On Monday, Meta Platforms, Inc. META CEO Mark Zuckerberg testified in a Washington, D.C., courtroom.

What Happened: The Federal Trade Commission (FTC) and Meta opened arguments in a trial that could lead to the forced divestiture of Instagram and WhatsApp, reported CBS News.

“There’s nothing wrong with Meta innovating,” said Daniel Matheson, the FTC’s lead attorney, in opening statements. “It’s what happened next that is a problem.”

Zuckerberg was the first witness called to testify. He defended Facebook’s 2012 decision to acquire Instagram, saying the company had struggled to compete with mobile-first platforms at the time.

See Also: Netflix Debuts OpenAI-Backed Search Engine That Lets You Discover Movies And TV Shows Based On Emotions, Not Just Titles

Meta attorney Mark Hansen countered that Instagram and WhatsApp flourished under Meta’s stewardship and that Meta offers its services for free—evidence, he argued, that it does not function as a monopoly.

“How can the FTC maintain this monopolization case when [Meta] has never charged users a cent?” Hansen asked the court.

Zuckerberg is set to resume his testimony in court on Tuesday morning.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: The case is being heard by U.S. District Judge James Boasberg and is expected to last several weeks. Testimony from former Meta executives Sheryl Sandberg and Mike Schroepfer, as well as Instagram co-founder Kevin Systrom, is anticipated.

The FTC is also asking the court to require Meta to notify the government before any future acquisitions.

A Meta spokesperson dismissed the FTC’s claims as outdated and out of touch.

“The evidence at trial will show what every 17-year-old in the world knows: Instagram, Facebook, and WhatsApp compete with TikTok, YouTube, X, iMessage, and many others,” the spokesperson said in a statement to CBS MoneyWatch.

YouTube is owned by Alphabet Inc.’s GOOG GOOGL Google. X was formerly known as Twitter but changed its name after Elon Musk acquired it in October 2022 for $44 billion. iMessage is Apple Inc.’s AAPL secure messaging service.

Meta earned more than $164 billion in revenue in 2024 and has a market capitalization of $1.37 trillion.

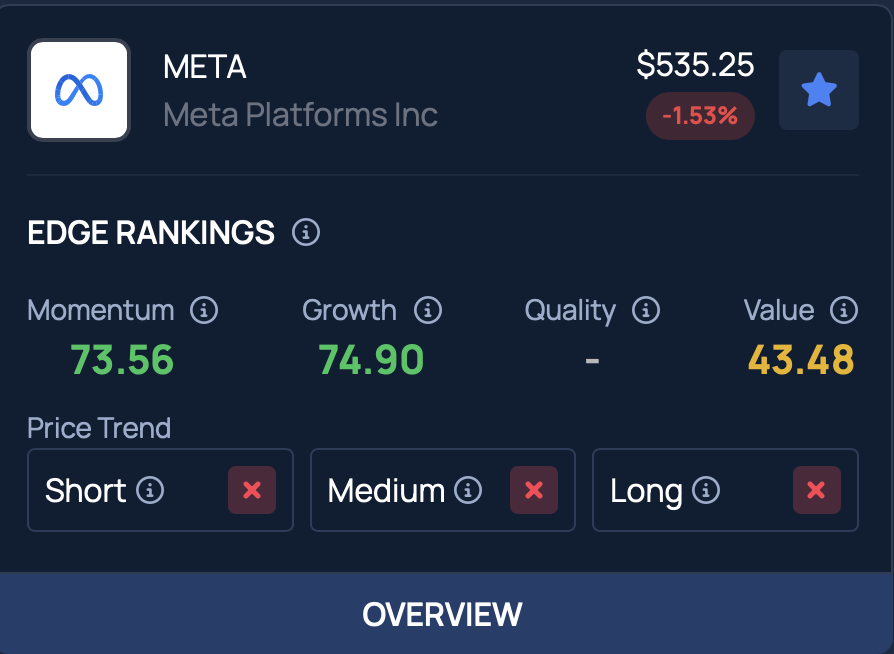

Price Action: On Monday, the company’s shares dropped 2.22%, reaching $531.48, according to data from Benzinga Pro.

Meta boasts a robust growth score of 74.90%, according to Benzinga Edge Stock Rankings. Click here to see how it stacks up against Apple, Alphabet, and other companies.

Photo Courtesy: Frederic Legrand – COMEO on Shutterstock.com

Read More:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs