into two stocks that have faced significant challenges recently: Alibaba (NYSE:) and PayPal (NASDAQ:).

Both associated with the online realm, Alibaba in e-commerce and PayPal in digital payments, these stocks have practically experienced a downward spiral since the beginning of 2021.

Both Alibaba and PayPal have experienced substantial losses, approximately 80% from their all-time highs in 2021. Currently, they find themselves downgraded by analysts, shunned by investors, and relatively overlooked by major fund managers.

Over the past three years, a considerable but not negligible timeframe, many investors made the mistake of buying these stocks at their peak valuations.

Particularly for PayPal, the surge during the COVID period inflated its valuations based on a narrative that eventually proved challenging.

Both companies share some common characteristics:

- Growing turnover and profits, albeit at a slower pace than in the past.

- Recent management changes.

- Shifts in corporate strategies.

- Extremely low sentiment and stock prices.

- Attractive valuations.

- Retention of competitive advantage.

Given these similarities, the question arises:

Reassessing Alibaba and PayPal: Which One Holds Promise?

While both are considered excellent companies, personal considerations lead to a preference for PayPal.

This preference stems from uncertainties surrounding Alibaba’s political landscape, which introduces unpredictable elements even if the company were to recover.

From a peace-of-mind perspective, PayPal appears more reassuring.

Moreover, the new CEO, Alex Chriss, demonstrates clear vision and excellent communication skills, as evidenced by his recent interview on January 25, where he hinted at making a significant announcement.

Although I didn’t consider buying PayPal in 2021 due to valuation concerns, the stock has become more intriguing in recent months.

Consequently, I’ve started accumulating shares during relative declines, adhering to a well-defined Money Management strategy.

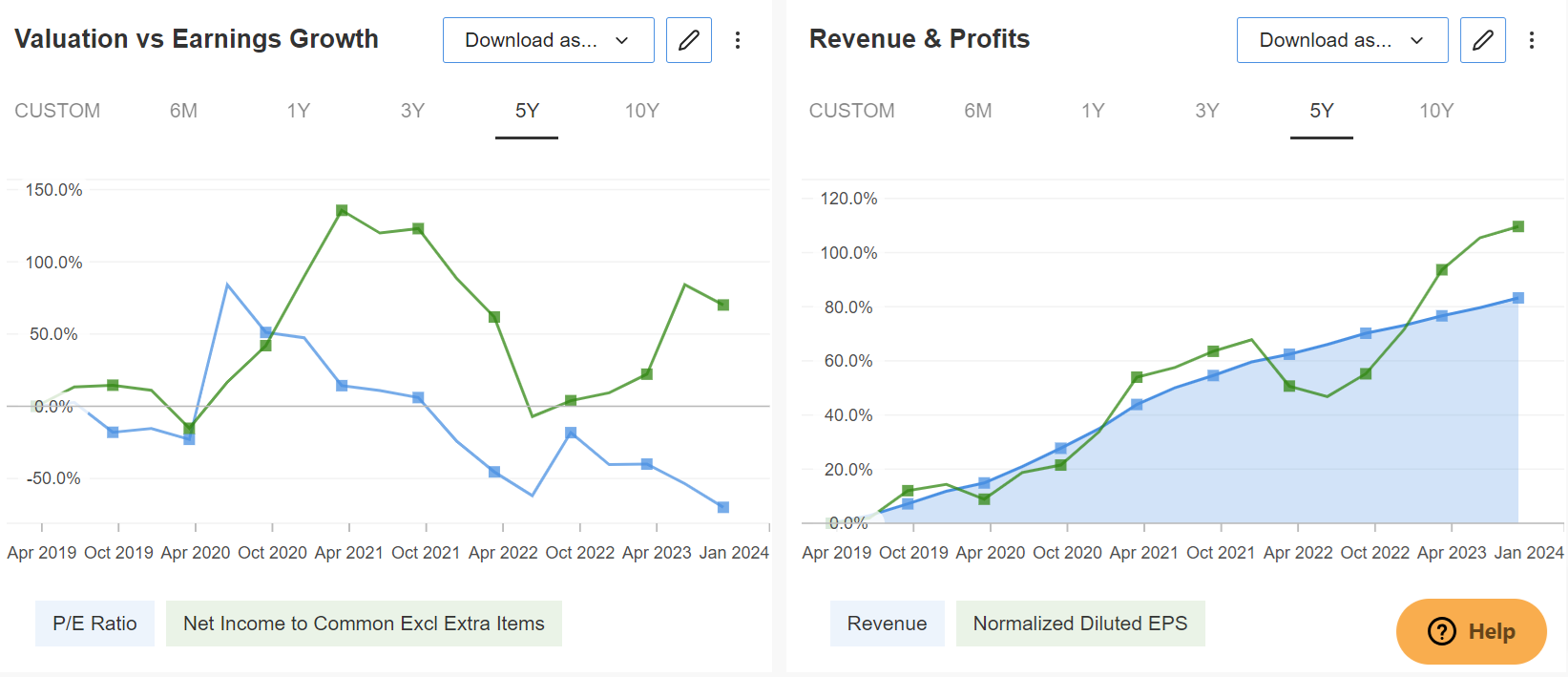

Source: InvestingPro

What interests me most is that turnover and earnings are growing steadily, while valuations (see box on the left) have diverged from fundamentals.

Usually, these divergences tend to narrow toward a more rational direction, sooner or later.

Time will tell if I am right or not but I will keep you posted.