Unlocking Potential: AYR Wellness Shines With 20% Yield Amid Florida’s Vote Imminence

As Florida stands on the cusp of a monumental vote that could usher in the era of recreational cannabis, astute investors are seizing the opportunity to navigate the dynamic market terrain. The esteemed Viridian Credit Tracker has bestowed upon AYR Wellness the coveted status of a strong buy, spotlighting its tantalizing 20% yield, largely fueled by its robust footprint in Florida’s burgeoning cannabis domain. With Florida poised to potentially greenlight recreational cannabis, AYR stands tall as a beacon of promise, beckoning investors to partake in its fortunes ahead of the crucial vote.

AYR Wellness: A Gateway to 20% Yield – Embracing Florida’s Potential Paradigm Shift

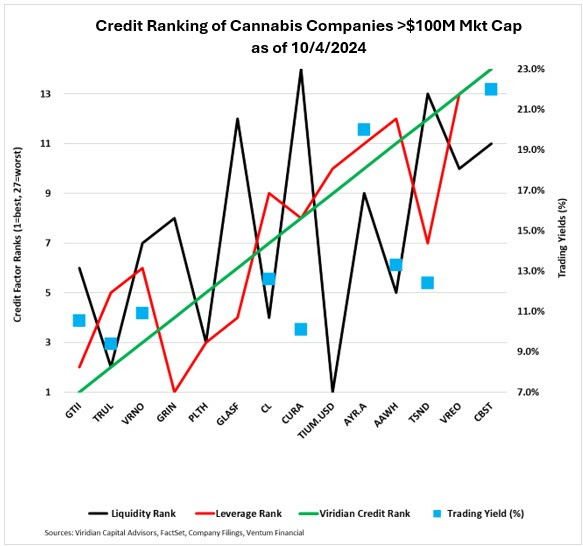

Delving into insights from the Viridian Credit Tracker curated by Viridian Capital Advisors, AYR’s strategic positioning in Florida’s lucrative market confers upon it a strategic advantage in anticipation of the state’s probable approval of recreational cannabis. AYR’s tantalizing 20% trading yield eclipses the benchmarks set by many of its industry peers. Should Florida give the nod to recreational cannabis, AYR’s valuation could skyrocket significantly – thereby positioning this stock as a shrewd acquisition for investors eyeing pre-vote opportunities.

Deciphering the Divergence: Cresco Labs vs. Curaleaf – Magnifying a 250 Basis Point Delta

Within the domain of suggested pair trades outlined in the report, investors are urged to consider acquiring Cresco Labs at a 12.6% yield while divesting their stakes in Curaleaf at 10.1%. This tactical maneuver not only affords investors a 250 basis point advantage but is equally underpinned by Cresco’s robust financial framework and enhanced credit profile. For discerning investors on the hunt for amplified returns entwined with credit robustness, this opportunity merits earnest contemplation.

Ruminating on TerrAscend: Unpacking a 12% Yield’s Insufficiency

In stark contradistinction, TerrAscend, offering a modest 12% yield, finds itself in the realms of a ‘sell’ recommendation. Despite its substantive foothold in the cannabis landscape, TerrAscend’s inferior yield and diminished exposure to Florida’s growth projection render it aesthetically inferior vis-à-vis AYR’s allure.

Peering into the Quandary: Cannabist’s Struggle with Liquidity Challenges

Amidst an enthralling array of high-flying stocks, Cannabist emerges as the cohort’s laggard due to pronounced liquidity apprehensions following recent asset dispositions. Investors are advised to exercise prudence, cognizant of Cannabist’s modest credit rating that could impede its near-term ascendancy despite latent prospects of amelioration.

Seizing the Moment: Florida’s Upcoming Vote – A Potential Catalyst for Transformation

Against the backdrop of Florida’s cannabis landscape poised for an expanse, investors harboring an appetite for maximizing returns should contemplate a strategic pair trade: acquiring AYR at 20%, offloading TerrAscend at 12%, and investigating Cresco Labs at 12.6% versus Curaleaf at 10.1%. The imminent vote harbors the potency to propel a seismic shift in the cannabis stocks diaspora, impelling proactive measures before this watershed event unfolds for a prospective windfall.

Read Next: SEC Charges ‘Magic Mushroom’ Co. Minerco In $8M Pump-And-Dump Scheme