Top-Rated Stocks Ahead of Earnings

The anticipation surrounding earnings week is building up, and as the market gears up for significant reports from heavyweights like Microsoft and Netflix next week, there are a couple of standout companies set to announce quarterly results before that. 1ST Source and Fastenal are two companies that demand attention ahead of their fourth-quarter reports on Thursday, January 18.

Fastenal Q4 Preview & Overview

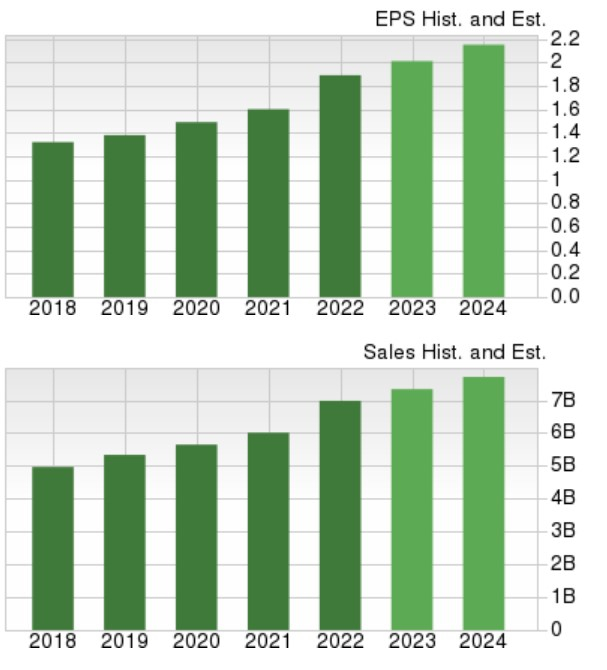

Fastenal, a national wholesale distributor of industrial and construction supplies, remains one of the most appealing retailers in the current market climate. With continued strength in infrastructure and construction-related activities such as homebuilding, Fastenal’s stock has surged by an impressive 32% over the last year, easily outperforming the Zacks Building Products-Retail Markets’ 10% and the S&P 500’s 20%.

For the fourth quarter, Fastenal’s earnings are expected to witness a 4% year-over-year increase to $0.45 per share, with sales projected to grow by 3% to $1.75 billion. The entire fiscal year of 2023 is expected to culminate in annual earnings growing by 6% to $2.00 per share and total sales increasing by 5% to $7.34 billion. Furthermore, Fastenal is anticipated to maintain its growth trajectory in FY24, with another 6% increase in its top and bottom lines, making it an intriguing option for growth. Investors are also drawn to Fastenal’s generous 2.20% annual dividend yield.

1st Source Q4 Preview & Overview

1ST Source, a regional bank with branches spread across Indiana and Michigan, is experiencing positive earnings estimate revisions. Despite a 5% decline in its stock over the past year, the company’s 12.3X forward earnings multiple is quite attractive, reflecting a valuation near the Zacks Banks-Midwest Industry average of 10.6X and well below the S&P 500’s 20X. Additionally, 1ST Source’s 2.63% annual dividend yield further bolsters its appeal from a valuation standpoint.

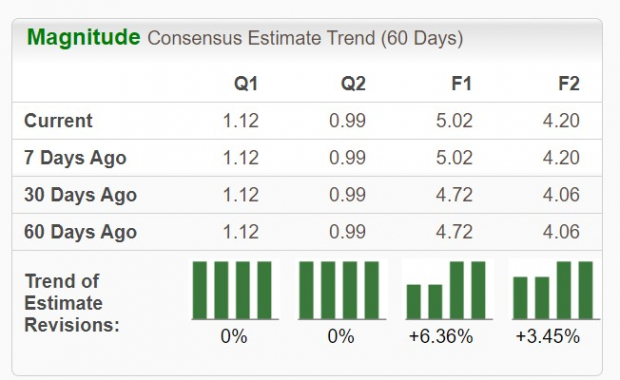

While 1ST Source’s stock has seemingly factored in the forecasted dip in Q4 earnings by 10% year-over-year to $1.12 per share, with sales expected to decline by 4% to $91.2 million, annual earnings for FY23 are still projected to rise by 4% to $5.02 per share. However, a dip to $4.20 per share in FY24 is predicted. It’s worth noting that over the last 60 days, FY24 earnings estimates have shown a 3% increase, while FY23 EPS estimates have risen by 6%. Total sales are now expected to rise by 4% in FY23 and then dip by 3% this year to $356.7 million.

Key Takeaway

Both Fastenal and 1ST Source have the potential to rally if they deliver favorable Q4 results and offer optimistic guidance. Currently, 1ST Source is adorned with a Zacks Rank #1 (Strong Buy) in line with its attractive valuation and rising earnings estimates, while Fastenal’s stock proudly holds a Zacks Rank #2 (Buy), making it a highly intriguing option for potential growth.

—

To read this article on Zacks.com click here.