As we progress through the new year, investors are certainly watching some of the top-performing stocks of 2024.

Narrowing the landscape, the Zacks Business Services sector has quite a few top performers to watch.

From financial transaction services to technology-driven applications, the business services sector has prime prospects for growth. The essentiality of these businesses is also appealing when considering the ever-evolving technological landscape of today’s society.

Most important to the case for more upside, is that earnings estimate revisions have trended higher for these business services stocks. Soaring well over +100% in the last year, rising EPS estimates suggest their monstrous gains could continue.

Attributed to their increased probability, here are three of these business services stocks to consider with a Zacks Rank #1 (Strong Buy).

The Apps King

Web builder companies like Wix.com WIX have a niche in providing tools and solutions to build apps for small businesses but on a larger scale, AppLovin APP is the king of apps.

AppLovin’s expansion and rapid strive for profitability have taken the market by storm since the company went public in 2021. Speaking to its underlying larger scale, AppLovin’s technology platform enables enterprise-scale app developers to market, monetize, and build their own apps and app technology for others.

This interdependency has catapulted AppLovin’s growth with APP shares trading over $300 after soaring more than +300% in the last year.

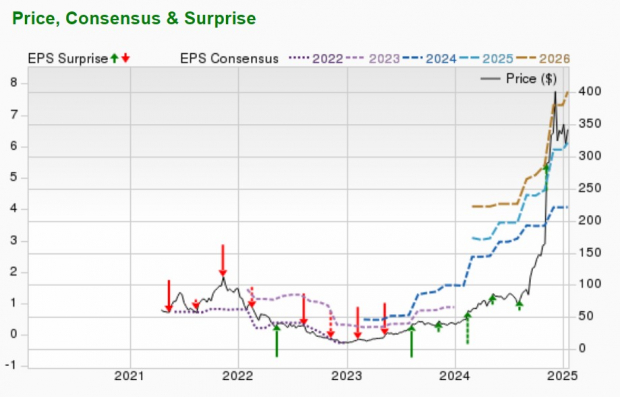

Image Source: Zacks Investment Research

Even at current levels, it’s hard to count out a continued rally in APP with AppLovin starting to reach and often exceed its quarterly expectations as shown in the EPS surprise chart above.

AppLovin will be reporting its Q4 results for fiscal 2024 in February with annual earnings expected at $4.06 per share compared to $0.98 in 2023. Plus, FY25 EPS is projected to soar another 50% with estimates up 6% in the last 60 days.

Image Source: Zacks Investment Research

Crypto Exchange Leader

Over the last year, Coinbase’s COIN gains of +140% have been near the performance of Bitcoin. As the largest cryptocurrency exchange, the trend of earnings estimate revisions is very pleasant for Coinbase with President Trump’s re-election pushing the price of Bitcoin to over $100,000 again.

The Trump administration has supported the deregulation of cryptocurrency which would certainly help Coinbase’s expansion after launching its IPO in 2021 as well. Like AppLovin, Coinbase has soared past the profitability line and is scheduled to release its Q4 results for FY24 in February. Astonishingly, annual EPS is slated to skyrocket to $5.71 versus $0.37 a share in 2023.

Although Coinbase’s bottom line is expected to dip to $3.48 per share this year, it’s noteworthy that FY24 and FY25 EPS estimates have spiked 13% and 28% in the last two months respectively.

Image Source: TradingView

Digital Payments Leader

We’ll round out this list of top-performing business services stocks with Sezzle SEZL, a leader in digital payment solutions. Sezzle’s platform increases the purchasing power of consumers by offering interest-free installment plans at online stores and select in-store locations.

As one of the hottest IPOs from 2023, Sezzle’s stock has sizzling gains of nearly +200% since going public, after rebounding and soaring an astonishing +600% last year. Consumers seem to be flocking to Sezzle with the company thought to have ended FY24 with total sales climbing 56% to $249.23 million. Plus, Sezzle’s top line is projected to expand another 33% this year to $331.95 million.

Image Source: Zacks Investment Research

Mirroring the impressive price performance of SEZL, Sezzle’s annual EPS is now projected at $9.85, a 688% increase from $1.25 per share in 2023. Magnifying its exceptional operating performance, at $238, SEZL still trades at a reasonable 18.2X forward earnings multiple with FY25 EPS expected to increase to an eye-catching $12.61.

Earnings estimates for FY24 and FY25 have soared over the last quarter and have remained higher in the last 60 days with Sezzle scheduled to release its Q4 results in late February.

Image Source: Zacks Investment Research

Bottom Line

It wouldn’t be surprising if the blazing performances of these highly ranked business services stocks were to continue, especially if they can beat Q4 expectations.

Reassuringly, they may be ideal buy-the-dip candidates in the event of a post-earnings selloff as AppLovin, Coinbase, and Sezzle are shaping up to be viable investments for 2025 and beyond.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand picked 7 your immediate attention.

AppLovin Corporation (APP) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

Sezzle Inc. (SEZL) : Free Stock Analysis Report

Wix.com Ltd. (WIX) : Free Stock Analysis Report