Following the release of its impressive Q1 results, Cava Group CAVA has begun to exhibit the kind of expansion that propelled renowned retail restaurant chains like Chipotle Mexican Grill CMG and Starbucks SBUX into investor limelight.

Since its IPO in June 2023, the Mediterranean fast-casual food chain has witnessed a remarkable surge of nearly +100%, outperforming Starbucks (-19%), the Zacks Retail-Restaurant Market (-6%), and even outstripping the broader indexes while narrowly eclipsing Chipotle’s growth (+56%).

As one of the hottest IPOs in recent memory, Cava Group’s exceptional performance prompts the key question: is now the opportune moment to invest in CAVA for further upside potential?

Image Source: Zacks Investment Research

Q1 Review

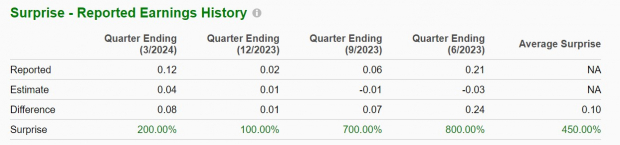

Cava Group posted Q1 sales of $259.01 million, marking a 46% increase from the last three months, surpassing Q4 sales of $177.17 million. Additionally, the Q1 EPS of $0.12 significantly outperformed expectations by 200%, soaring from $0.02 per share in Q4.

Image Source: Zacks Investment Research

Growth Trajectory & Overview

Established in 2006 and having gone public last year, Cava Group has a nationwide presence in the United States. The company’s growth is underpinned by a distinct dining experience, offering a build-your-own bowl concept resembling Chipotle, enabling customers to tailor their meals with top-notch fresh ingredients.

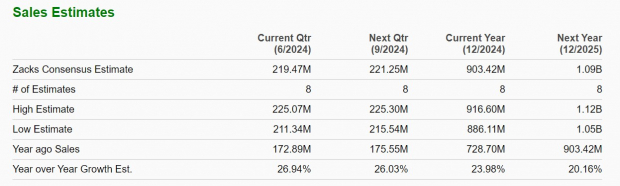

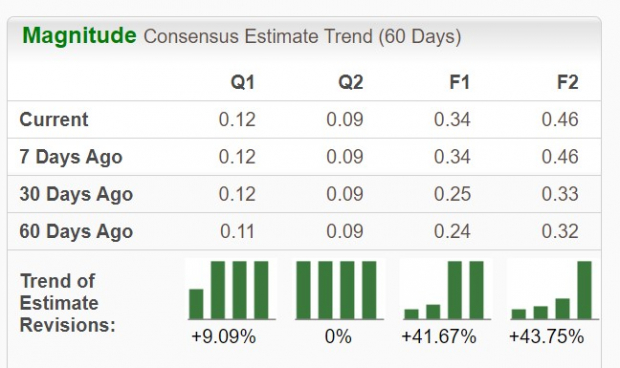

Anticipated total sales for Cava Group are projected to increase by 24% in FY24 and jump an additional 20% in FY25 to exceed $1 billion. Annual earnings are forecasted to surge by 62% this year to $0.34 per share, compared to $0.21 per share in 2023. Moreover, FY25 EPS is expected to broaden by another 33% to $0.46.

Image Source: Zacks Investment Research

What adds an element of intrigue and signals a potential continuation of CAVA’s upswing is the substantial upward revisions in earnings estimates for FY24 and FY25, soaring over 40% in the last two months respectively.

Image Source: Zacks Investment Research

Bottom Line

Currently boasting a Zacks Rank #2 (Buy), Cava Group’s stock holds promise for further growth, with the company’s encouraging growth trajectory and the positive trend in earnings estimate revisions suggesting potential for upward movement.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.