Super Micro Computer Inc. SMCI stock surged nearly 9% in after-market hours trading after the company received an extension from Nasdaq to file its overdue annual and quarterly reports by Feb. 25.

What Happened: The AI server manufacturer, known for its advanced liquid cooling technology, has been under scrutiny since August when it delayed its annual report filing, citing the need to evaluate internal controls over financial reporting.

This delay came shortly after Hindenburg Research disclosed a short position, alleging accounting and governance issues.

Last month, Super Micro appointed BDO USA as its new auditor and submitted a compliance plan to Nasdaq to address the listing threat. The company aims to complete all necessary filings by the extended deadline to maintain its Nasdaq listing.

Additionally, Super Micro has launched a search for a new finance chief, following recommendations from a special committee investigating its accounting practices.

See Also: Dormant Bitcoin Whale Awakens After 11 Years, Moves $257M Worth Of BTC

Why It Matters: The extension granted by Nasdaq is a crucial step for Super Micro as it navigates through a challenging period marked by auditor resignations and allegations of misconduct.

In October, the company’s independent auditor, Ernst & Young, resigned over governance and transparency concerns, causing a significant drop in stock value. This resignation prompted the formation of an independent special committee to review the allegations.

In early December, the committee concluded its review, finding no evidence of misconduct by the company’s management or board. This finding led to a substantial increase in Super Micro’s stock price, with shares jumping over 30% following the announcement. Despite these positive developments, analysts from JPMorgan have advised investors to monitor the acceptance of the committee’s findings by the newly appointed auditors, BDO.

The ongoing demand for Super Micro’s AI servers, particularly in the artificial intelligence sector, underscores the importance of resolving these issues swiftly.

Price Action: SMCI stock closed at $43.93 on Friday, up 6.8% for the day. In after-market hours, it surged by 8.9%. Year-to-date, SMCI stock is up 54%, according to data from Benzinga Pro.

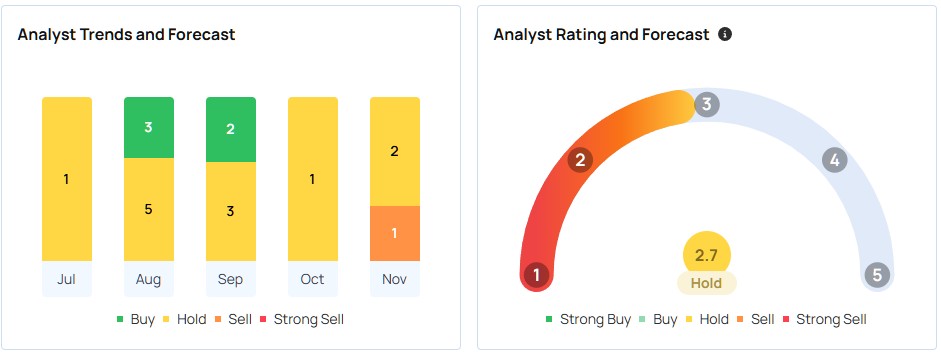

Furthermore, Benzinga Pro data shows analysts have a consensus “Buy” rating on the SMCI stock. Based on the three most recent analyst ratings from Goldman Sachs, JP Morgan, and Wedbush, the average price target of $27.67 implies a downside of 37%.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Wikimedia

Market News and Data brought to you by Benzinga APIs