Cloudflare Inc NET, despite its pivotal role in powering the internet’s backbone, hasn’t escaped this year’s market turmoil, with its stock feeling the weight of broader economic uncertainty. From its February highs, the NET stock plunged almost 50% to its April 9 low, before paring some of those losses. However, over the past some weeks, smart money has been quietly building a position, implying a possible sentiment reversal.

Starting on April 10, Benzinga’s options scanner identified several unusual transactions in NET stock derivatives. At the time, the sentiment was dominated by the bears, who had placed a mixture of sold calls and bought puts. In fact, on that day, the most optimistic trade was a neutral sentiment trade, possibly indicating a hedged position; that is, the acquisition of calls to offset the risk of a short trade.

On April 21, the ice began to thaw. To be fair, the overall sentiment was still pessimistic, with the biggest trade on that day representing sold $100 calls with an expiration date of May 9 (next Friday). However, there were also sweep transactions for the same call with bullish sentiment, suggesting brewing optimism among smart money traders.

Finally, the following day, Benzinga’s scanner identified unusual options activity with a clear optimistic edge. On the day, the biggest trade was for sweep bullish-sentiment call options; specifically, $115 calls with Jan. 15, 2027 expiration date. As a debit-based trade, the purchasing of calls requires a specific outcome to be realized before the derivatives become net profitable. It’s a rather strong commitment.

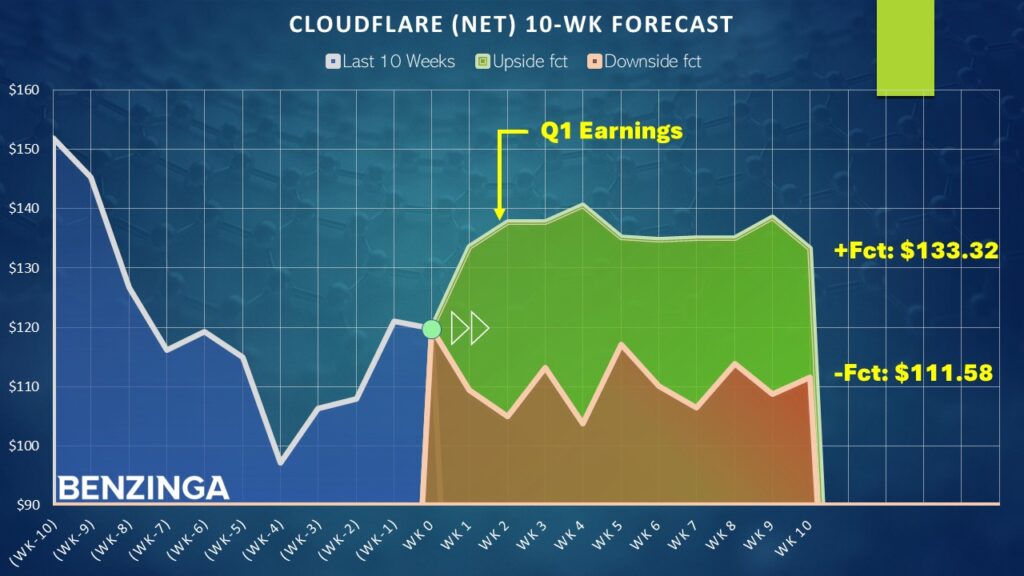

Notably, Cloudflare will release its earnings results for the first quarter of 2025 on May 8. Therefore, the shift in smart money sentiment arrives at a curious time.

A Closer Look At The Sentiment Shift

As wonderful as analyzing options activity is, however, it will always be the consequence of a broader sentiment shift. Putting too much weight on deciphering options activity is akin to explaining why a person is so tall based on their shadow. The shadow is a residual trail of the person’s existence; it doesn’t explain anything fundamental.

To understand NET stock (or any other security), one must consider its demand. Here’s where the financial analysis industry gets scrambled: price is not the equivalent of demand. Price is merely the scalar representation of when demand was exercised at a specific point in time. Demand is the impetus that transitioned an entity from a fence-sitter to a buyer.

More elementally, price is an infinite signal, whereas demand is a discrete event. Demand is either happening or it’s not. Conceptually, there is no such thing as a half-demand state of existence.

Through the process of discretization or abstraction, one can take the chaos of price discovery into a defined genetic code. Under this framework, it’s easy to identify that in the last 10 weeks, NET stock posted a “3-7” sequence: three weeks of upside interspersed with seven weeks of downside, with an overall negative trajectory across the period.

What’s significant is that 65% of the time that the 3-7 sequence flashes, the NET stock has demonstrated a propensity to rise in the subsequent week. Adding to the intrigue, NET has enjoyed an upward bias, both in terms of price and demand.

It’s quite possible that the smart money sees Cloudflare stock as a strong value play. Plus, an earnings surprise could potentially add fuel to the fire.

Banking on a Positive Showing for Q1 Earnings

Using historical data, the median return one week following the 3-7 sequence is a whopping 11.5%, assuming the positive pathway. If the NET stock succumbs to the negative pathway, the median loss sits at 8.69%. Still, the risk-reward profile asymmetrically favors bulls. Plus, with both demand and second-order effects like price and unusual options activity aligned optimistically, smart money seems to believe in a strong turnaround.

With that in mind, the most aggressive two-leg strategy that makes the most sense is arguably the 127/133 bull call spread expiring May 9. This transaction involves buying the $127 call and simultaneously selling the $133, for a net debit paid of $215. Should the NET stock rise through the short strike price of $133 at next Friday’s expiration, the maximum reward stands at $385, a payout of more than 179%.

To note, the implied volatility (IV) is conspicuously higher than historic volatility (HV) for the May 9 options chain, which is to be expected. Market makers anticipate greater-than-average movement in the security and are thus pricing in a heftier premium in order to justify underwriting the elevated risk profile.

For the straight debit purchaser, the higher IV makes the option more expensive, relatively speaking. However, the call spread — with half of the transaction involving a credit portion from the sold call — helps offset this added cost, making it a more prudent form of speculation.

Read Next:

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.