Tesla TSLA shares have mostly moved on product launches, delivery numbers, and margin chatter. But lately, the stock has been swinging wildly for a different reason— and that is politics.

The war of words between Tesla CEO Elon Musk and U.S. President Donald Trump has reignited, and it’s weighing on Tesla stock. Shares declined more than 5% yesterday, just ahead of Tesla’s Q2 delivery report that’s already expected to be weak.

It all started in early June when Musk slammed Trump’s new tax bill, calling it a “disgusting abomination” that would balloon the budget deficit. Trump fired back, calling Musk “crazy” and hinting that the government should review the subsidies going to Tesla and SpaceX. The market didn’t take it lightly. On June 5, Tesla stock lost over $150 billion in market value—its worst single-day drop ever.

The rhetoric cooled for a bit, but on June 30, Musk resumed posting criticism of the tax bill. Trump responded on July 1, “Elon Musk may get more subsidy than any human being in history, by far, and without subsidies, Elon would probably have to close up shop and head back home to South Africa.” and suggested the Department of Government Efficiency (DOGE) look into it. Musk replied bluntly on X: “I am literally saying CUT IT ALL. Now.”

What’s Really at Stake?

EV Tax Credits: Trump’s bill eliminates the $7,500 federal EV credit included in Biden’s Inflation Reduction Act. This incentive helps make Tesla vehicles more affordable in the United States. Losing it by September 2025 could dent demand, already under pressure due to growing competition.

Energy Incentives: Tesla’s solar and battery storage units also benefit from federal tax breaks. Removing these could slow down growth in one of the company’s fastest-expanding areas. Tesla’s energy division has warned that ending these incentives would hurt grid reliability and energy independence.

A Carve-Out That Helps Rivals: The bill includes a “special rule” that preserves tax credits through 2026—but only for automakers that haven’t sold 200,000 EVs by the end of 2025. That excludes Tesla, General Motors GM and Ford F, while favoring startups like Rivian and Lucid.

Last Word

Musk often says Tesla doesn’t need subsidies, but the numbers suggest otherwise. U.S. tax credits have somewhat supported Tesla’s price cuts and margin defense strategy, especially in a market that’s getting more competitive by the quarter. With those supports disappearing, Tesla may face tougher decisions, such as raising prices or accepting thinner margins.

On the energy side, favorable policy remains the key. Without tax incentives, big bets on solar and battery storage become harder to scale, slowing a business that Tesla sees as its next growth engine.

The Musk–Trump feud isn’t just noise anymore—it’s swaying investors’ sentiment on Tesla. Investors will need to brace for more volatility tied not just to earnings, but to power plays in Washington and forces well beyond Tesla’s factories.

The Zacks Rundown on Tesla

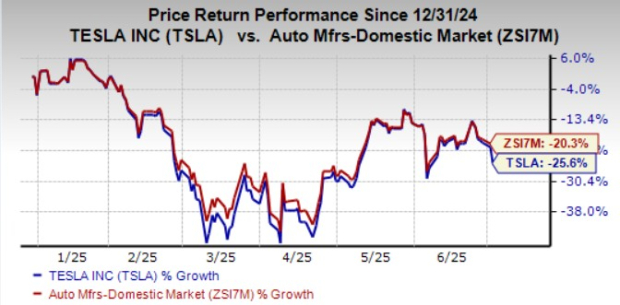

Shares of Tesla have lost around 25% year to date compared with the industry’s decline of 20%. Meanwhile, Ford is up 14.6% while General Motors is down just 2.6%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

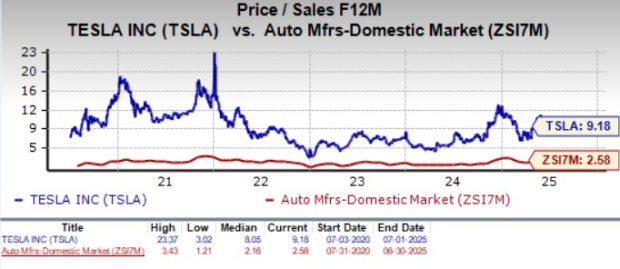

From a valuation standpoint, TSLA trades at a forward price-to-sales ratio of 9.18, way above the industry. It carries a Value Score of F. Meanwhile, General Motors trades at a forward sales multiple of 0.29 and Ford at 0.28.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

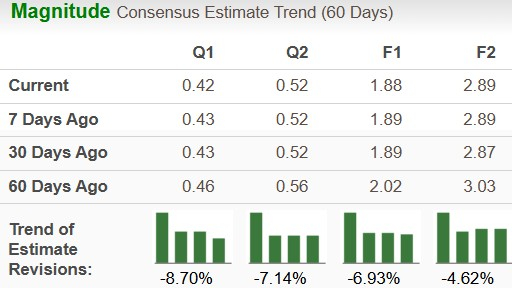

See how the Zacks Consensus Estimate for TSLA’s earnings has been revised over the past 60 days.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Tesla stock currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company’s customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners Up

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).