Investors can breathe a sigh of relief as October inflation data met economists’ expectations, though the annual headline rate showed a slight uptick from the previous month.

As anticipated, the Consumer Price Index (CPI) rose 2.6% year-over-year in October, marking an increase from September’s 2.4% but snapping six straight months of declines.

Excluding food and energy, core inflation held steady at 3.3% for the third consecutive month, highlighting some stickiness in underlying price pressures that remain above the Fed’s 2% target.

In response to the data, speculators raised their expectations for an interest-rate cut, with increased bets on a 25-basis-point reduction in December. Market-implied probabilities now indicate a 79% likelihood of a December rate cut, up from 58% before the CPI report, as per the CME FedWatch tool.

Following the release, Minneapolis Fed President Neel Kashkari expressed optimism about inflation’s trajectory, stating on Bloomberg TV, “I have confidence inflation is headed in the right direction.”

On Tuesday, Kashkari had flagged the risk of a rate pause in December if inflation data surprises to the upside.

“I am not yet seeing a lot of upside inflation risks; the bigger risk is getting stuck,” he added on Wednesday.

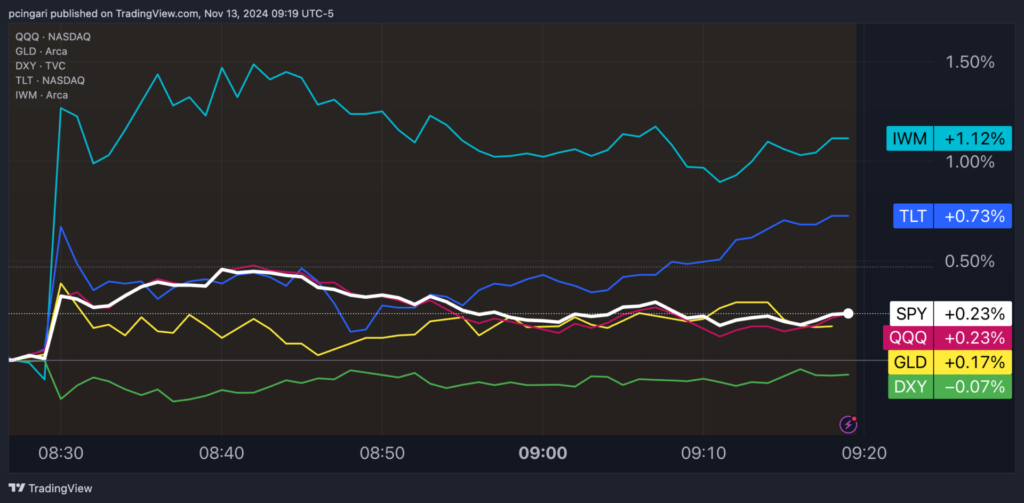

Markets reacted positively, with U.S. equity futures slightly rising, while Treasury yields and the dollar eased amid increased rate-cut expectations.

Market Reactions

- The S&P 500, as tracked by the SPDR S&P 500 ETF Trust SPY, was 0.2% higher.

- The Nasdaq 100, followed by the Invesco QQQ Trust, Series 1 QQQ, inched 0.15% higher.

- Small caps outperformed large-cap counterparts, as the iShares Russell 2000 IWM, rallied 1.1% minutes ahead the New York open.

- Top-performing S&P 500 stocks during the premarket trading were Charter Communications Inc. CHTR, GE Vernova Inc. GEV and Albemarle Corp. ALB up 5.7%, 4% and 3.7%, respectively.

- Skyworks Solutions Inc. SWKS, Fair Isaac Corp. FICO and Bio-Techne Corp. TECH were the laggards, down 6.7%, 4.1% and 2.8%, respectively.

- Gold prices rose 0.3%, following three straight sessions of declines.

- The U.S. dollar index (DXY) slightly eased 0.1%.

- Treasury-linked ETFs rose, with the iShares 20+ Year Treasury Bond ETF TLT up by 0.7%.

Read Next:

Market News and Data brought to you by Benzinga APIs