Over the last few weeks, the stock market had seen the largest monthly decline since the COVID-19 pandemic. Of course, the post-pandemic recovery would end up making the COVID-19 plunge one of those once-in-a-lifetime opportunities to reap massive returns when the market rebounded.

The current economic scenario may be different but one thing that remains the same is that the trend of earnings estimate revisions will help investors navigate which stocks to invest in, which is what the Zacks Rank is predicated on.

To that point, following the Zacks Rank will allow investors to see which companies are navigating a tariff-induced economic slowdown effectively. While it’s never wise to bet against the stock market’s long-term prospects, the jitters are understandable as the Trump administration has implemented the highest tariffs on imports in over a century. This will certainly have global economic ramifications, especially with some countries likely to counter with reciprocal tariffs of their own.

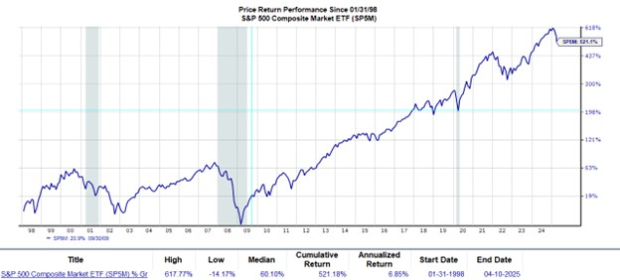

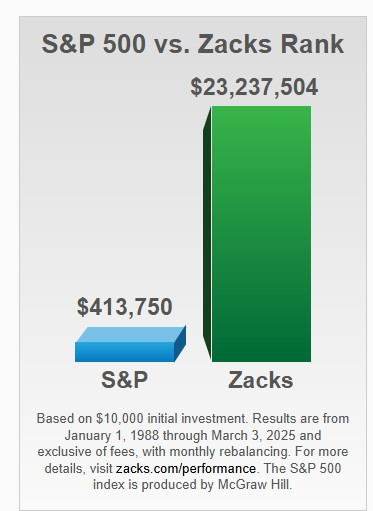

Still, the Zacks Rank can help, with it noteworthy that the Zacks Rank #1 (Strong Buy) stocks have more than doubled the S&P 500 with an average gain of +23.9% per year since 1998.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

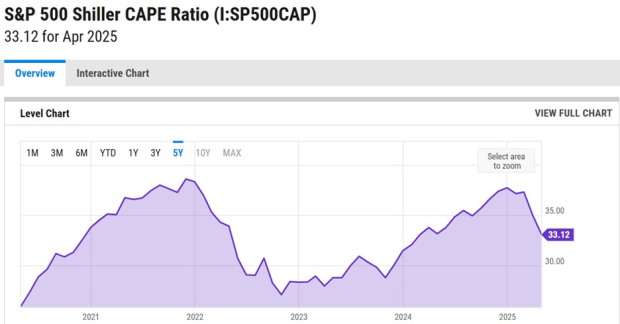

Market Recalibration & Cape Ratio Concerns

With many analysts calling for a recalibration in the market, famed investor and billionaire Jeffrey Gundlach has pointed out that the Cape ratio on the S&P 500 had been near its second-highest level ever at 38X, suggesting stocks are still overvalued.

Also known as the Shiller P/E ratio, the Cape ratio is used to calculate the price of the stock market or individual stocks relative to their average inflation-adjusted earnings over the last 10 years, smoothing out fluctuations caused by economic cycles. Although the forward earnings multiple on the S&P 500 is at a reasonable 20.1X, the Cape ratio still stands at 33.1X compared to its historical average of 16.9X.

Notably, Gundlach has called for a 60% chance of a recession, stating that leverage investors may be at risk of bankruptcy amid large market swings while companies deal with tariff ramifications as opposed to supply chain issues during the pandemic.

Image Source: YCHARTS

Using The Mag 7 as an Example

There is no doubt that intriguing long-term buying opportunities are being presented, and many investors may be scoping out the Mag-7 stocks such as EV leader Tesla TSLA, AI chip leader Nvidia NVDA, and electronics giant Apple AAPL.

Apple for instance may be placed in a difficult spot for investors to consider whether it’s time to buy on the dip with AAPL recently trading near its 52-week low of $164 a share before rebounding to just under $200. While Apple’s stock is still trading 23% from its 52-week high, the company will be significantly affected by tariffs as it relies heavily on international manufacturing in China, India, and Vietnam.

The Zacks Rank suggests it may be time to fade the recent rally in AAPL off its lows, as earnings estimate revisions have continued to decline over the last quarter and are down in the last week for fiscal 2025 and FY26. This has led to Apple’s stock landing a Zack Rank #4 (Sell).

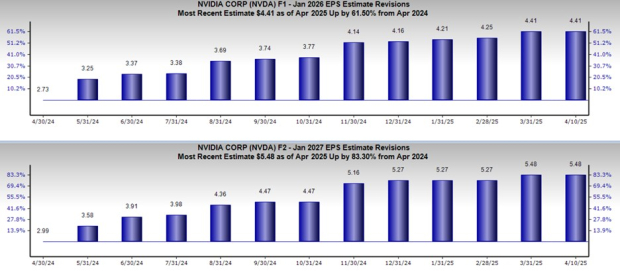

Image Source: Zacks Investment Research

It’s noteworthy that Nvidia is the only Mag 7 stock that has a buy rating (Zacks Rank #2) at the moment as the chipmaker has seen a pleasant trend of positive earnings estimate revisions, suggesting NVDA should be in store for a sharper rebound than its big tech peers. The trend of rising EPS estimates has continued over the last year with NVDA still up +25% during this period despite an 18% dip in 2025.

Image Source: Zacks Investment Research

ASLE is an Intriguing Addition to the Zacks Rank #1 List

Trading under $10 a share, AerSale’s ASLE stock is an intriguing addition to the Zacks Rank #1 (Strong Buy) list. AerSale provides integrated, diversified aviation aftermarket products and services for aircraft owners and operators to realize savings in the operation, maintenance, and monetization of their aircraft, engines, and components. Notably, AerSale’s Zacks Aerospace-Defense Equipment Industry is currently in the top 9% of over 240 Zacks industries.

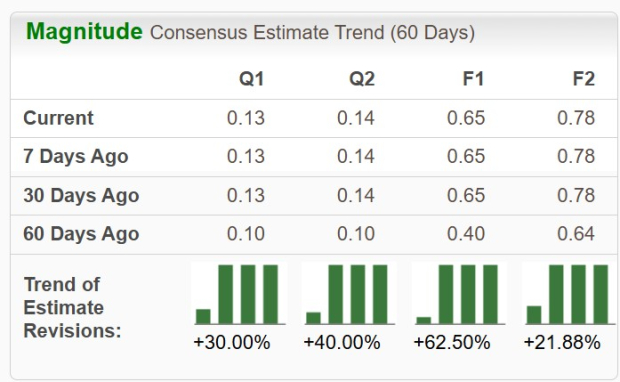

Benefiting from its strong business environment, EPS estimates have soared for AerSale over the last 60 days, with annual earnings now expected to skyrocket 261% this year to $0.65 per share compared to $0.18 in 2024. Plus, FY26 EPS is projected to increase another 20% to $0.78.

Image Source: Zacks Investment Research

Bottom Line

With earnings estimate revisions seen as the most powerful force impacting stock prices, following the Zacks Rank will surely be beneficial amid heightened market volatility, as a historic trade war plays out.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Apple Inc. (AAPL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

AerSale Corporation (ASLE) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).