After posting favorable results for its fiscal second quarter on Thursday, investors may be wondering if it’s time to buy shares of Lamb Weston’s (LW) stock. In recent years, Lamb Weston has emerged as a market favorite, drawing parallels to renowned consumer food companies such as General Mills (GIS) and Hormel Foods (HRL).

Lamb Weston is a leading supplier of frozen potato products in North America and has made its mark globally as well. Let’s delve into whether this is an opportune moment to consider investing in Lamb Weston’s stock following its impressive Q2 performance.

Q2 Review & Highlights

Lamb Weston CEO Tom Werner highlighted the company’s solid financial performance in the quarter, attributed to effective execution across customer channels in North America and key international markets. This success was driven by inflation-driven pricing actions, improvements in customer and product mix, and cost-saving enhancements in the supply chain.

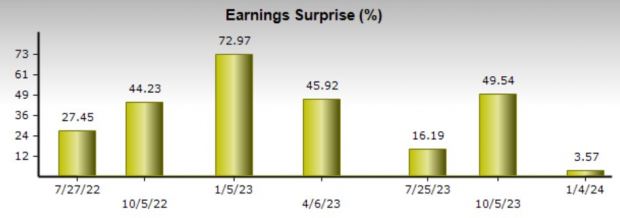

Lamb Weston’s net sales surged 36% year over year to $1.73 billion, surpassing the Zacks consensus by 2%. Meanwhile, adjusted net income climbed 17% to $212 million, with earnings per share increasing by 13% to $1.45, exceeding expectations by 3%.

Other noteworthy highlights for the quarter included Lamb Weston repurchasing $50 million of common stock and boosting its quarterly dividend by 29% to $0.36 per share.

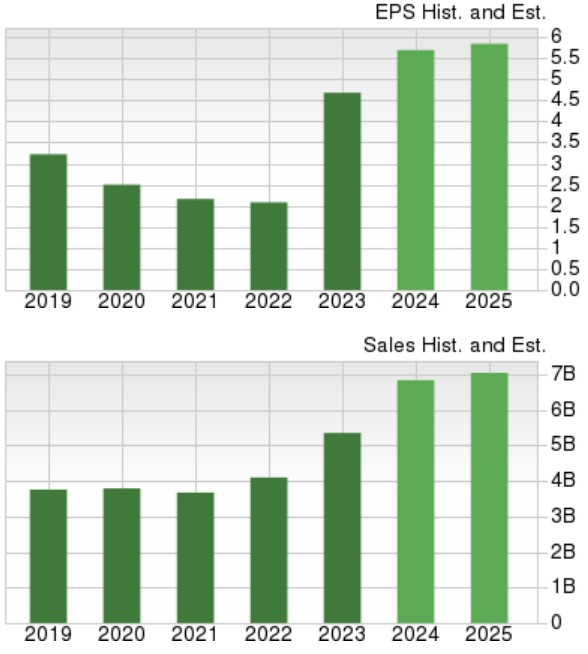

For its full-year 2024 outlook, Lamb Weston raised its adjusted net income target from $805-$875 million to $830-$900 million, translating to earnings per share of $5.70-$6.15, and reaffirmed its net sales target of $6.8-$7 billion and adjusted EBITDA target of $1.54-$1.62 billion.

Image Source: Zacks Investment Research

Growth & Outlook

According to Zacks estimates, Lamb Weston’s annual earnings are projected to grow by 25% in fiscal 2024 to $5.84 per share, up from $4.68 per share in 2023. Additionally, total sales are expected to increase by 28% to $6.85 billion this year, compared to $5.35 billion in the previous year. Sales for fiscal 2025 are anticipated to see a further 5% uptick to over $7.1 billion.

Image Source: Zacks Investment Research

Recent Performance

While other consumer food stocks have faced challenges in the past year, Lamb Weston’s stock has seen a respectable uptick of +10%, outshining the Zacks Food-Miscellaneous Markets’ -6% and significantly surpassing General Mills’ -22% and Hormel Foods’ -30%. Over the past three years, Lamb Weston’s stock has soared +40%, eclipsing the S&P 500’s +26% and outperforming its Zacks Subindustry’s -2%, General Mills’ +12%, and Hormel Foods’ -29%.

Image Source: Zacks Investment Research

Bottom Line

Lamb Weston’s stock currently holds a Zacks Rank #3 (Hold). However, the company’s raised EPS guidance could potentially trigger upward revisions in annual earnings estimates in the coming weeks, possibly paving the way for a buy rating. The outlook for Lamb Weston looks even more promising following its Q2 report.