I’m going to be very real with y’all…

When I first heard about “financial vision boards,” my brain immediately filed it under Things People on Pinterest Do.

You know, right next to color-coded meal plans and perfectly arranged spice racks.

But then I started noticing articles about who actually uses vision boards. And sure, it’s people on Pinterest, but it’s also titans of business. People like Michelle Obama and Oprah Winfrey and, oh yeah, Conrad Hilton.

In fact, in 2019, Inc.com loudly proclaimed that 1 in 5 successful entrepreneurs use vision boards, and the results are backed by neuroscience.

In a CNBC interview that same year, neuroscientist, medical doctor and executive coach Tara Swart said, “You would be surprised how many high-powered executives secretly have action or vision boards at home or saved on their computers.”

How does she know? They’re her clients.

Swart routinely works with executives at major companies like KPMG, LinkedIn, MIT Sloan School of Management, Samsung, Sony, SAB Miller and Stanford Business School, teaching them how to achieve their goals using neuroscience (including vision boards as a tool).

Really??

At first, I dismissed it. I mean, it’s just a bunch of pictures glued to a piece of cardboard, right? How could that possibly help me save for a dream retirement or keep me from procrastinating on the bigger money moves I know I need to make?

But the idea wouldn’t let me go. I kept thinking… what if they’re onto something?

What if this slightly woo-woo exercise actually works? What if staring at a picture of a paid-off mortgage or a dream vacation could make those things happen faster? Or at all?

So, here I am… writing this, not just to convince you — it’s a little bit to convince myself, too — to give it a shot. Because, honestly, if this little exercise could help me achieve some of the big financial goals in my life, I’m all in.

Ready to see if we can make our money dreams a little more… real?

It’s the January 2025 vision board experiment. Let’s do it.

What Is a Financial Vision Board?

Let’s start with the basics.

A financial vision board is where your money meets your dreams. It’s a visual tool — a collection of images, words, and ideas that represent what you want to achieve, both financially and in life.

Think of it as your personal “why.” Why you’re saving. Why you’re budgeting. Why you’re saying no to another Friday night takeout so you can say yes to something bigger later on.

Here’s how it works: You gather images that resonate with your goals. Maybe it’s a photo of a house, a stack of books symbolizing lifelong learning, or a plane flying to that dream vacation spot. You put them all on a board (physical or digital) and keep it somewhere you’ll see it regularly.

Why? Because having those goals front and center makes them feel real. Tangible. Achievable.

It’s not just about staring at pretty pictures, either. A financial vision board helps you connect the dots between the life you want and the money it will take to get there. It’s like a mini roadmap, guiding your financial decisions in a way that aligns with your values.

Here’s the deal: Money without meaning can feel, well, meaningless.

You can save and save and save — but without a clear goal in mind, it’s easy to lose track of why you’re doing it. That’s where a financial vision board comes in.

When you create one, you’re not just identifying what you want — you’re actively visualizing it. You’re making it real. Studies have shown that visualization can actually help people achieve their goals by keeping them focused and motivated. (Apparently, our brains love a good visual cue!)

And yes, I get it — at first, it might sound a little… abstract. I was skeptical, too! But the more I learned about how it works — and how many people swear by it — the more I thought, Why not?

Worst case, I spend an hour creating something inspiring. Best case, I give my financial goals the clarity and purpose they deserve.

How to Make a Financial Vision Board

Alright, you’re sold — or at least curious enough to give this a shot. So, let’s get into the nitty-gritty. How do you actually make a financial vision board? Don’t worry, you don’t need a crafting degree or an endless supply of magazines. It’s easier (and more flexible) than you think.

Step 1: Gather Your Materials

First, decide how you want to create your board. You’ve got options:

Old-School:A physical board with printed images, magazines, scissors, and glue.

Digital:Pinterest, Canva, or even a simple Word document to collect and arrange your images.

Both work. Choose whatever feels easiest and most exciting for you.

Now, start gathering images. Ellen Rogin, a former wealth advisor who literally co-wrote the book on how to create a financial vision board, suggests picking at least 20 to 30 images to start with. They can be images of anything — lifestyle, food, sports, nature, people, etc. — as long as it sparks something in you, like a dream, a goal, or even just a good feeling. These could be

– Pictures of places you want to visit.

– Symbols of debt freedom (a paid-off credit card, anyone?).

– Anything tied to the life you want: a cozy home, a thriving career, or time with loved ones.

Pro tip:Don’t overthink it. Just pick what resonates. You can always edit later.

Step 2: Reflect on Your Images

This is where the magic happens.

Take a close look at the images you’ve gathered. One by one, ask yourself:

– Why does this image stand out to me?

– What does it represent?

– Picture yourself in the context of the image. Where are you? What do you see? What do you smell?

– How would I feel if I achieved this?

– Who would I share this with?

Don’t just think about money here. Think about your life. For example:

A picture of a beach might mean financial freedom for one person and a much-needed family vacation for someone else.

A dining table might symbolize hosting more gatherings — or maybe even buying a bigger home in a different city.

This reflection helps you identify what truly matters and what your goals are. You may even uncover goals you didn’t realize you had. Once you identify each goal, write it down so you don’t forget it; in the next step, you can start tying those goals to specific financial actions.

Step 3: Arrange Your Vision Board

Here’s where the vision board gets practical.

There are two general ways to arrange your board. The first is very free flowing. You simply start arranging your images in any way that feels good to you. Add words or phrases, even quotes, that resonate with you and align with your goals.

This idea isn’t new. In fact, a young Conrad Hilton famously ripped an image of the Waldorf Astoria out of a magazine in 1931, wrote “The Greatest of Them All” across it, and tucked it under the glass on his desk. Eighteen years later, he owned the hotel.

If that approach feels too open-ended, there’s also a more structured method that can help you map out your goals with even greater clarity.

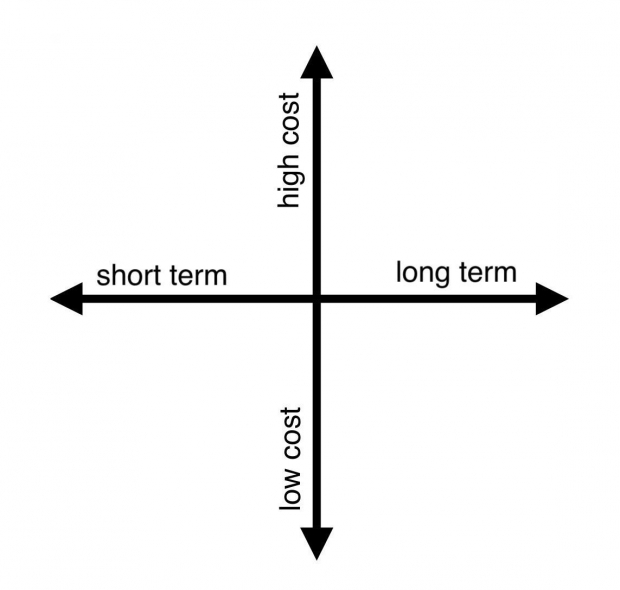

You can also arrange your board by time and cost. Grab your board (or open your digital file) and draw a simple grid with four quadrants. Your horizontal line represents time (short term to long term), and your vertical line represents cost (low cost to high cost).

Image Source: Zacks Investment Research

Some examples of where you could put certain visions/goals…

Top Left: High-cost, short-term goals (saving for a car or a big trip).

Top Right: High-cost, long-term goals (retirement, buying a house).

Bottom Left: Low-cost, short-term goals (like picking up a new hobby).

Bottom Right: Low-cost, long-term goals (building stronger relationships, learning a new skill).

Placing your images in these quadrants will help you visualize not just what you want but when and how much effort it might take. For example: That dream vacation might land in the top left — something you can save for in a year or two — while paying off your mortgage might sit in the top right, as a long-term goal with a bigger price tag.

As you arrange your financial vision board, you’ll start to see a sharper picture of the life you’re working toward — and how much time, effort, and money it will take to make it a reality. Again, add words or phrases, even quotes, that resonate with you and align with your goals.

Step 4: Keep It Visible

The key to making a financial vision board work? You need to see it.

Hang it above your desk, pin it to your fridge, or save it as your phone wallpaper. Somewhere you’ll see it every day.

Because the more you stare at your board, the more likely it is that a pile of cash will fall from the sky? Of course not.

Let’s be clear… a vision board won’t do the work for you. But it can supercharge your focus by constantly reminding your brain of what’s important, training it to spot opportunities and solutions that align with your goals.

Here’s where it gets fascinating. Your brain isn’t static — it’s constantly rewiring itself based on what you focus on. This process, called neuroplasticity, is the foundation of why visualization works. When you look at your vision board, you’re literally training your brain to pay attention to the things that matter most to you.

Two key players in this process are:

– Mirror Neurons:These help us plan and learn by mimicking actions we see or imagine. When you visualize your goals, your brain treats it as a practice run for achieving them.

– Neural Resonance:This helps you focus and solve problems, boosting your ability to spot opportunities and take action toward your goals.

Creating a vision board isn’t just about dreaming big — it’s also about cutting through the noise. The act of selecting images forces you to clarify what really matters. Once your board is done, it acts as a visual filter, helping your brain prioritize relevant information and opportunities.

You see, your brain doesn’t know the difference between imagining success and actually experiencing it. That’s why athletes visualize winning — it primes their minds (and bodies) for the real thing.

So when you look at your vision board, don’t just see your goals — feel them. Imagine the excitement of hitting “submit” on your last debt payment. Picture the joy of stepping onto that plane for your dream vacation. Emotions send powerful signals to your subconscious, reinforcing what you’re working toward.

How to Use Your Vision Board to Stay on Track

Alright, your financial vision board is done. It’s sitting there, looking all shiny and motivational. But now what? How do you turn those images into your reality?

The first thing you need to do is connect your goals to a plan.Your vision board is like a map, but a map is useless if you don’t know how to read it.

Take a good look at each image and ask yourself:

– What’s the first step toward making this happen?

– How much will it cost, and how long will it take?

– What adjustments do I need to make to my spending, saving, or earning habits?

For example…

If you’ve got a picture of a cozy kitchen renovation, start researching costs and setting up a dedicated savings fund.

If debt freedom is on your board, figure out how much extra you can pay each month toward your balance.

The clearer your plan, the more likely you are to stay on track.

Whenever you feel your motivation flag, look at your board. Remind yourself why you’re working hard and making these choices. Visualize what it will feel like to achieve the goals staring back at you. And refocus on the big picture.

Don’t forget; your financial vision board isn’t just a snapshot of what you want. It’s a living document — a work in progress.

As you move closer to your goals, update your board to reflect your achievements. Cross out completed goals or add a picture of you achieving that goal (moving into the new house, walking across the beach on your dream vacation, etc.) to that section of your board. Seeing your progress visually can be incredibly satisfying and keep you motivated to tackle the next challenge.

My January 2025 Vision Board Experiment

You’ve got the tools, the science, and the inspiration. Now it’s time to put it all together.

Here’s my plan: This January, I’m diving into my own vision board experiment. I’ll spend a little time reflecting on what I really want from the next few years (financially and otherwise) and build a vision board that ties my money habits to those aspirations. I’ll keep it visible, use it daily, and revisit it throughout the year to see how it’s helping me stay on track.

Why not join me? Whether you’re a seasoned budgeter, a goal-getter, or just curious to see if this works, let’s give it a shot. Who knows — this simple exercise might just help us all achieve our “somedays” much sooner than we first thought.

Free: Get Wealth-Building Tips Right in Your Inbox

Zacks’ Money Sense newsletter is a trusted source of personal finance information and resources. Every week, you’ll receive new ideas and practical strategies you can use to save more, invest more intelligently, and build a brighter financial future.

Whether you’re just starting out or you’ve already built a big nest egg, the insights our team of experts share can help you reach the next level of financial freedom and success. Sign up free today.

Get Money Sense absolutely free >>