- Every investor envisions purchasing a stock at a meager price and witnessing its value soar exponentially.

- This exploration delves into the annals of 100-bagger stocks, examining how to sift through them using critical metrics.

- We will unveil a strategy to pinpoint potential 100-bagger stocks based on historical trends and present a curated list of promising contenders.

The term “100-bagger” first caught the eye in Peter Lynch’s 1989 masterpiece, “One Up on Wall Street.” Lynch cited names like Microsoft, Dell, Nvidia, and Apple as examples showcasing the potential for stock prices to surge tenfold.

But how frequent are such explosive gains, and is it feasible to identify the upcoming breakout stars?

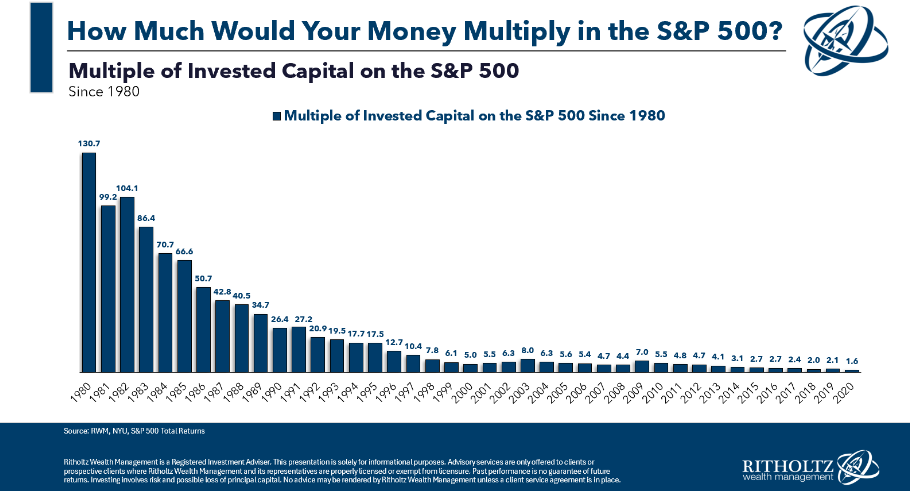

Let’s plunge into the realm of 100-baggers. The data reveals a mesmerizing truth: to locate a ten-bagger as of late 2023, we must rewind our clocks back to the 1980s.

What truly astounds is that during the 1980s, certain stocks skyrocketed in value by a hundredfold. It serves as a testament to the long-term growth potential of the stock market, with the S&P 500 averaging 11% annual returns since 1980.

Each investor dreams of acquiring a stock at a bargain and selling it later at a price 100 times higher. Reviewing a roster of stocks that achieved this feat from 1962 to 2014, nearly 400 such instances exist. However, what distinguishes these stocks, and how can investors pinpoint them?

Deciphering Potential 100-Baggers

While there is no foolproof formula, several key characteristics often surface when scrutinizing historical 100-baggers. Here are some pivotal elements:

- Consistent Growth: Companies exhibiting a history of consistent earnings growth, especially at the bottom line, tend to be robust contenders.

- Low Initial Valuations: Seek stocks with appealing valuations, such as a low price-to-earnings (P/E) ratio.

- Modest Market Capitalization: Historically, companies with a market capitalization under $500 million have a higher probability of achieving 100-bagger status due to their potential for meteoric growth.

Achieving a hundredfold appreciation often involves unwavering growth, notably in earnings, and commencing with a modest valuation, like a low price-to-earnings (P/E) ratio. Furthermore, many of these stocks commenced as smaller entities, as larger corporations encounter greater challenges in achieving such substantial growth.

Crafting Your Watchlist: Sifting for 100-Bagger Potential

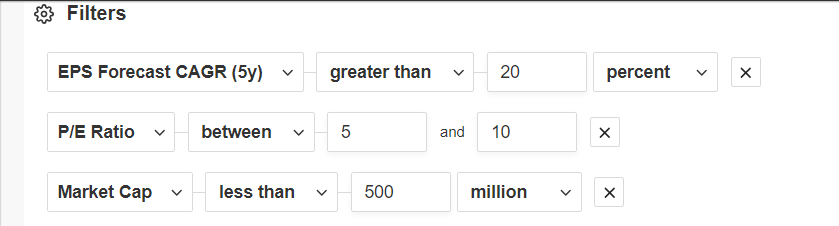

The encouraging news? We can leverage tools like InvestingPro to configure filters and identify stocks possessing traits akin to historical 100-baggers. In this scenario, we have applied three key filters:

- Compound Annual Earnings Growth: At least 20% over the past five years.

- Price-to-Earnings (P/E) Ratio: Ranging between 5 and 10.

- Market Capitalization: Below $500 million.

Source: InvestingPro

By applying these filters across the U.S. and European stock markets, we have condensed a vast database of over 162,000 stocks to a curated list of 113 potential contenders. Will any of them blossom into the next 100-bagger? Only time will unravel that tale.

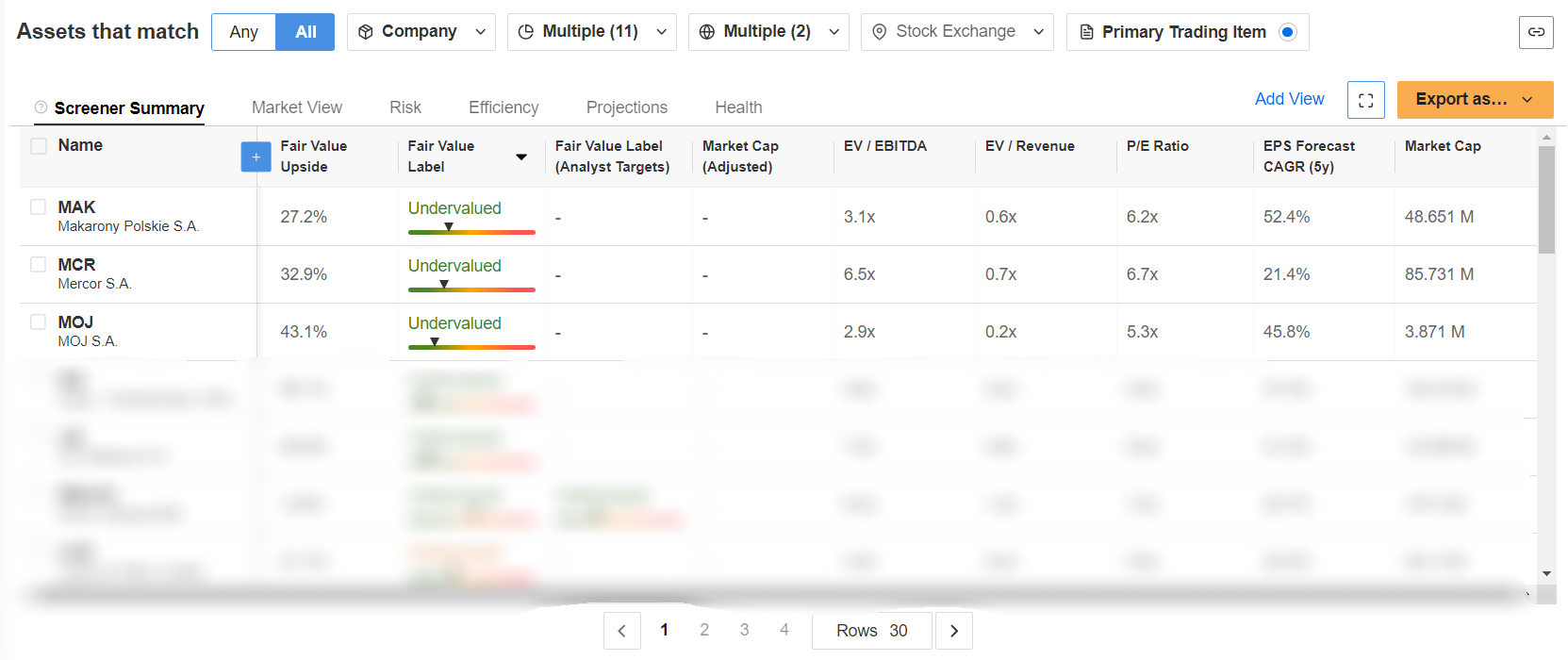

Could the unicorns among them indeed exist? Here are the top three hopefuls on our watchlist (in no specific order):

Source: InvestingPro

Discover 100-bagger stocks and their Fair Value with InvestingPro+. Subscribe now and get over 40% off your annual plan for a limited time! Subscribe HERE AND NOW!

Disclaimer: This article is penned for enlightening purposes alone; it does not amount to a solicitation, offer, advice, or recommendation to invest, and hence, does not aim to encourage asset acquisition in any form. I wish to emphasize that any form of asset evaluation is multifaceted and carries high risks; hence, any investment decision and associated risk rest with the investor.