Wyndham Hotels & Resorts, Inc. has recently bolstered its global presence through a strategic collaboration with Decameron All Inclusive Hotels & Resorts. This venture marks a significant milestone for Wyndham as it brings over 50 new resorts into its all-inclusive portfolio.

Expanding its horizon to include nine all-inclusive resorts spanning Mexico, Panama, and Jamaica, Wyndham’s move not only diversifies its product offerings but also amplifies its market reach on a global scale. Moreover, these new additions have seamlessly integrated into Wyndham’s popular rewards program, Wyndham Rewards, granting members the opportunity to accrue points during their stay.

Among the nine resorts, five prestigious properties including Grand Decameron Complex Bucerías, Grand Decameron Panama, Grand Decameron Los Cabos, Grand Decameron Montego Beach, and Grand Decameron Cornwall Beach fall under the Trademark Collection brand. The remaining four resorts, namely Decameron Los Cocos Guayabitos, Decameron La Marina Guayabitos, Decameron Isla Coral Guayabitos, and Decameron Club Caribbean Runaway Bay, are associated with the Ramada brand.

Wyndham’s Aggressive Expansion Strategy

Wyndham’s robust growth trajectory is underscored by its unwavering commitment to expanding its geographical footprint and enhancing its product range across all market segments. The company’s investment in high-return ventures, coupled with strategic collaborations like the Decameron partnership, reflects its prudent capital allocation approach.

The first quarter of 2024 witnessed Wyndham unveiling over 13,000 rooms worldwide, marking a notable 27% year-over-year surge. As of March 31, 2024, the company’s global room count stood at 876,300, demonstrating a 4% increase compared to the prior-year period. In the same quarter, Wyndham launched 50 new hotels in key U.S. locations such as Charlotte, Raleigh, Tucson, and Jacksonville, including 11 hotel conversions under the innovative WaterWalk Extended Stay by Wyndham brand. Anticipation surrounds the upcoming debut of the ECHO Suites brand in 2024, offering fresh extended-stay accommodations.

Notably, WH’s global development pipeline consists of nearly 2,000 hotels and approximately 243,000 rooms, illustrating an 8% year-over-year upsurge. A significant portion of this pipeline, around 58%, pertains to international projects, indicating Wyndham’s strong global growth trajectory.

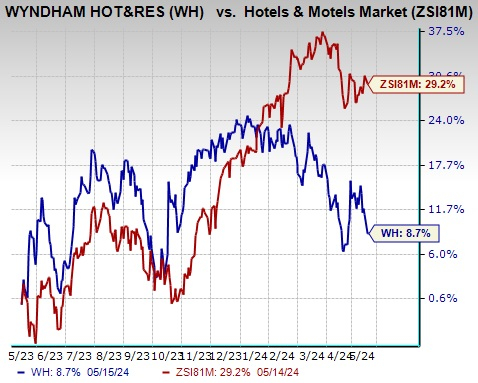

Image Source: Zacks Investment Research

Shares of Wyndham Hotels & Resorts have demonstrated an 8.7% uptick in the past year, albeit trailing the 29.2% industry growth in the Hotels and Motels sector. Despite this relative underperformance, the company’s ongoing expansion endeavors are expected to fuel further growth in the foreseeable future.

Zacks Rank & Promising Picks

Currently holding a Zacks Rank #3 (Hold), Wyndham continues to navigate a competitive landscape as it forges ahead with its expansion initiatives.

Notable stocks from the Consumer Discretionary sector include Strategic Education, Inc. (Zacks Rank #1 – Strong Buy), Netflix, Inc. (Zacks Rank #1), and Royal Caribbean Cruises Ltd. (Zacks Rank #1). These companies have yielded robust earnings surprises and impressive stock performance, bolstering investor confidence in the sector.

Amidst an evolving market scenario with growing demands for Artificial Intelligence, Machine Learning, and the Internet of Things, these companies are poised for sustained growth as they capitalize on emerging trends and consumer preferences.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.