Chinese stocks have weathered significant turbulence over recent years, leading many investors to steer clear. Geopolitical risks, coupled with headwinds in the Chinese economy, have cast a shadow over the future of these stocks. However, even amidst skepticism, certain Wall Street analysts continue to view select Chinese tech stocks as compelling investments.

Despite the uncertainties, there is a glimmer of hope for these stocks, especially with talks of potential Chinese economic stimulus. This possible intervention could provide a much-needed boost to the beleaguered Chinese tech market. This past year has shown some resilience, with Chinese tech stocks experiencing newfound vigor, despite enduring relentless pressure.

A Closer Look at Select Chinese Tech Stocks

Let’s take a deep dive into three U.S.-listed Chinese tech stocks that Wall Street analysts believe might see growth potential in 2024.

PDD: Pinduoduo on the Brink of a New Narrative?

PDD Holdings, known as Pinduoduo, has surged over 275% in the past two years. While its recent nosedive due to Evergrande liquidation news raised concerns, PDD holds promise with its expanding shopping app, Temu.

Consumer enthusiasm for affordable discretionary goods remains high, offering a glimmer of hope amidst economic challenges. Despite recent setbacks, PDD’s prospects appear all the more intriguing, especially in the context of potential China stimulus plans.

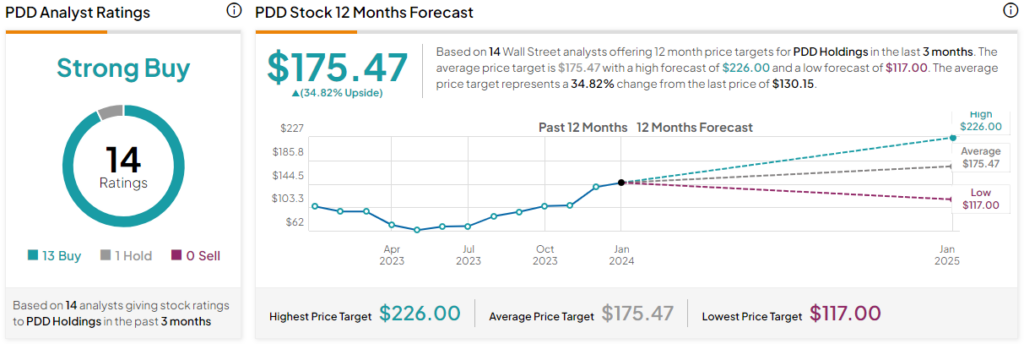

Price Target for PDD Stock

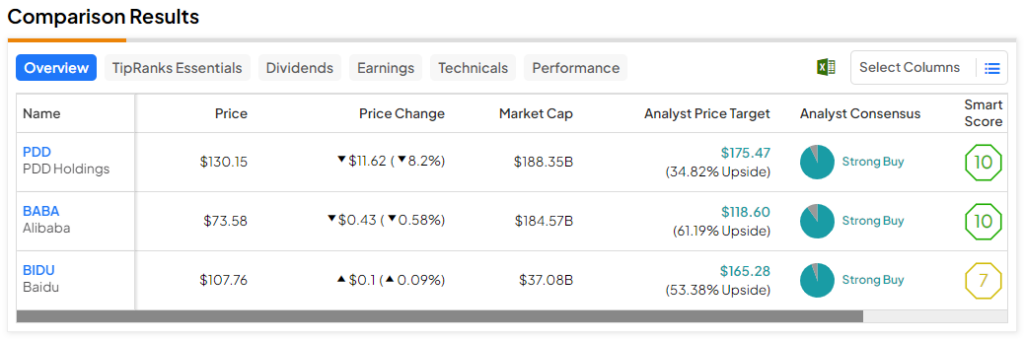

Analysts rate PDD stock as a Strong Buy, with an average price target of $175.47, indicating a 34.8% potential upside.

BABA: Alibaba Navigating Choppy Waters

Alibaba’s stock has plummeted to around $73, nearing its 2022 lows of approximately $58. The company’s prospects, however, may shift as it explores the potential of generative artificial intelligence and capitalizes on any forthcoming stimulus. Jack Ma’s recent substantial investment in Alibaba shares may instill confidence in some investors.

Amidst tumultuous times, Alibaba appears to exude signs of deep value, although waiting for a sustained rally remains enigmatic. The current rally triggered by stimulus seems to have lost momentum due to Evergrande fears, leaving shareholders in suspense.

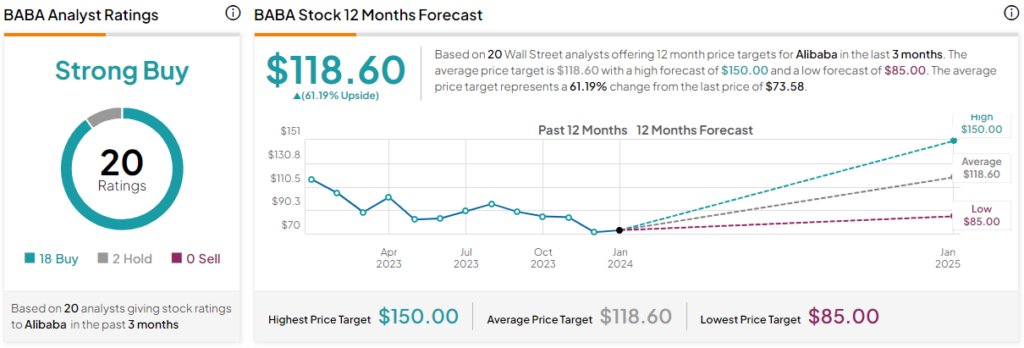

Price Target for BABA Stock

Analysts designate Alibaba stock as a Strong Buy, with an average price target of $118.60, reflecting a 61.2% potential upside.

BIDU: Baidu’s AI Endeavors Amidst Economic Uncertainty

Baidu’s introduction of its Ernie chatbot in Samsung’s latest Galaxy S24 smartphones has garnered attention. This move could potentially yield significant benefits for the stock, offsetting its prolonged underperformance.

While the promise of value in Baidu is appealing, potential challenges lie in the effectiveness of economic stimulus and geopolitical risks. Nonetheless, Baidu’s AI advancements position it as one of the more affordable AI stock prospects.

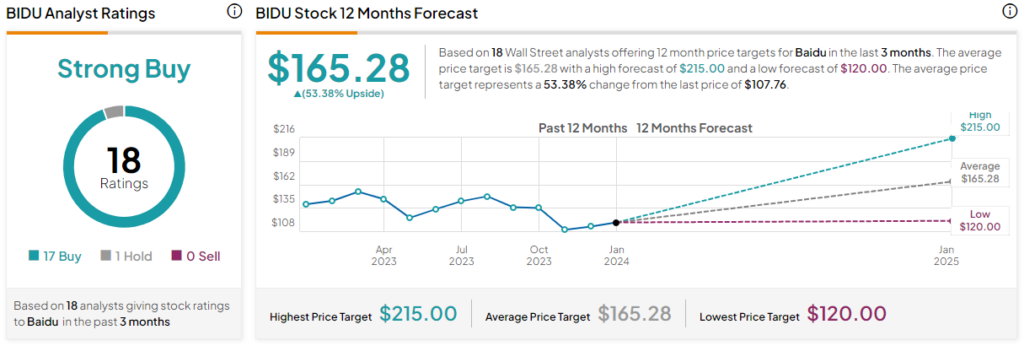

Price Target for BIDU Stock

Analysts classify Baidu stock as a Strong Buy, with an average price target of $165.28, indicating a 53.4% potential upside.

The Bottom Line

Despite the ongoing turbulence and negative economic developments, these stocks present deep value opportunities. Among the three Strong Buy-rated stocks, analysts perceive the most upside potential in BABA, at 61.2%, for the upcoming year.