NVIDIA Corporation NVDA has been a standout performer in 2024, with its stock rocketing nearly 180% year to date. This stellar rise puts NVIDIA at the forefront of the semiconductor industry, handily outpacing the Zacks Semiconductor – General industry’s 127.5% gain and the Technology Select Sector SPDR Fund XLK ETF’s 22.6% climb.

YTD Price Return Performance

Image Source: Zacks Investment Research

With a market capitalization of $3.395 trillion, NVIDIA is now the second most valuable publicly traded U.S. company, trailing only Apple Inc. AAPL at $3.622 trillion. Joining the exclusive $3 trillion club alongside Microsoft Corporation MSFT, NVIDIA’s remarkable ascent raises the question: Is there still room for growth, or has it peaked?

The AI Revolution: NVIDIA’s Core Growth Engine

NVIDIA’s meteoric rise is anchored in its leadership in artificial intelligence (AI), particularly generative AI. As businesses increasingly adopt AI to boost productivity, demand for NVIDIA’s advanced graphic processing units (GPUs), which power these applications, has surged.

According to Fortune Business Insights, the global generative AI market is projected to skyrocket to $967.6 billion by 2032 at a compound annual growth rate (CAGR) of 39.6% from 2024. This rapid expansion makes NVIDIA’s GPUs indispensable for companies investing in AI infrastructure.

NVIDIA’s cutting-edge technology delivers unmatched computational power, enabling large-scale AI models to perform intricate calculations. With generative AI applications spanning industries such as healthcare, automotive and manufacturing, NVIDIA is positioned to dominate this space for years.

NVIDIA’s Diversified Growth Across Industries

NVIDIA’s influence extends well beyond AI. The company’s GPUs are integral to advancements in sectors like automotive, healthcare and manufacturing. In automotive, NVIDIA’s solutions contribute to the development of autonomous vehicles, a market expected to experience rapid growth over the next decade. In healthcare, NVIDIA’s GPUs are revolutionizing medical diagnostics, enhancing imaging processes and improving patient care. This broad, multi-industry applicability positions NVIDIA as a resilient and diverse growth engine in the tech landscape.

Moreover, NVIDIA’s robust data center solutions are gaining traction. As companies invest in cloud and edge computing, demand for powerful data center infrastructure rises, making NVIDIA’s data center business a critical growth driver. This sector alone is projected to significantly boost the company’s revenues as businesses accelerate their digital transformation efforts, solidifying NVIDIA’s long-term growth potential.

NVIDIA’s Robust Financial Performance Highlights Strength

NVIDIA’s financial results underscore its dominance. In the third quarter of fiscal 2025, the company reported a staggering 94% year-over-year revenue increase, paired with a 103% jump in non-GAAP earnings per share (EPS). For the fourth quarter, management expects revenues to soar to $37.5 billion, up from $22.1 billion in the prior-year quarter.

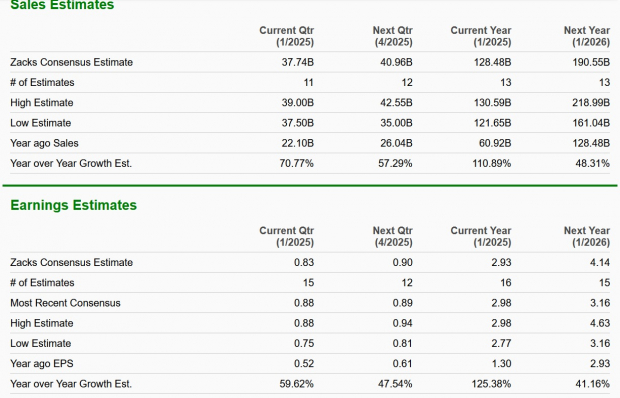

The Zacks Consensus Estimate for NVIDIA’s fiscal 2025 and 2026 revenues and earnings points to sustained growth, reflecting confidence in the company’s market leadership across multiple sectors, including gaming, automotive and professional visualization.

Image Source: Zacks Investment Research

This financial prowess is reflected in NVIDIA’s strong balance sheet. As of Oct. 27, 2024, the company held $38.4 billion in cash, up from $34.8 billion on July 28. Over the first three quarters of fiscal 2025, NVIDIA generated $47.5 billion in operating cash flow and $45.2 billion in free cash flow.

This financial stability not only supports ongoing innovation but also provides a cushion against market volatility, ensuring NVIDIA can capitalize on emerging opportunities.

NVIDIA’s Discounted Valuation Amid Growth

Despite its remarkable run, NVIDIA’s valuation remains attractive. The stock trades at a trailing 12-month price-to-earnings (P/E) ratio of 35.15, below the Zacks Semiconductor – General industry average of 37.83. This suggests the stock is trading at a relative discount, offering potential upside for investors.

Image Source: Zacks Investment Research

NVIDIA: In a Nutshell

NVIDIA’s 180% YTD surge is impressive, but its growth trajectory is far from over. The company’s leadership in AI, diversified applications and robust financial performance position it as a cornerstone of the semiconductor and technology sectors.

For investors seeking exposure to the AI revolution and beyond, NVIDIA represents a compelling opportunity. The stock’s long-term prospects and attractive valuation make it a must-buy for those looking to ride the wave of technological innovation.

NVIDIA currently carries a Zacks Rank #2 (Buy) and has a VGM Score of B. Our research shows that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or #2, offer the best investment opportunities for investors. NVDA stock appears to be a compelling investment proposition at the moment. You can see the complete list of today’s Zacks #1 Rank stocks here.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Technology Select Sector SPDR ETF (XLK): ETF Research Reports