Getting Closer to a Bitcoin ETF

The anticipation for a spot Bitcoin exchange-traded fund (ETF) is reaching a fever pitch, as investors eagerly await the potential launch of a regulated financial product that would provide both institutional and retail investors with easier access to Bitcoin’s price without requiring direct investment in the asset.

The Regulatory Deadline

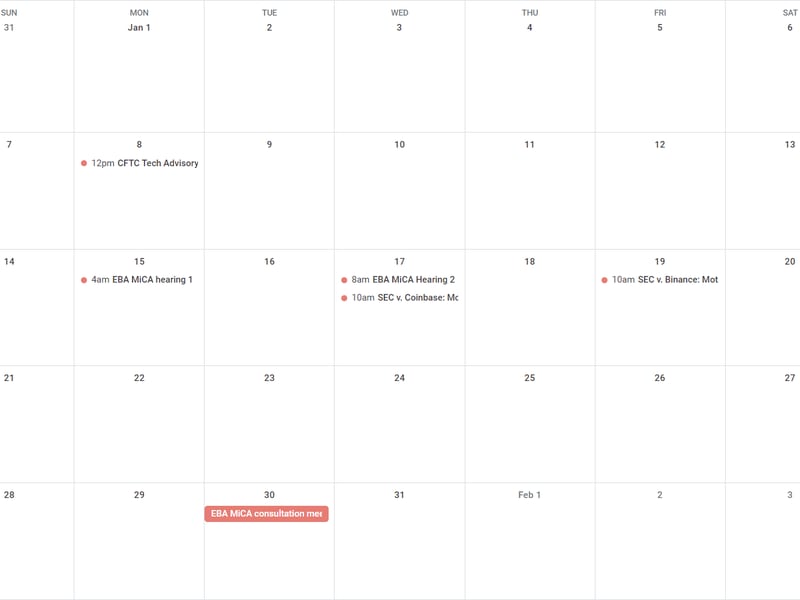

The U.S. Securities and Exchange Commission (SEC) is facing a critical deadline of January 10 to approve an application from Ark 21 Shares. This key date is widely viewed as the final opportunity for the SEC to make a decision on over a dozen pending ETF applications.

Signs of Approval

Positive indicators abound, with ongoing meetings between SEC staff, exchanges, and prospective issuers. Furthermore, a flurry of filings suggests that a spot Bitcoin ETF approval may be imminent. Representatives from major stock exchanges, including the New York Stock Exchange, Nasdaq, and Cboe Global Markets, recently engaged in discussions with SEC officials, fueling optimism about the upcoming decision.

SEC staff have also been actively engaging with ETF issuers, focusing on various aspects of their S-1 filings, with particular emphasis on the adoption of a cash creation and redemption model, rather than an in-kind approach.

Regulatory Debate

Companies such as BlackRock and Grayscale have advocated to the SEC in favor of allowing in-kind creation, highlighting potential benefits such as broader market participation and tighter spreads on the ETF. However, regulatory concerns, including the need to update rules for broker-dealer custody transactions, may pose hurdles to the approval of in-kind creations at this stage.

Notwithstanding the regulatory debate, recent procedural steps by Fidelity and other issuers, such as the filing of Form 8-A, suggest that preparations for potential approval are well underway. However, beyond these formalities, 19b-4 and S-1 approvals will ultimately determine whether these ETFs can commence trading.

Market Momentum

Amid the mounting excitement, various market players are positioning themselves for the anticipated spot trust product approval. T-REX Group’s filing for a range of inverse and long spot Bitcoin ETFs serves as a clear testament to the fervent anticipation surrounding the potential launch of a spot Bitcoin ETF.

What Lies Ahead

The coming weeks hold immense significance, as stakeholders eagerly await the SEC’s decision on the spot Bitcoin ETF applications. The culmination of these developments may mark a historic turning point in the realm of cryptocurrency investment, potentially paving the way for increased participation and accessibility for investors.

If you have any thoughts or questions on what should be discussed in the next edition or any other feedback to share, feel free to reach out via email or Twitter. Your engagement is vital as we navigate this exciting juncture in cryptocurrency regulation and investment.

Join the group conversation on Telegram to stay updated on the latest developments in the cryptocurrency landscape.