Within the realm of industrial investments, there are hidden gems waiting to be discovered. Oppenheimer, renowned for navigating the complex seas of market dynamics, has singled out four stocks deemed as tactical buys with great potential.

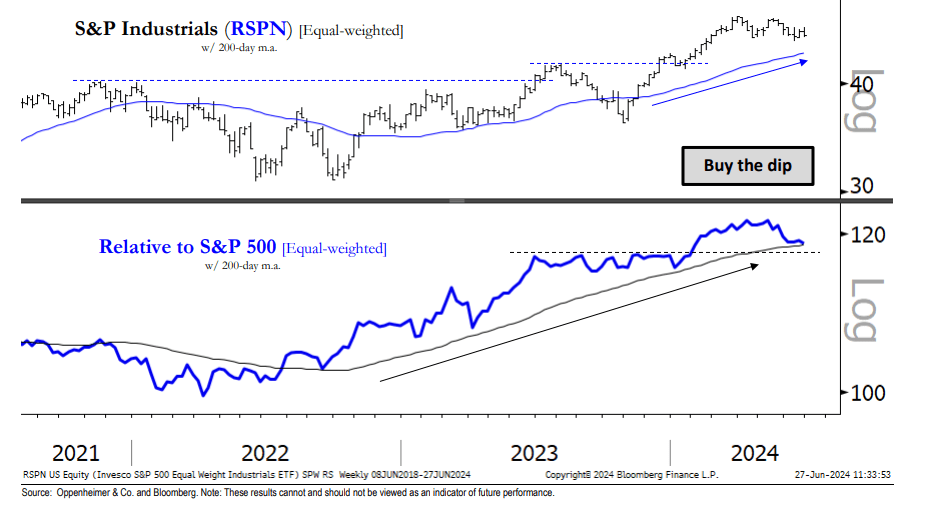

In a recent revelation by Oppenheimer Technical Analysis, the S&P 500 Equal Weight Industrials ETF (NYSEARCA:RSPN) has emerged as a beacon of hope, showcasing “key leadership” throughout the bullish wave by skillfully ascending on a relative basis, akin to a seasoned mountaineer conquering new peaks.

Analyst Ari H. Wald emphasized the significance of sector rotation, terming it as “a hallmark of a healthy advance.” This strategic maneuver ensures that leadership is diversified, guarding against groups that may dangerously extend themselves beyond their limits.

The industrial sector has gracefully corrected itself through its 200-day average, now glimmering with a bullish slope beckoning investors towards a window of opportunity to dive into the churning waters of long-term strength, akin to a skilled surfer catching the perfect wave.

These exceptional opportunities have been identified by Oppenheimer analysts as “outperform” stocks:

- Uber Technologies, Inc. (UBER) – Rated as a Buy

- XPO, Inc. (XPO) – Rated as a Buy

- Republic Services, Inc. (RSG) – Rated as a Buy

- Knife River Corp. (KNF) – Rated as a Buy

Exploring Further into Opportunities with Invesco S&P 500 Equal Weight Industrials ETF: