The answer lies in yesterday’s meeting – and what they refused to face.

Have you ever watched an ostrich when it feels threatened?

It doesn’t fight. It doesn’t run. It buries its head in the sand and pretends the danger isn’t there.

Of course, we all know that doesn’t make the problem go away. In the wild, it means the predator is still circling. The ground is still shaking. But the ostrich convinces itself that if it can’t see the threat, maybe the threat can’t see it.

It’s a survival tactic built on denial. And it rarely ends well.

Yesterday, that’s exactly how the Federal Reserve behaved.

At the conclusion of its latest meeting, our central bank admitted the risks building in the labor and housing markets. But when it came time to act, they took the easy path. Rather than tackling the problem head-on, they chose to bury their heads in the sand.

And here’s why it matters: When the Fed acts like an ostrich, the market doesn’t rise evenly. It gets narrow. A handful of stocks take off, while others end up being dead money.

That’s why, in today’s Market 360, I’ll explain why I’m calling the Fed ostriches after yesterday’s meeting. From the “dot plot” to housing and jobs, the signs are everywhere – and I’ll show you what they’re pointing to next.

Breaking Down Yesterday’s Fed Meeting

So, what did the Fed do yesterday?

They cut a quarter point, just like most people expected. The vote was 11 out of 12. A new Federal Open Market Committee (FOMC) member, Steven Moran, voted against the cut – not because he wanted no cut, but because he wanted a bigger one. He was pushing for a half-percent cut.

The FOMC statement itself leaned dovish. It admitted job gains have slowed. The unemployment rate has edged up and the downside risk to employment has risen. So, on the surface, the Fed is acknowledging what we all know – that the jobs market is not healthy right now.

So far, so good.

In his press conference, Powell admitted the landscape is shifting. He said the labor market is “really cooling off” and warned that the Fed doesn’t want it to weaken further. On inflation, he expects goods prices to keep easing into 2026 and downplayed the risk of a persistent outbreak, though he acknowledged tariffs could still filter through as companies raise prices. Powell also brushed off the wide range of views in the dot plot as normal, but conceded there’s “no risk-free path” forward – calling the current environment one of the toughest policy backdrops in years.

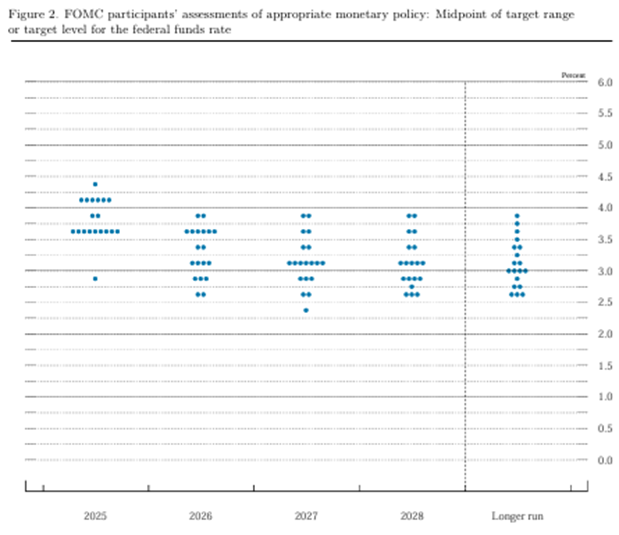

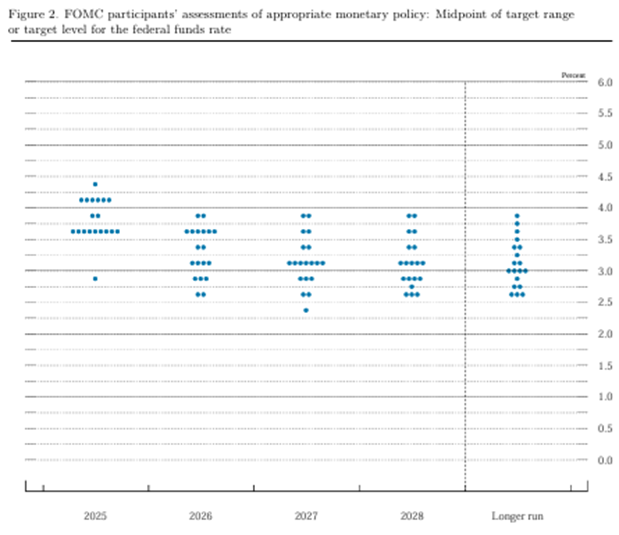

But then came the “dot plot,” which is the Fed’s chart of each official’s view of where rates will be. And that’s where it got disappointing.

This includes not just voting members, but also non-voting ones. And, as you can see below, it was all over the place.

Six said they didn’t want to cut. One said they shouldn’t have cut yesterday at all – a true super hawk. And only two members said they expected another cut this year.

Now, the good news is that the median projection shows two more quarter-point cuts by the end of the year. But right now, the hawks are clearly in charge. That’s why Treasury bond yields have firmed up and the U.S. dollar has strengthened.

Proof the Fed Is Acting Like Ostriches

The Fed has talked a good game lately with regard to unemployment. But the cracks are bigger than they want to admit.

Just this month, the Bureau of Labor Statistics quietly admitted it overstated nearly a million jobs over the past year – the biggest payroll revision in 26 years. Full-time jobs are shrinking while part-time positions rise. Weekly unemployment claims are sitting at four-year highs. And wage growth has slowed, leaving consumers squeezed.

That’s not a healthy labor market.

Another reason the Fed needs to cut: The housing slowdown is even worse than it looks.

New housing starts have plunged to a 1.3 million annual pace, and building permits – which tell us where future construction is headed – are also declining. Homebuilders themselves are losing confidence, with surveys showing sentiment at multi-year lows. Buyers aren’t biting because affordability remains stretched, and sellers are resorting to price cuts. Meanwhile, layoffs in construction are piling up, feeding directly into the rising unemployment claims we’re seeing.

So, we have two big problems right now: labor and housing. But when you look at that dot plot… It doesn’t seem the Fed is willing to do much about either of them.

And that’s why I say they’re acting like ostriches – burying their heads in the sand while the risks keep piling up.

The Market’s Warning Signs Are Clear

The Fed may keep its head buried in the sand – but investors can’t afford to.

Because while Powell hesitates, President Trump is doing the opposite. With his legacy on the line, he’s pulling out every stop to deliver the boom he’s promised.

From tariffs and onshoring to energy and infrastructure, everything is building toward September 30. That’s when I expect what I call the Trump Shock – a $7 trillion flood of money on the sidelines – to ignite the narrowest, most lucrative bull market we’ve seen in years.

Now, I’ve already identified five A-rated stocks flashing strong buy signals ahead of this moment.

And in a recent special briefing, I told viewers more about these stocks – and what they need to do ahead of September 30 to prepare.

Go here now to watch my urgent briefing.

I’ll even give you the name and ticker of one of these stocks absolutely free – and show you how to access all five before the Trump Shock sends them soaring.

Sincerely,

Louis Navellier

Editor, Market 360