Casey’s General Stores CASY stock was a top mover in Wednesday’s trading session after blasting earnings expectations for its fiscal third quarter yesterday evening.

Standing out from an earnings lineup that also featured quarterly reports from several notable retailers such as Dick’s Sporting Goods DKS and Kohl’s KSS, Casey’s stock rose more than +6% today, to over $400 a share.

Casey’s Q3 Results

Casey’s Q3 sales spiked 17% year over year to $3.9 billion compared to $3.32 billion in the comparative quarter. Fuel gallons sold were up 20%, driving Casey’s expansion as a retail convenience store and gas station operator. This came as Casey’s store count grew 10% versus the prior year quarter after the acquisition of Fikes Wholesale in November, the owner of CEFCO convenience stores.

Third quarter net income was at $87 million or $2.33 per share, which was flat from the prior period but crushed Q3 EPS expectations of $1.76 by 32%. Notably, Casey’s has surpassed the Zacks EPS Consensus for seven consecutive quarters with an average earnings surprise of 22.71% in its last four quarterly reports.

Image Source: Zacks Investment Research

Tracking Casey’s Expansion

Another strong driver to Casey’s quarterly sales growth was its prepared food business, with the company known for its signature made from scratch pizza. Expanding throughout the Midwest, Casey’s has operations in 17 states with its stores offering a comprehensive range of products outside of fuel, including groceries, pet supplies, and automotive supplies.

Executing on its 3-year strategic plan, Casey’s intends to keep growing its food business and accelerate its unit growth, while operating its stores more efficiently. Conveying such, Casey’s expects full-year fiscal 2025 EBITDA to increase by approximately 11% despite the purchase of property and equipment of $500 million.

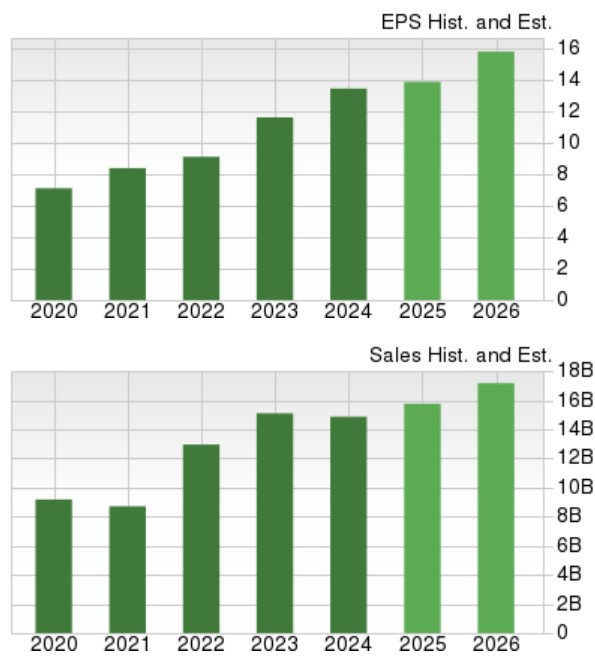

Based on Zacks estimates, Casey’s total sales are currently projected to rise 6% in FY25 and are forecasted to increase another 10% in FY26 to $17.44 billion. Casey’s annual earnings are now expected to be up 3% this year and are projected to spike another 12% in FY26 to $15.60 per share.

Image Source: Zacks Investment Research

CASY Performance & Valuation

Year to date, Casey’s stock is up +2% to outperform the benchmark S&P 500’s -5% with the Nasdaq down 9%. While tariff concerns have dealt a blow to markets of late, it’s noteworthy that CASY has soared over +120% in the last three years to largely outperform the broader indexes.

Image Source: Zacks Investment Research

At current levels, Casey’s stock trades at 24X forward earnings which isn’t a stretched premium to the benchmark or its primary competitor Murphy USA’s MUSA 17X. Plus, CASY trades at less than 1X sales.

Image Source: Zacks Investment Research

Bottom Line

Casey’s operational efficiency is very attractive and alludes to the notion that the company is taking advantage of its expansion and acquisition efforts. For now, Casey’s stock lands a Zacks Rank #3 (Hold), although a buy rating could be on the way considering earnings estimate revisions are likely to trend higher following its impressive Q3 earnings beat.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Casey’s General Stores, Inc. (CASY) : Free Stock Analysis Report

Kohl’s Corporation (KSS) : Free Stock Analysis Report

DICK’S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).