Disney DIS presents a compelling investment opportunity for the second half of 2025, with shares gaining 9.3% year to date as multiple business transformation catalysts converge to drive sustained outperformance.

The company has successfully navigated its streaming profitability challenge while executing the largest theme park expansion in its history, positioning it for accelerated growth across all business segments.

Streaming Business Achieves Profitability Milestone

Disney’s direct-to-consumer transformation represents the most significant positive development for 2H25. The streaming business generated $336 million in operating income during fiscal second-quarter 2025, demonstrating sustainable profitability after years of investment. Disney+ added 1.4 million subscribers to reach 126 million total, defying analyst expectations and showcasing platform resilience.

Disney’s recent partnership with ITV in the United Kingdom demonstrates innovative cross-platform strategies that enhance subscriber value while expanding market reach. Starting July 16, Disney+ customers gained access to premium ITV content, including the award-winning Mr Bates vs The Post Office and Love Island, while ITVX viewers can sample Disney+ offerings like The Bear and Only Murders in the Building.

The ESPN streaming service launch in Fall 2025 represents a major revenue catalyst, creating an entirely new revenue stream from Disney’s most profitable content. Combined with strategic partnerships like the Disney-Amazon AMZN advertising integration and Disney-ITV content sharing initiative, the company has created sophisticated monetization capabilities that significantly enhance revenue per user. Disney’s bundle strategy continues driving higher retention rates while expanding international reach.

Looking ahead, Disney’s content slate for the remainder of 2025 includes highly anticipated releases, such as Zombies 4: Dawn of the Vampires, Percy Jackson and the Olympians Season 2, and Marvel’s Wonder Man series, besides high-profile releases like Avatar 3 and Zootopia 2. Disney’s tentpole strategy, focusing on quality over quantity, provides sustainable competitive advantages against Netflix’s (NFLX) volume-based approach, particularly in family and franchise content segments.

The company operates in an increasingly competitive streaming environment where content costs continue to escalate while subscription growth faces natural limits. Netflix NFLX, Amazon Prime Video, and newer entrants like Apple AAPL-owned Apple TV+ are all vying for the same subscriber base and advertising dollars, potentially pressuring Disney’s ability to raise prices or maintain market share.

Shares of Disney have returned 9.3% in the year-to-date period against the Zacks Consumer Discretionary sector’s growth of 11.8%. While Apple has lost 15.9% year to date, shares of Amazon and Netflix have returned 0.7% and 43.2%, respectively.

Disney’s Year-to-date Performance

Image Source: Zacks Investment Research

Historic $60 Billion Parks Expansion Creates Growth Runway

Disney’s $60 billion capital investment program over 10 years represents the largest theme park expansion in the company’s history, with multiple projects delivering through 2H25. The company increased parks capital expenditures to $4.3 billion in fiscal second-quarter 2025, targeting 20-25% capacity increases by 2027 with a projected mid-teens return on invested capital.

Magic Kingdom’s largest-ever expansion includes the new Villains Land and Cars-themed Frontierland replacement, both beginning construction in 2025. Monsters, Inc. Land at Hollywood Studios will feature Disney’s first suspended coaster, while Animal Kingdom’s Tropical Americas adds Indiana Jones and Encanto attractions. These developments address the persistent demand-supply imbalance that has enabled Disney to maintain premium pricing power.

The Disney Cruise Line expansion to 13 ships by 2031 represents a fleet doubling with strong financial returns. New vessels Disney Destiny and Disney Adventure launch end-2025, with the Singapore-based Adventure marking Disney’s first Southeast Asian cruise operations. The cruise segment maintains 97% occupancy rates and generates industry-leading margins.

Financial Strength Supports Expansion and Returns

Disney’s fiscal second-quarter 2025 financial performance exceeded expectations across all metrics, with $23.6 billion revenues (+7% YoY) and $1.45 adjusted EPS (+20% YoY) driving management to raise full-year guidance to $5.75 EPS, representing 16% growth. The company generates $17 billion in operating cash flow guidance, supporting both expansion investments and shareholder returns.

Experiences segment revenues reached $8.9 billion (+6% YoY) with $2.5 billion operating income (+9% YoY), demonstrating pricing power resilience despite macroeconomic pressures. Domestic parks revenues grew 9% to $6.5 billion, while international parks benefited from successful expansion projects.

The balance sheet remains robust with $36.4 billion in long-term debt and 0.34 debt-to-equity ratio, providing financial flexibility for continued expansion. Disney maintains $3 billion in share buybacks for fiscal 2025 while demonstrating balanced capital allocation.

The Zacks Consensus Estimate for fiscal 2025 revenues is pegged at $95.15 billion, indicating 1.14% year-over-year growth, with earnings expected to increase 16.3% to $5.78 per share. These projections suggest steady growth ahead.

The Walt Disney Company Price and Consensus

The Walt Disney Company price-consensus-chart | The Walt Disney Company Quote

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

Investment Outlook and Valuation Opportunity

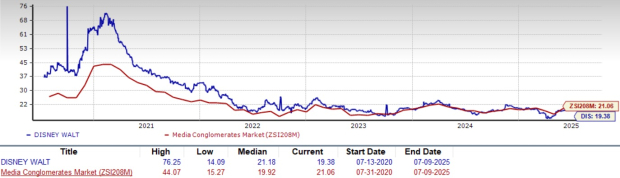

Disney trades at a forward P/E of approximately 19.38x despite achieving streaming profitability and executing massive expansion plans, notably below the Zacks Media Conglomerates industry average of 21.06x.

DIS’ P/E F12M Ratio Depicts Discounted Valuation

Image Source: Zacks Investment Research

The company’s unmatched IP portfolio spanning Disney, Pixar, Marvel, Star Wars, and National Geographic creates sustainable competitive moats across multiple revenue streams. Unlike pure-play streaming competitors, Disney’s integrated ecosystem allows cross-platform monetization through theatrical releases, streaming content, theme park attractions, cruise experiences, and consumer products.

Conclusion

Disney represents an exceptional investment opportunity for 2H25, with successful streaming transformation providing profitability visibility while historic parks expansion creates an unprecedented growth runway. The combination of financial strength, strategic partnerships, and competitive advantages positions Disney for sustained outperformance as multiple catalysts converge, making it an attractive buy for investors. Disney currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Higher. Faster. Sooner. Buy These Stocks Now

A small number of stocks are primed for a breakout, and you have a chance to get in before they take off.

At any given time, there are only 220 Zacks Rank #1 Strong Buys. On average, this list more than doubles the S&P 500. We’ve combed through the latest Strong Buys and selected 7 compelling companies likely to jump sooner and climb higher than any other stock you could buy this month.

You’ll learn everything you need to know about these exciting trades in our brand-new Special Report, 7 Best Stocks for the Next 30 Days.

Download the report free now >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).