Waller breaks ranks with the Fed… are tariffs inflationary or not?… good news on the inflation expectation front… what happens if there are no cuts?… a reminder about tomorrow’s seasonality event with Keith and Louis

VIEW IN BROWSER

Federal Reserve Governor Christopher Waller is about to break ranks at next week’s July FOMC meeting.

On Friday, in a Bloomberg TV interview, Waller hinted that he would dissent if the rest of the FOMC committee voted to hold interest rates steady.

From Bloomberg:

While it’s important not to dissent regularly, officials should take the step “if you make it very clear you think at this moment in time this is an important thing to do,” Waller said Friday…

Waller restated the case he first revealed in a Thursday speech that the Fed should cut when policymakers gather later this month, given data suggesting the US labor market is “on the edge.”

“The private sector is not doing as well as everybody thinks it is,” he said. “Most of the employment growth we saw last month was in the public sector, and that means the private sector is not doing particularly well.”

But what about that wave of tariff-based inflation that’s allegedly on the way? If the Fed cuts rates, wouldn’t that be like pouring gasoline on a flame?

This appears to be what Federal Reserve Chairman Jerome Powell is concerned about. Here he is from last month:

At this time all forecasters are expecting pretty soon that some significant inflation will show up from tariffs.

And we can’t just ignore that.

Waller would likely respond with the point he’s made in recent weeks…

Tariff-based inflation – if it arrives – will be more of a one-time price bump on select goods rather than an ongoing price acceleration throughout the economy. Meanwhile, the jobs market is weakening.

So, given the Fed’s dual mandate, the greater danger today comes from not cutting rates.

Remember, inflation doesn’t measure “price”

It measures the rate at which prices rise (or fall).

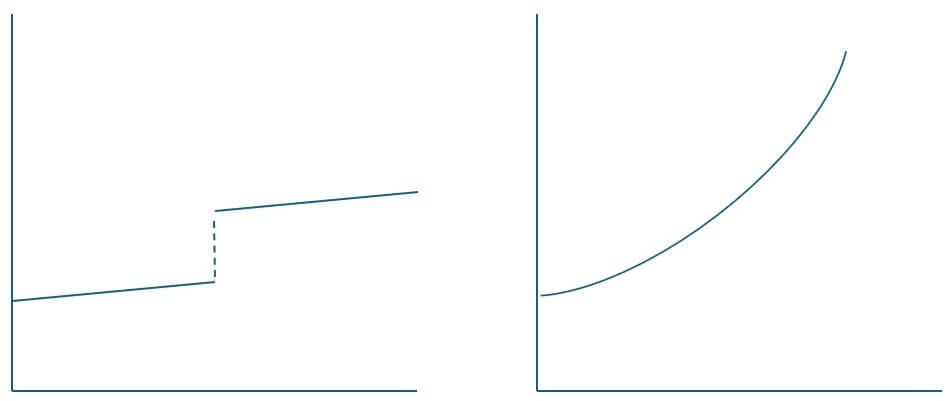

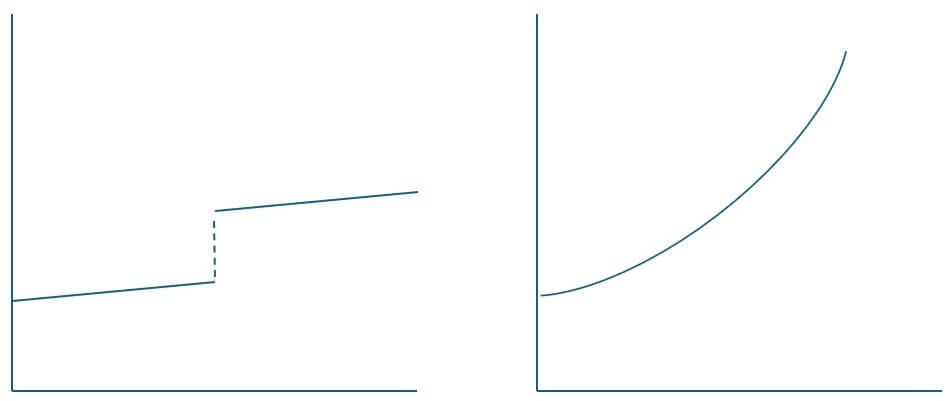

So, what Waller seems to envision is crudely represented by the chart below on the left. It shows a one-time price reset higher on select tariffed goods. After the reset, prices continue on their same prior trajectory.

Meanwhile, Powell’s concern appears to be crudely represented by the chart below on the right. It reflects the traditional inflation dynamic wherein prices continue rising aggressively due to persistent and increasing inflation.

Legendary investor Louis Navellier has been calling for rate cuts

With the economic data not providing evidence to support persistent “too hot” inflation, Louis has been railing against Powell’s unwillingness to cut rates for months now.

Let’s go to his recent issue of Market 360:

Simply put, tariffs have not caused the inflation bogeyman to appear. They haven’t dramatically impacted consumer spending, either.

You may recall that Powell even stated that rates would have been cut by now if not for Trump’s tariffs. Still, despite favorable inflation data and a resilient consumer, the Fed isn’t expected to cut key interest rates when it meets on July 30…

Powell needs to give some kind of guidance next week – not only to save face, but to calm markets and restore confidence.

Zeroing in on Louis’ use of the term bogeyman, we haven’t seen widespread inflation from tariffs yet. Why?

Remember: A tariff is basically a tax on imported goods, paid for by businesses or consumers at the far end of the supply chain.

So, are taxes inflationary?

That’s not the prevailing economic opinion. The more common stance is that taxes reduce spending, therefore they have a deflationary impact.

Think about it – when you hear politicians proclaim, “We need to raise taxes on the rich so that they pay their fair share!” do worried economists suddenly chime in to predict an ensuing inflationary spiral?

No. Because a tax, like a tariff, represents a one-time shift higher in a required monetary outlay. Yes, that higher outlay may persist, but it doesn’t, by nature, continue to climb – which is what Powell appears to be concerned about.

Let’s make this clear…

A one-time tariff-based price increase doesn’t qualify as the kind of “inflation” that Powell & Co. are there to address through policy. Tariff-based price changes don’t stem from an overheated economy or excessive money chasing limited goods. They happen once – then buyers either change their behavior (buying a non-tariffed brand) or they accept the new, static higher price for that specific good.

Either way, that new, tariff-impacted price doesn’t suddenly suffer from a new, higher inflation rate. Theoretically, its inflation rate should be the same as it was prior to that one-time price bump (like our chart above, on the left).

And that puts the spotlight on where inflation is today, and what that alone suggests is the correct interest rate policy.

So, what is that?

Well, here’s Powell from last month:

If you just look at the basic data and don’t look at the forecast, you would say that we would’ve continued cutting.

This is a strong argument in favor of Louis’ point – Powell is fighting an inflation monster that – if we go purely by today’s data – doesn’t exist.

Now, the Powell argument does have one potential ace up its sleeve…

Might consumers see higher prices from tariffs, get confused about their origin, and then expect even higher prices to come?

Traditional inflation – the kind that Powell fears – has a huge psychological component.

If consumers become convinced that inflation will worsen, they’ll buy goods and services today at prices that they believe will be lower than prices tomorrow.

Of course, it’s this very buying pressure that results in higher demand, fueling the exact price increases that consumers fear. It’s a self-reinforcing feedback loop.

So, if consumers believe that higher prices are coming, then the “one time price bump” aspect of a tariff won’t matter. Consumers will fear even higher prices tomorrow and buy today, initiating the vicious inflation cycle.

For example, yesterday, Morning Brew ran a headline reading “Beef prices in the US hit record highs.”

Headlines like this can affect behavior. So, it’s something to watch closely.

But fear-based psychological inflation isn’t happening today.

Let’s go to last Friday’s latest University of Michigan survey which showed tumbling inflation expectations.

From CNBC:

Consumers’ worst fears about tariff-induced inflation have receded…

The outlook at the one- and five-year horizons both tumbled, falling to their lowest levels since February, before President Donald Trump made his “liberation day” tariff announcement on April 2.

The report also indicated that sentiment has grown more positive, rising 1.8% from June – its highest level since February.

Put it altogether, and it suggests the Waller and Louis are on the right track in how they’re characterizing inflation today. Of course, we’ll have to wait until next Wednesday to see if the rest of the Fed members agree.

So, what happens if the Fed keeps holding rates steady as the economy weakens?

At the top of this Digest, I spotlighted Waller’s quote:

The private sector is not doing as well as everybody thinks it is.

What’s the case for this?

Well, let’s go straight to Waller himself from his speech last Thursday in New York:

While the labor market looks fine on the surface, once we account for expected data revisions, private-sector payroll growth is near stall speed, and other data suggest that the downside risks to the labor market have increased.

With inflation near target and the upside risks to inflation limited, we should not wait until the labor market deteriorates before we cut the policy rate…

The headline numbers from the June jobs report looked reassuring—the unemployment rate stands at 4.1 percent, within the range it has been for the past year, and payroll gains were reported as 147,000, essentially the same as in May.

But looking a little deeper, I see reasons to be concerned.

Half of the payroll gain came from state and local government, a sector of employment that is notoriously difficult to seasonally adjust this time of year.

In contrast, private payroll employment grew just 74,000, a much smaller gain than in the previous two months…

[Finally], A pattern in data revisions in recent years tells us that the private payroll data are being overestimated and will be revised down significantly when the benchmark revision occurs in early 2026…

Looking across the soft and hard data, I get a picture of a labor market on the edge.

A labor market on the edge turns into an economy on the edge… which can mean a stock market falling over the edge.

This is happening at the same time that stocks are about to enter a seasonally weak time of year

We profiled this seasonal headwind last week with the help of data from our corporate partner TradeSmith. They’re one of the most advanced, respected quantitative investing firms in the world.

TradeSmith’s CEO Keith Kaplan and his team of quants have created a seasonality trading tool that’s pointing to a market change that all investors should know about. It suggests that next week, we’re in for a major market shift. Not a crash, but a clear transition to a bearish seasonal pattern.

Let’s go to Keith:

Take a look at the chart below…

Green shaded areas represent times when the index tends to go up. The white areas are times when the index tends to fall.

As you can see, it’s been prime time for the S&P 500 since the end of June.

The June 28 to July 28 window has produced gains 15 years in a row.

Over the past 15 years, the return for the S&P 500 has dipped below 2% only five times—and it’s often been much higher.

For instance, in 2016, 2020, and 2022 this seasonal window delivered a gain of more than 6%.

We’re in the eye of that bullish storm now.

But following this bullish window, we get a major regime change.

After topping out around July 28, the market tends to stumble.

Historically the S&P 500 has fallen more than half the time over the next three months, with an average return of MINUS 1.8%.

Tomorrow morning at 10:00 a.m. Eastern, Keith and Louis are holding a webinar to discuss this seasonal shift and what they’re doing about it

One thing they’re doing is becoming more selective in their trades with the help of Keith’s seasonality tool. It identifies the exact days to buy and sell a stock based on that stock’s unique, historical patterns.

Here’s Keith:

Our algorithm runs 50,000 tests a day to analyze every stock in the major indexes and zero in on the ones with the strongest seasonality trends…

Some stocks trade so consistently—rising or falling during specific windows, year after year—that you can map out a year’s worth of great trades.

But we can take it one step further…

Tomorrow, Keith and Louis will discuss a strategy they call the “Navellier Edge.” It blends Keith’s seasonality/technical approach with Louis’ fundamental approach, refined over decades of experience. It’s a “best of” of two powerful quant systems.

You’ll hear more tomorrow, along with what the seasonality tool predicts for the broader market in the coming weeks.

To reserve your seat, just click here. And when you do, you’ll get instant access to the seasonality tool so that you can give it a spin yourself.

Plug in your own portfolio holdings to see what this cutting-edge piece of fintech suggests for its upcoming price action.

Coming full circle…

If the futures market is right, Powell won’t be cutting rates next week due to fears of inflation.

But if Waller is right, this is a mistake, endangering our labor market – and by extension, the stock market.

Meanwhile, the market is running into a historically bad time of year.

Put it altogether and the bottom line is that we’re not in a “cruise control” market.

So, let’s stick with our bullish trades – but be ready to pivot if/when headwinds roll in as history suggests they’re about to do.

Have a good evening,

Jeff Remsburg