Earnings season is a rollercoaster for investors, a time when companies pull back the curtain to reveal what’s been happening behind the scenes. The upcoming 2023 Q4 cycle holds particular significance as investors seek insights into the year ahead.

Among the stocks causing a stir are Netflix, Chipotle Mexican Grill, and MercadoLibre, all boasting a positive Zacks Earnings ESP Score leading up to their releases.

Chipotle Mexican Grill

Chipotle Mexican Grill, currently a Zacks Rank #2 (Buy), operates quick-casual and fresh Mexican restaurant chains. Throughout 2024, its shares have displayed resilience, having added 1.5% in value while the S&P 500 dipped by 0.4%.

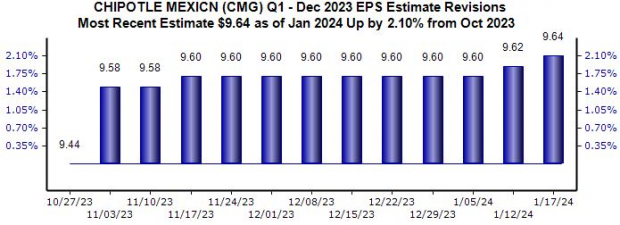

Analysts are bullish about the upcoming release, with the $9.64 Zacks Consensus EPS Estimate now 2% higher than October last year. This suggests a substantial 16% increase from the same period a year ago.

Image Source: Zacks Investment Research

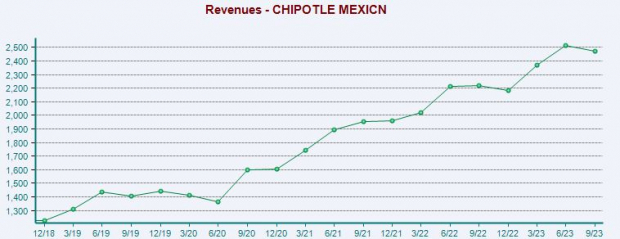

The company’s top line is expected to show robust expansion, with a $2.5 billion quarterly revenue estimate indicating a 14% climb – up 1.4% since October. CMG has benefited from cost reductions and sustained business momentum, contributing to its strong growth.

CMG’s revenue growth trend is impressively depicted below.

Image Source: Zacks Investment Research

Currently trading at a steep 44.1X forward earnings multiple, CMG’s stock is undoubtedly expensive, albeit below the 53.3X five-year median. Nevertheless, investors have readily accepted the premium due to the company’s growth.

Netflix

Netflix, a streaming behemoth, has witnessed impressive stock performance over the past decade. It currently holds a Zacks Rank #2 (Buy) with upward revisions in earnings expectations.

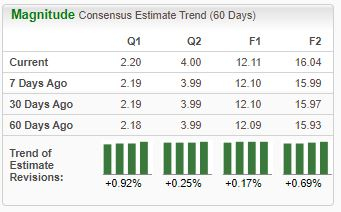

Image Source: Zacks Investment Research

The Zacks Consensus EPS Estimate of $2.20 reflects quadruple-digit year-over-year growth of over 1700%, while our $8.7 billion quarterly revenue estimate implies an 11% increase.

Subscriber numbers are a key metric. Paid Net Membership additions totaled 9 million in the last release, smashing expectations and fueled by the adoption of the company’s new ad-supported plans. Impressively, ad-supported memberships grew 70% quarter-over-quarter.

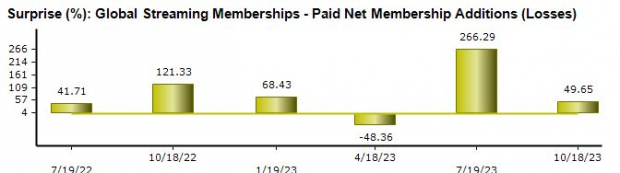

For the upcoming release, the Zacks Consensus Estimate for Net Membership Additions stands at 8.9 million, well above the 7.6 million reported in the same period last year. The company has consistently delivered positive surprises on this front, as illustrated below.

Image Source: Zacks Investment Research

MercadoLibre

MercadoLibre is a major e-commerce platform in South America, leading the market in several countries based on unique visitors and page views.

The company is expected to post significant growth, with consensus earnings and revenue estimates indicating upticks of 105% and 38%, respectively. Across its last four releases, MELI has surpassed our consensus EPS expectations by an average of 33%.

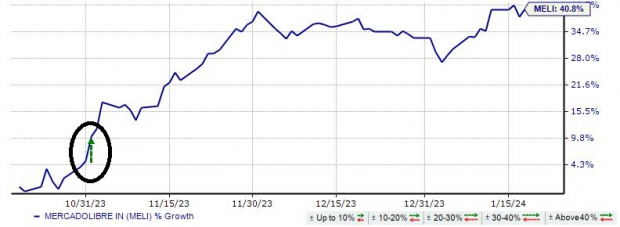

Shares surged following its most recent earnings report, as indicated below.

Image Source: Zacks Investment Research

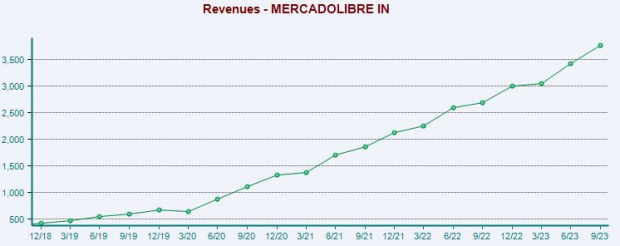

Similar to CMG, MercadoLibre’s revenue growth has been consistently strong, with double-digit year-over-year revenue growth rates for 13 straight quarters, illustrated below.

Image Source: Zacks Investment Research

Time for Revelations

Earnings season may be a whirlwind, but it’s an exciting time for investors to gain deeper insights into company performance.

Each of the three stocks – Netflix, Chipotle Mexican Grill, and MercadoLibre – could deliver positive surprises, supported by their positive Zacks Earnings ESP Scores. Furthermore, all three uphold a favorable Zacks Rank, reflecting overall analyst optimism.