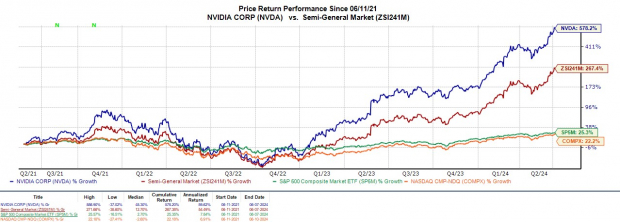

In a move to broaden its investor base, Nvidia’s NVDA underwent a 10-1 stock split, bringing its share price down to just over $120. This decision follows the chip giant’s remarkable stock price surge, tripling in 2023 and doubling further in the current year.

While stock splits don’t alter a company’s market value, the reduced share price raises the question of whether it’s an opportune moment to consider investing in NVDA, especially after soaring to previous all-time highs exceeding $1,000 per share.

Image Source: Zacks Investment Research

Market Value

Nvidia’s dominance in semiconductor chips powering artificial intelligence has propelled its market capitalization above $3 trillion, making it the second most valuable U.S. company, trailing only Microsoft MSFT. This surpasses the market caps of other key chip players like AMD AMD and Intel INTC, standing at $271 billion and $130 billion respectively.

Image Source: Zacks Investment Research

Post-Split Growth Trajectory

Nvidia’s firm grip on the market cap and industry positioning make a compelling case for potential investment in its stock. It’s essential to note that stock splits do not affect a company’s fundamental metrics or earnings, albeit diluting the earnings per share (EPS) due to the increased share count.

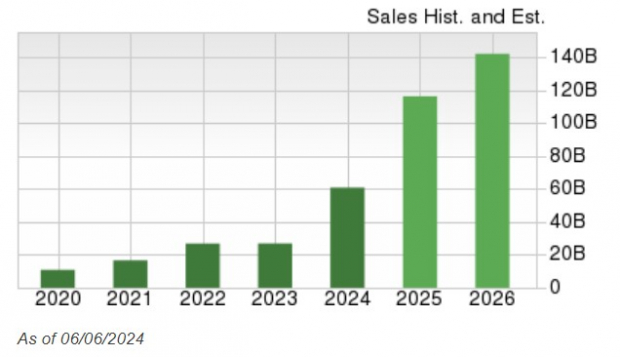

Looking ahead, Nvidia’s anticipated annual earnings now stand at $2.65 per share ($26.54 per share/10) for fiscal year 2025, with a projected 22% growth in EPS to $3.25 in FY26. Revenue remains unaffected by the split, with an expected 91% surge in FY25 to $116.4 billion compared to $60.92 billion in FY24. Moreover, FY26 sales are forecasted to climb another 22% to $142.29 billion.

Image Source: Zacks Investment Research

Key Point

Encouragingly, Nvidia’s recent stock split presents an enticing entry point into the tech giant’s expansive growth trajectory at a more affordable price point, especially with NVDA holding a Zacks Rank #1 (Strong Buy).

Moreover, the timing of the forward stock split aligns well with the impending launch of Nvidia’s Blackwell series of GPUs, anticipated to be the market’s most potent AI chips surpassing both its existing H200 series and AMD’s MI300 series.