XPENG Company Overview

Zacks Rank #3 (Hold) stock XPENG (XPEV) is a leading Chinese electric vehicle manufacturer. Founded in 2014, XPEV designs, develops, and manufactures “smart EVs” aimed at attracting tech-savvy, middle-class customers. XPEV sells sedans, SUVs, and large vehicles. Unlike most automakers, XPEV is largely vertically integrated and manufactures its powertrains, electronics, and vehicle software in-house. Because of its vertically integrated manufacturing process, XPEV offers low-cost vehicles, with its “Mona M03” model starting at ~$17,000 in China. Meanwhile, XPENG’s “G7” SUV starts at $27,300, undercutting the Tesla (TSLA) Model Y by ~$9,0000.

XPENG Reports Record Deliveries

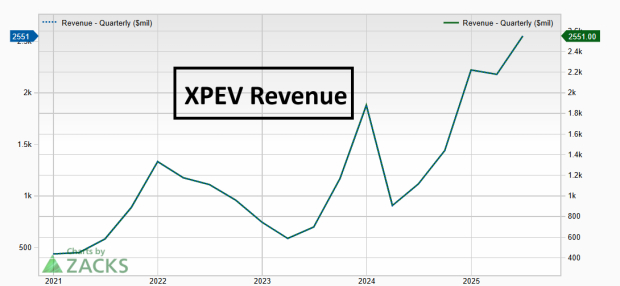

The combination of a refreshed vehicle lineup, particularly its lowest-cost Mona M03 model, and a booming Chinese EV market has resulted in record deliveries for XPENG. Last month, XPEV delivered 42,013 vehicles (76% year-over-year growth). October marked the fourth consecutive month of record deliveries for the company. Though the company is slightly unprofitable due to its young history, XPEV revenues have trended strongly upward since becoming public and have posted triple-digit year-over-year growth in the two most recent quarters.

Image Source: Zacks Investment Research

XPENG: Beyond an EV Manufacturer

Earlier this month, XPENG held an AI event where the company illustrated its intent to be far more than a one-dimensional EV company. Below are some products XPENG unveiled:

· Robotaxi technology: Thanks to lax regulations and strong government support, China currently has the world’s largest robotaxi market. Next year, XPENG plans to launch three robotaxi models equipped with its in-house autonomous driving technology. Additionally, XPENG has named German automotive powerhouse Volkswagen (VWAGY) as a strategic partner.

· Humanoid robot: XPENG’s unveiling of its “Iron” humanoid robot went viral.

· Flying cars: XPENG also showcased an eVTOL concept.

XPENG’s impressive AI showcase means that the company is taking a page out of Tesla’s book and plans to be a physical AI company rather than just an EV maker. XPEV is well positioned to capitalize on the burgeoning robotaxi and humanoid robot markets.

XPEV Threatens Technical Breakout

XPEV Shares are in the process of breaking out of a 6-month base structure.

Image Source: TradingView

Bottom Line

XPENG’s combination of surging EV deliveries, a refreshed product lineup, and bold move into AI-driven mobility positions the company as a potential long-term winner.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Volkswagen AG Unsponsored ADR (VWAGY) : Free Stock Analysis Report

XPeng Inc. Sponsored ADR (XPEV) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).