IonQ Inc. IONQ is scaling the heights in quantum

computing, pioneering the commercialization of trapped ion technology-based computers. As artificial

intelligence (AI) garners widespread acceptance, investors are relentlessly seeking out the next groundbreaking

technology, and quantum computing looms large on the horizon. Yet, despite the buzz, the reality of quantum

computing is still taking shape. Its transformative applications and superiority over traditional supercomputers

are yet to be solidified. We’re in the era of potential and probability, where quantum computing holds the promise

of a world-altering impact, as IonQ boldly declares on its website.

Operating in the computer and technology sector, IonQ competes with the quantum computing divisions of Alphabet Inc.

and International Business Machines Co.

Quantum Computing: Bridging Hype and Reality

Quantum computing introduces a third state called superposition, enabling a concurrent representation of both zero

and one, unlike traditional supercomputers that operate with just the two distinct states. This revolutionary

paradigm allows quantum computing to tackle intricate problems with a multitude of variables and optimization

needs, all while minimizing the number of computation processes and reducing computation time.

Potential Quantum Computing Applications

The realm of drug discovery emerges as a prime playground for quantum computers, with their unparalleled capacity

to simulate molecular behavior and interactions with unprecedented precision. By meticulously modeling complex

biological molecules and chemical reactions across myriad scenarios, quantum computing could compress the drug

discovery timeline from years to mere weeks or days.

Further, quantum computers hold the promise of supercharging AI by leveraging superposition and entanglement,

enabling simultaneous calculations that expedite problem-solving and processing.

Safeguarding Quantum Machines

Trapped ion technology necessitates the cooling of atoms to near-zero kelvin and trapping them using electric fields.

For context, zero kelvin isn’t zero degrees but a chilling negative 459 degrees Fahrenheit. At this icy temperature,

molecular activity halts, and particles freeze in place, devoid of kinetic energy.

Quantum computers demand a stable environment close to zero kelvin to operate efficiently with minimal thermal

interference. The slightest warmth or vibration can induce errors, hence these systems are typically ensconced in

refrigerators equipped with cryogenic cooling mechanisms sustaining temperatures near zero kelvin. Achieving absolute zero, the theoretically lowest attainable temperature, remains an elusive pursuit.

Hence, facilitating quantum computer access via the cloud emerges as the optimal solution, known as quantum computing

as a service (QaaS), ensuring these machines are housed in stable, near absolute zero conditions. IonQ extends QaaS

subscriptions through cloud providers such as Amazon.com Inc. AWS, Google Cloud, and Microsoft Co. Azure to researchers and developers.

Revenue Generation at IonQ

IonQ harnesses a revenue stream. Despite reporting a loss of 18 cents per share in Q2 of 2024, revenues skyrocketed by

1086.4% YoY to $11.38 million, surpassing consensus estimates of $8.66 million. Revenue generation stems from QaaS

subscriptions and research contracts, with the company securing $9 million in new bookings. Despite a net loss of

$37.6 million, IonQ boasts $402 million in cash and cash equivalents.

Anticipating Q3 2024 revenue within the $9 million to $12 million bracket against a consensus estimate of $10.26

million, IonQ projects full-year 2024 revenue spanning $38 million to $42 million, surpassing consensus estimates of

$39.42 million.

CEO Peter Chapman lauded this quarter as significant for IonQ’s commercial pursuits, highlighting milestones like

securing a system design project with ARLIS (the Applied Research Laboratory for Intelligence and Security) and an

extension of their system access deal with AWS.

Recent Contract Wins

On September 9, 2024, IonQ inked a $9 million pact with the University of Maryland to provide cutting-edge quantum

computing access to the National Quantum Lab in Maryland. Subsequently, on September 27, 2024, IonQ clinched the

largest U.S. quantum contract of 2024, totaling $54.5 million with the United States Air Force Research Lab (AFRL),

propelling year-to-date bookings to $72.8 million and reiterating guidance in the $75 million to $95 million range

for full-year 2024.

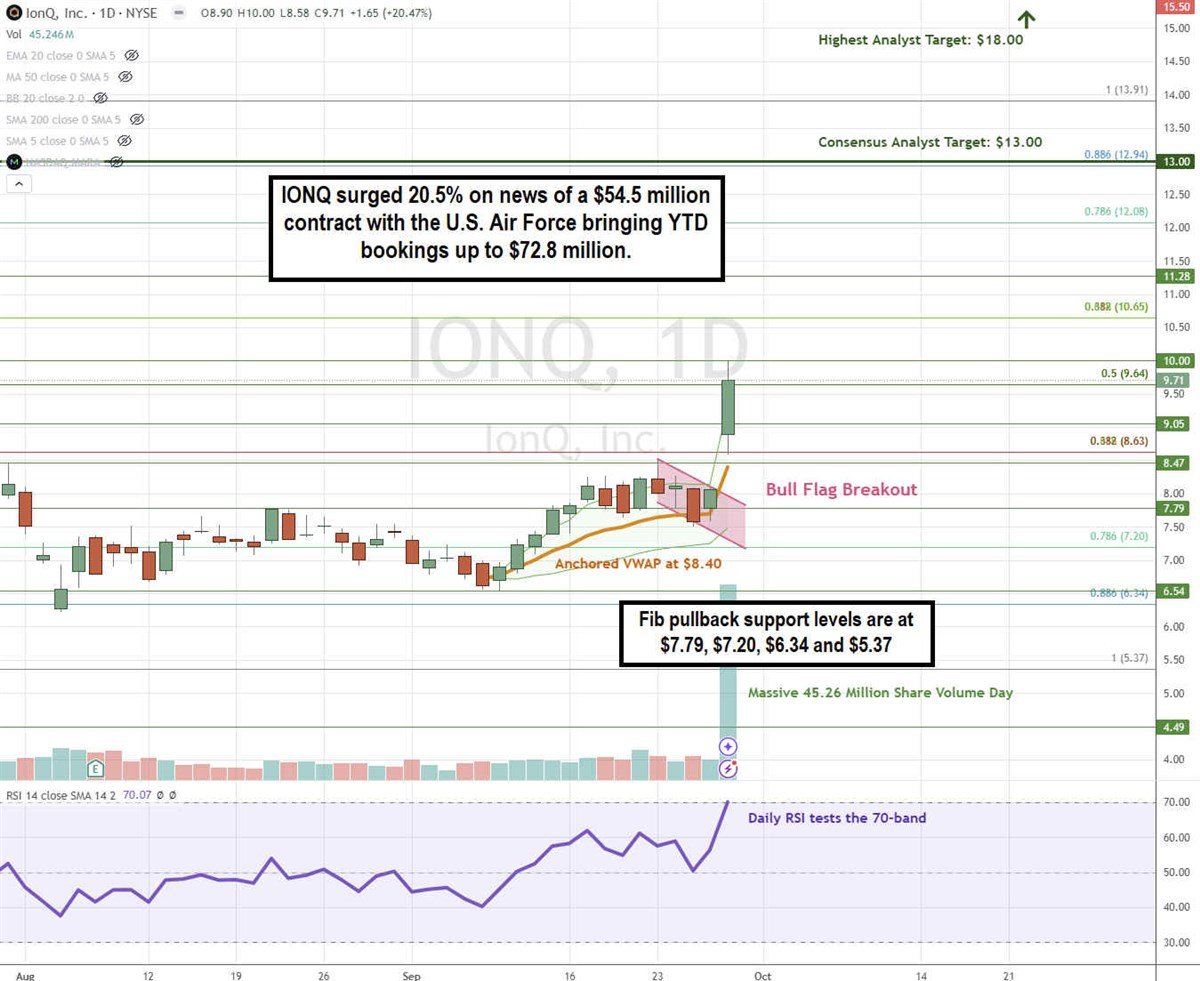

IONQ Stock Soars with Bull Flag Breakout

A bull flag unfurls as the stock breaches upper descending trendline resistance.

IONQ sparked the bull flag breakout on September 27, 2024, following the announcement of the $54.5 million U.S. Air Force

contract. This development catalyzed a 20.5% surge in share price on a volume of 45.26 million shares, igniting the

breakout. Daily anchored VWAP support rests at $8.40. The daily relative strength index (RSI) surged to the 70-band.

Fibonacci (Fib) pullback supports are positioned at $7.79, $7.20, $6.34, and $5.37.

With an average consensus price target of $13.80 and a peak analyst price target hovering at $18.00, IONQ garners three

analyst Buy endorsements alongside two Hold ratings.

Actionable Options Strategies: In light of the news surge and robust trading volume, bullish

investors can capitalize on pullbacks through cash-secured puts, leveraging the elevated premiums at Fib pullback

support levels to make strategic entries. Caution is advised given the wide spreads, typically linked to thin

liquidity.

Bullish investors eyeing long-term commitments at a reduced capital outlay can explore out-of-the-money (OTM) directional

LEAPS call options on this speculative stock.

The original article “Is IonQ Leading the Quantum Revolution? Major Deals Fuel Growth”

first appeared on MarketBeat.

© 2024 Benzinga.com. Benzinga does not offer investment advice. All rights reserved.