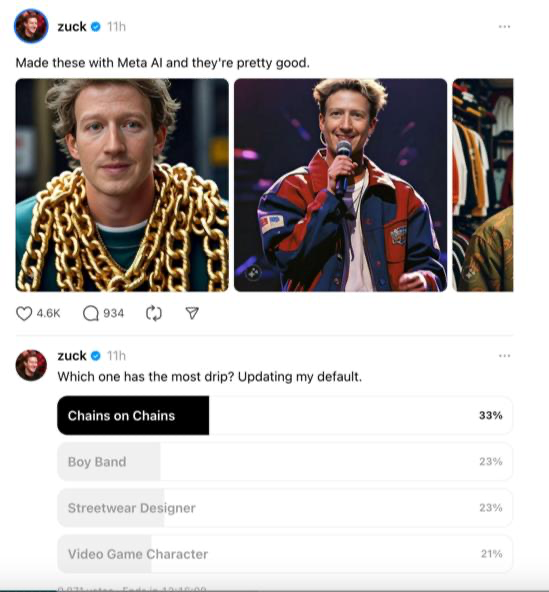

Mark Zuckerberg, the CEO of Meta Platforms Inc., is seeking fashion advice from the public. Zuckerberg recently shared AI-generated images of himself in various outfits, asking his followers to vote for their favorite look.

The Fashion Experiment

Known for his signature casual style, Zuckerberg is now exploring new sartorial avenues. The images, created using Meta AI, portray him in different attires, from oversized gold chains to a streetwear designer and even a “video game character” in a cap and vest.

The fashion endeavor coincides with the unveiling of Meta’s latest AI model, Llama 3.1, enabling users to generate AI-driven images based on their selfies. The image featuring Zuckerberg adorned with large gold chains garnered 33% of the votes, becoming the crowd favorite.

Meta’s Diversification

On a different track, Meta may venture into the streetwear sector. The company has acquired a 5% stake in Ray-Ban‘s parent company EssilorLuxottica, as reported by The Wall Street Journal. This move follows the announcement of EssilorLuxottica’s acquisition of the popular Gen Z streetwear label Supreme.

Significance of the Fashion Experiment

Zuckerberg’s fashion foray aligns with Meta’s broader AI ambitions. Llama 3.1 is a part of Meta’s expansive AI strategy, positioning the company to compete with tech giants like Alphabet Inc. and Musk’s xAI in the AI domain.

Meta’s AI initiatives have also stirred some controversy, particularly with Apple Inc.. Meta’s CTO Andrew Bosworth made a witty comment regarding Apple’s stance on privacy after Apple declined to integrate Llama into its suite of AI features.

Furthermore, Meta’s AI goals are intertwined with its strategy to lead in the mixed-reality sphere. The company has opened up its Quest operating system to third-party hardware manufacturers, fostering a new realm of mixed-reality devices.

Closing Thoughts

Mark Zuckerberg’s leap into the world of fashion choices underlines Meta’s relentless pursuit of innovation. As Meta pushes the boundaries of AI and extends its reach into diverse industries, the tech landscape braces for what lies ahead.

Photo courtesy: Flickr