Investors often lean on analyst recommendations when contemplating buying, selling, or holding a stock. These recommendations, hailing from the brokerage world, have the potential to sway market sentiment and consequently impact a stock’s price. But just how much stock should one put in these recommendations?

Before we dissect the credibility of brokerage recommendations and how to leverage them to your advantage, let’s gauge the sentiment of Wall Street concerning Nvidia (NVDA).

Wall Street’s Perceptions of Nvidia

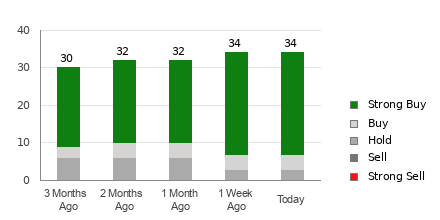

Nvidia currently boasts an average brokerage recommendation (ABR) of 1.23, graded on a scale from 1 to 5 (ranging from Strong Buy to Strong Sell). This number is derived from the concrete recommendations (Buy, Hold, Sell, etc.) given by 37 brokerage firms. The ABR of 1.23 places it between Strong Buy and Buy.

Of the 37 recommendations contributing to the ABR, 31 tout it as a Strong Buy, while three label it as a Buy. This tallies up to 83.8% and 8.1% of all recommendations, respectively.

Broader Trends in Brokerage Recommendations for NVDA

Despite the ABR endorsing an Nvidia buy, it would be imprudent to base investment decisions solely on this information. Research has consistently shown the limited success of brokerage recommendations in guiding investors towards stocks with the most promising price appreciation. Why is that?

The analysts employed by brokerage firms often harbor a strong bias in favor of the stocks they cover due to their employer’s vested interest. Studies reveal that for every “Strong Sell” recommendation, brokerage firms assign five “Strong Buy” recommendations. Their interests aren’t always aligned with those of retail investors, and their ratings rarely serve as reliable indicators of a stock’s future price movement. Thus, it may be wiser to use this information as a means of corroborating your personal research or as a supplement to a proven method of predicting stock prices.

Zacks Rank, our exclusive stock rating tool with an externally audited track record, classifies stocks into five categories ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This tool effectively predicts a stock’s price performance in the coming future. It may, therefore, be judicious to validate the ABR using the Zacks Rank to inform your investment decisions.

Distinctive Features of ABR and Zacks Rank

Although both the ABR and Zacks Rank are rated on a scale of 1-5, they carry distinct meanings.

The ABR is computed solely based on brokerage recommendations, typically displayed with decimals (e.g., 1.28). Conversely, the Zacks Rank is a quantitative model that enables investors to leverage the power of earnings estimate revisions. It’s expressed in whole numbers ranging from 1 to 5.

Brokerage analysts have historically been excessively bullish in their recommendations, frequently issuing ratings that are more favorable than their research would warrant, due to their employers’ vested interest. Consequently, they tend to mislead investors more often than guide them. In contrast, earnings estimate revisions form the crux of the Zacks Rank, and empirical evidence demonstrates a strong correlation between trends in earnings estimate revisions and short-term stock price movements.

Moreover, the different grades within the Zacks Rank are appropriately allocated to stocks for which brokerage analysts provide current-year earnings estimates, thereby maintaining balance across the five ranks.

There is a significant distinction in the timeliness of the ABR and Zacks Rank. While the ABR may not always be up-to-date, the Zacks Rank promptly reflects brokerage analysts’ ongoing revisions of their earnings estimates in response to shifting business trends. Consequently, the Zacks Rank consistently proves timely in its ability to predict future stock prices.

Investing in NVDA: An Overview

In terms of earnings estimate revisions for Nvidia, the Zacks Consensus Estimate for the current year has shown a 0.1% increase over the past month, settling at $12.31.

Analysts’ increasing optimism regarding the company’s earnings prospects, evidenced by a strong consensus in upwardly revising EPS estimates, may well set the stage for the stock to surge in the immediate future.

The substantial change in the consensus estimate, along with three other associated factors related to earnings estimates, has garnered Nvidia a Zacks Rank #2 (Buy). To view the complete list of Zacks Rank #1 (Strong Buy) stocks, please visit here.

Therefore, the Buy-equivalent ABR for Nvidia may serve as a valuable reference point for investors to consider.

Read the full article on Zacks.com for a more detailed analysis.