The artificial intelligence (AI) frenzy remains intact in the United States despite the Chinese DeepSeek mayhem. In fact, the low-cost DeepSeek ecosystem has expanded the global AI space. Irrespective of DeepSeek, four of the “magnificent 7” stocks have decided to invest a massive $325 billion in 2025 as capital expenditure for AI-infrastructure development. This marks a significant 46% year-over-year increase in capital spending on the AI ecosystem.

This huge spending on AI infrastructure will dramatically change the world in the next five years in fields like hyperscale automation, robotics, autonomous vehicles, life-science revolutions, energy and materials.

At this stage, we recommend two little-known AI stocks with a favorable Zacks Rank that are set to provide solid returns in the short term. Moreover, these two stocks have a lot of value supported by global AI spending that will be unveiled in the long term. These two stocks are Five9 Inc. FIVN and Astera Labs Inc. ALAB.

2 AI Stocks to Buy to Reap Benefits in the Short Term

These two stocks have strong revenue and earnings potential for 2025 and have seen positive earnings estimate revisions in the last 30 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Five9 Inc.

Zacks Rank #1 Five9 provides intelligent cloud software for contact centers in the United States, India, and internationally. FIVN offers a virtual contact center cloud platform delivering a suite of applications that enable the breadth of contact center-related customer service, sales, and marketing functions.

FIVN’s platform comprises interactive virtual agents, agent assist, workflow automation, workforce engagement management, AI insights, and AI summaries. It allows managing and optimizing customer interactions across voice, chat, email, web, social media, and mobile channels directly or through its application programming interfaces.

Five9 came up with fourth-quarter 2025 adjusted earnings of $0.78 per share, beating the Zacks Consensus Estimate of $0.70 per share. This compares to earnings of $0.61 per share a year ago.

The company posted quarterly revenues of $278.66 million, surpassing the Zacks Consensus Estimate by 4.18%. This compares to year-ago revenues of $239.06 million. Renewable subscription sales climbed 19% year over year.

AI-Led Innovations

FIVN has been benefiting from the growing adoption of AI tools in its call center services, with personalized AI agents emerging as a major growth driver. On Feb. 19, Five9 introduced its Intelligent CX Platform powered by Five9 Genius AI on the Google Cloud space of Alphabet Inc. GOOGL. It also released new Five9 AI agents tailor made for Google Cloud.

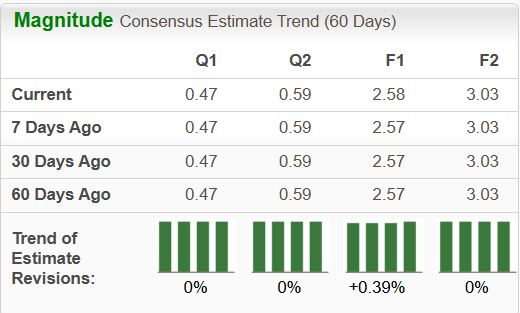

Strong Estimate Revisions for FIVN Stock

Five9 has an expected revenue and earnings growth rate of 9.3% and 4.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.4% in the last seven days.

It has an expected revenue and earnings growth rate of 9.8% and 17.5%, respectively, for next year. The Zacks Consensus Estimate for next-year earnings has remained the same in the last 60 days.

Image Source: Zacks Investment Research

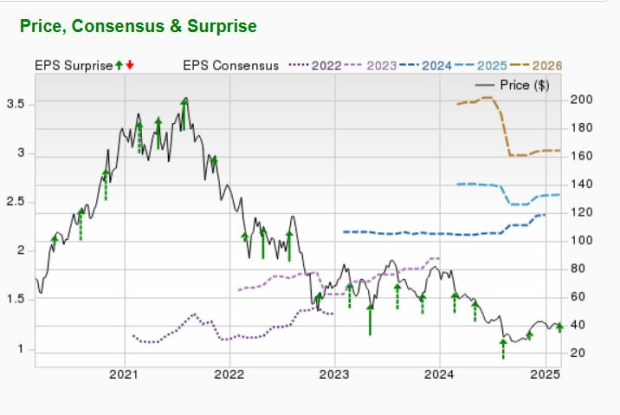

Lucrative Valuation and Price Upside of FIVN Shares

Five9 currently carries the forward P/E of 16.33X for the current, compared with 28.21X of the industry and 18.71X of the S&P 500. It currently carries the forward P/S of 3.04X for the current year, compared with 4.46X of the industry and 3.02X of the S&P 500.

The short-term average price target of brokerage firms for the stock represents an increase of 23.7% from the last closing price of $42.09. The brokerage target price is currently in the range of $40-$67. This indicates a maximum upside of 59.2% and a maximum downside of 5%.

Image Source: Zacks Investment Research

Astera Labs Inc.

Zacks Rank #2 Astera Labs is a developer of connectivity solutions for cloud computing and AI applications. Its key offerings include an Intelligent Connectivity Platform that includes both hardware (like chips and modules) and software (COSMOS) designed to enhance connectivity in AI and cloud environments.

ALAB’s increasing demand for AI platforms, particularly those leveraging high-performance GPUs and AI accelerators, drove strong design wins and sales for products like Aries Retimers, Taurus Smart Cable Modules, and Scorpio Fabric Switches.

In the fourth quarter of 2024, Astera Labs introduced its new portfolio of Scorpio Smart Fabric Switches, purpose-built for AI infrastructure at the cloud scale. The P-Series features GPU-to-CPU/NIC/SSD PCIe Gen 6 connectivity, and the X-Series is for back-end AI accelerator clustering. The switches are currently shipping in pre-production quantities.

ALAB’s robust PCIe retimers under the Aries product line highlight significant growth opportunities. With increasing demand for advanced connectivity solutions, Aries retimers are positioned as a critical enabler for businesses looking to enhance the performance of its AI ecosystems.

Extensive Use of AI and Robust Clientele

In the fourth quarter of 2024, Astera Labs expanded its widely deployed Aries PCIe/CXL Smart DSP Retimer portfolio with the introduction and initial shipment of Aries 6 Retimers, the industry’s lowest power PCIe 6.x/CXL 3.x Retimer solution, enhancing bandwidth and reach for complex AI and compute topologies.

ALAB has made a significant impact on the AI industry with collaborations with top chipmakers, including NVIDIA Corp. NVDA and Advanced Micro Devices Inc. AMD.

Astera Labs products are used in NVIDIA’s GB200 product. The PCIe switch is expected to play a key role in future NVDA products. This collaboration further emphasizes Astera Labs’ influence in the development of advanced AI technologies.

AMD also continues to utilize Astera Labs solutions to enhance the efficiency and scalability of its AI-driven products. The partnership strengthens both companies’ positions in the AI market, fueling advancements in next-gen technologies.

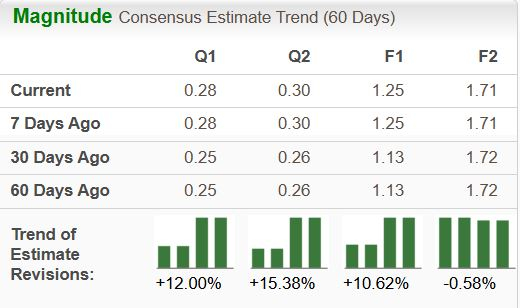

Solid Estimate Revisions for ALAB Stock

ALAB’s continued demand for its AI-related products and an expanding customer base are expected to drive top-line growth. Astera Labs continues to expect strong growth from the Aries product family across diverse AI platforms, ramping Taurus SCM for 400-gig applications and additional preproduction shipments of Scorpio P-Series switches.

For the first quarter of 2025, ALAB expects revenues between $151 million and $155 million. Non-GAAP earnings are expected to be between $0.28 and $0.29 per share.

Astera Labs has an expected revenue and earnings growth rate of 69.1% and 48.8%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 10.6% in the last 30 days.

It has an expected revenue and earnings growth rate of 32.3% and 36.2%, respectively, for next year. The Zacks Consensus Estimate for next-year earnings has remained the same in the last 30 days.

Image Source: Zacks Investment Research

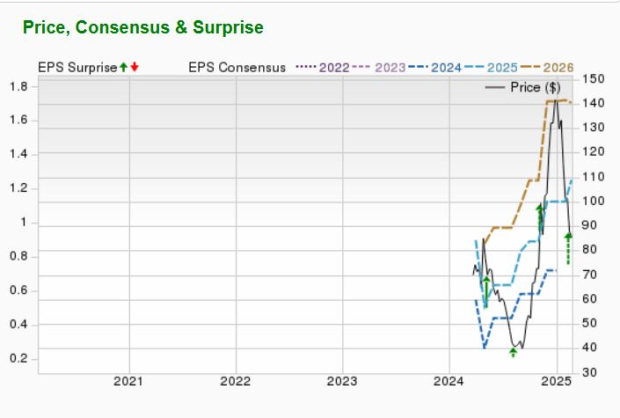

Massive Price Upside for ALAB Shares

The short-term average price target of brokerage firms for the stock represents an increase of 44.4% from the last closing price of $85.72. The brokerage target price is currently in the range of $114-$150. This indicates a maximum upside of 75% and no downside.

Image Source: Zacks Investment Research

Just Released: Zacks Top 10 Stocks for 2025

Hurry – you can still get in early on our 10 top tickers for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2025. You can still be among the first to see these just-released stocks with enormous potential.

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Five9, Inc. (FIVN) : Free Stock Analysis Report

Astera Labs, Inc. (ALAB) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).