Earlier this week, I wrote about how, though the 2025 bull market remains intact, cracks began to appear in the market internals, particularly in breadth (which measures market participation). In the wake of a Supreme Court decision on President Trump’s tariffs and the ongoing government shutdown, the major indices have been incredibly resilient. However, the indices have masked the ugly truth below the mask of the major indices. For instance, even though the S&P 500, Nasdaq, Russell 2000, and Dow Jones Industrial Average are within a stone’s throw of all-time highs, the number of stocks hitting 52-week lows in the S&P 500 Index recently hit the lowest levels since the April tariff panic – indicating a bifurcated, tricky market environment.

Government Shutdown Becomes the Longest in History

On October 1st, the government shutdown began when the US Congress failed to pass the budget laws needed to fund federal agencies (such as the FAA, the military, and the postal service, to name a few). Though stocks usually brush off government shutdowns (with a history of gaining ground during them), the longer they last, the more negatively they affect the economy and the stock market. Friday marks the 38th day the government has been shut down, the longest in US history. Below are three negative impacts government shutdowns have on the economy:

· GDP Slows: The Congressional Budget Office (CBO) estimates that the current government shutdown will slow down Q4 GDP by 1 to 2%.

· Consumers Spend Less: With hundreds of thousands of Federal employees furloughed or working without pay, consumer spending typically drops.

· Government Contracts Delayed: Estimates suggest that government spending is responsible for up to a quarter of GDP. Shutdowns lead to decreased government spending; thus, they take a toll on the economy.

Politicians on the left and the right do not seem confident of a resolution to the shutdown in the near-term. Nevertheless, the market tells a different story. Below are three reasons the government shutdown will end in November, including:

Betting Markets Suggest Government Shutdown Will End in November

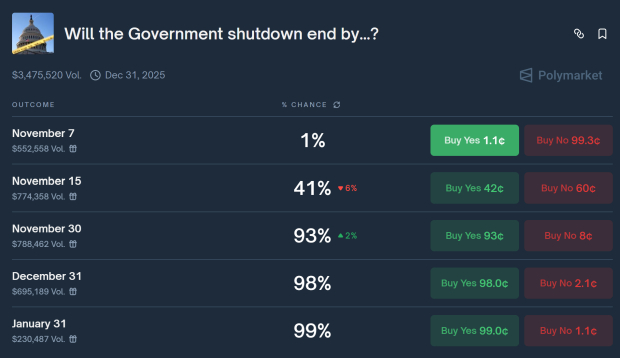

Prediction markets like Polymarket have been highly accurate in predicting the future. For example, betting markets correctly predicted President Trump’s victory last November, Tesla (TSLA) CEO Elon Musk’s pay package being passed, and the government shutdown itself. Unlike politicians, who may have ulterior motives behind their rhetoric, betting markets reflect real-world wagers. Currently, bettors on Polymarket, which just received a signficant investment from Intercontinental Exchange (ICE), assign 92% chance that the government shutdown will end by November 30th.

Image Source: Polymarket

Strength in Airline Stocks Suggests an End to the Government Shutdown

The Federal Aviation Administration (FAA) has an order to scale back flights nationwide in more than 40 airports ahead of Thanksgiving if the government shutdown cannot be resolved. Nevertheless, as Stanley Druckenmiller once proclaimed, “The inside of the stock market is the best economic indicator I know.” Obviously, a prolonged scale back of flights would negatively impact airlines’ stocks. However, despite the carnage in stocks this week, airlines like American Airlines (AAL), United Airlines (UAL), and Delta Airlines (DAL) are all green – suggesting that investors do not believe a prolonged shutdown is in the cards.

Techical Action and Options Activity Suggests a Market Bounce is Imminent

The Nasdaq 100 Index ETF (QQQ) is retreating to its 10-week moving average. Since retaking the level in April, QQQ has held it all year long.

Image Source: TradingView

Additionally, VIX out-of-the-money put options are now more expensive than equidistant calls, a typical sign that a market bottom is imminent.

Bottom Line

While political gridlock continues to drag on the economy, markets are ready to look past the turmoil. Strength in airline stocks is a clue that the government shutdown may end soon.

Zacks’ Research Chief Picks Stock Most Likely to “At Least Double”

Our experts have revealed their Top 5 recommendations with money-doubling potential – and Director of Research Sheraz Mian believes one is superior to the others. Of course, all our picks aren’t winners but this one could far surpass earlier recommendations like Hims & Hers Health, which shot up +209%.

See Our Top Stock to Double (Plus 4 Runners Up) >>

Intercontinental Exchange Inc. (ICE) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

This article originally published on Zacks Investment Research (zacks.com).