The 2024 Q4 earnings season is slowly grinding to a halt, with the vast majority of S&P 500 members already delivering their results. There remains a handful of notable companies left, but it’s fair to say that it was a solid reporting period overall, underpinned by strong showings from the Tech and Finance sectors.

And throughout the period, several titans – Meta Platforms META, Apple AAPL, and beloved NVIDIA NVDA – all posted quarterly records. Let’s take a closer look at each.

Meta Reports Record Sales & Profit

Concerning headline figures in its release, Meta Platforms posted adjusted EPS of $8.02 and record sales of $48.4 billion, reflecting growth rates of 50% and 21%, respectively. Net income of $20.9 billion was the company’s highest read ever.

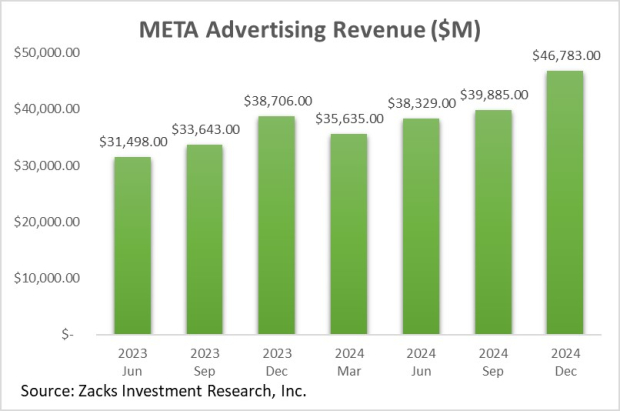

Notably, the company’s ad business continued to perform at a high level, with revenue of $46.8 billion again exceeding our consensus estimate and reflecting 20% year-over-year growth. As shown below, META’s advertising revenue has remained strong.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In addition, META continues to see nice user growth, with Family Daily Active People (DAP) improving 4% year-over-year to roughly 3.4 billion. Average revenue per user has increased likewise amid the strong advertising efforts, improving by a sizable 41% year-over-year.

Apple Breaks Multiple Records

Apple posted adjusted EPS of $2.40 and sales of $124.3 billion, reflecting growth rates of 10% and 4%, respectively. Both EPS and sales figures reflected all-time records for the company, with Services revenue also touching an all-time high.

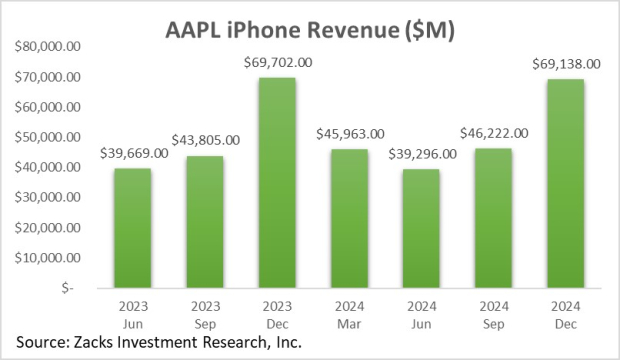

iPhone results came in a tad soft, an interesting development given the implementation of Apple Intelligence. iPhone sales of $69.2 billion fell roughly 1% year-over-year, also marginally falling short of our consensus estimate.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

NVIDIA Continues Momentum

Concerning headline figures in the print, quarterly sales of $39.3 billion shot 78% higher from the year-ago record, also reflecting a new quarterly record. Adjusted EPS of $0.89 reflected 71% growth YoY, also beating our consensus estimate by nearly 6%.

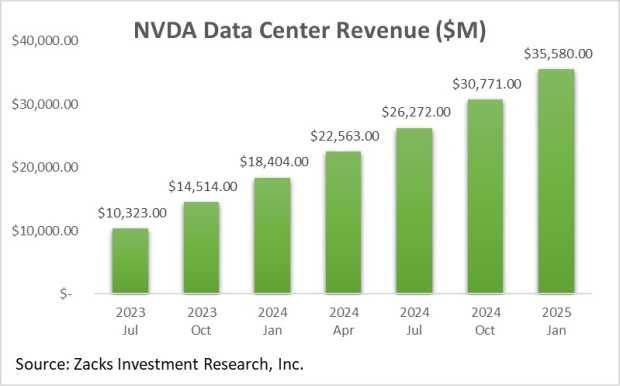

The big growth on headline figures is undoubtedly reflective of a positive demand picture, a trend we’ve become very accustomed to over recent periods. Of course, Data Center results were the highlight of the print, which again were rock-solid.

Data Center revenue totaled a record $35.6 billion, up more than 90% YoY and an impressive 16% sequentially. Notably, the reported figure beat out our consensus estimate by $2.0 billion, continuing its recent streak of outsized beats.

Image Source: Zacks Investment Research

Bottom Line

The 2024 Q4 reporting cycle has overall been positive, with several notable companies – Meta Platforms META, Apple AAPL, and NVIDIA NVDA – all breaking quarterly records.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand picked 7 your immediate attention.

Apple Inc. (AAPL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).