MercadoLibre MELI is scheduled to release its fourth-quarter 2024 results on Feb. 20.

For the fourth quarter, the Zacks Consensus Estimate for revenues is pegged at $5.84 billion, suggesting a rise of 37.11% from the prior-year quarter’s reported figure.

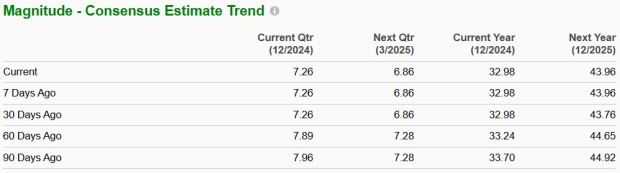

The Zacks Consensus Estimate for fourth-quarter earnings is pegged at $7.26 per share, suggesting a jump of 123.8% from the year-ago reported figure. The estimate has been unchanged over the past 30 days.

Image Source: Zacks Investment Research

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Earnings Surprise History

MercadoLibre has a mixed earnings surprise history. In the last reported quarter, the company delivered a negative earnings surprise of 30.52%. The company’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters while missing the same twice, the average negative surprise being 14.86%.

MercadoLibre, Inc. Price and EPS Surprise

MercadoLibre, Inc. price-eps-surprise | MercadoLibre, Inc. Quote

Earnings Whispers for MELI

Our proven model does not conclusively predict an earnings beat for MercadoLibre this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is not the case here. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

MercadoLibre has an Earnings ESP of 0.00% and carries a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Key Factors to Influence MecadoLibre Q4 Results

The e-commerce giant’s fourth-quarter performance is likely to have benefited from its strengthened logistics network, with the recent addition of six new fulfillment centers in third-quarter 2024 (five in Brazil and one in Mexico) is expected to have enhanced delivery capabilities and customer experience. The expanded fulfillment infrastructure, while pressuring margins in the short term, might have supported long-term growth objectives. The Zacks Consensus Estimate for commerce revenues is pegged at $3.47 billion.

The company’s fintech segment, particularly Mercado Pago, is likely to have maintained its growth trajectory following the third quarter’s strong performance where credit card TPV grew 166% year over year. However, investors should note that the accelerated credit portfolio growth and shift toward credit cards may continue to pressure NIMAL spreads in the near term. The Zacks Consensus Estimate for commerce revenues is pegged at $3.47 billion.

The recently revamped loyalty program, MELI+, with its two-tier structure (Essencial and Total) launched in the third quarter, is expected to have driven user engagement and retention in the fourth quarter. However, the program’s impact on margins warrants attention as the company balances growth with profitability. While MercadoLibre’s advertising business continues to show promise, with third-quarter 2024 reaching 2% of GMV, the segment’s growth rate may face tough year-over-year comparisons. The core e-commerce operations are likely to have maintained solid growth, supported by the company’s strengthened brand presence and improved user experience.

Macroeconomic conditions in key markets, particularly Brazil’s interest rate environment and Argentina’s economic situation, remain important factors to monitor. While the company has demonstrated resilience, these external factors might have impacted consumer behavior and credit performance.

Given these mixed factors and the stock’s recent performance, investors might have benefited from a cautious approach despite MercadoLibre’s strong market position and growth prospects. The company’s longer-term outlook remains positive, but near-term volatility and margin pressures suggest waiting for a more attractive entry point or maintaining current positions rather than adding exposure at current levels.

Key Metrics Estimates for Q4

The Zacks Consensus Estimate for gross merchandise volume is pegged at $14.7 billion.

The consensus mark for total payments volume is pegged at $59.79 billion.

The consensus mark for the number of successful items sold is pegged at 505 million. The same for the number of successful items shipped is pegged at 453 million.

MELI Price Performance & Stock Valuation

MercadoLibre shares have gained 19.3% in the past year, underperforming the Zacks Retail-Wholesale sector and the S&P 500 index’s return of 31.2% and 23.3%, respectively.

MercadoLibre faces tough competition from Amazon AMZN, Walmart WMT and AliExpress, owned by Alibaba BABA, among others. Shares of AMZN, WMT and BABA have rallied 34.9%, 83.2% and 68.8%, respectively, in the year-to-date period.

1-Year Performance

Image Source: Zacks Investment Research

Now, let us look at the value that MercadoLibre offers investors at current levels.

Currently, MELI is trading at a premium with a trailing 12-month P/S of 4.11X compared with the Zacks Internet – Commerce industry’s 1.91X, reflecting a stretched valuation at present.

MELI’s P/S F12M Ratio Depicts Stretched Valuation

Image Source: Zacks Investment Research

Investment Thesis

MercadoLibre presents a compelling long-term growth story in Latin American e-commerce and fintech, but investors might want to hold current positions or await a better entry point ahead of fourth-quarter 2024 results. While the company’s strategic investments in logistics, credit portfolio expansion and enhanced loyalty programs signal strong growth potential, near-term margin pressures and macroeconomic headwinds in key markets warrant caution. The recent acceleration in credit card issuance and fulfillment center expansion, though promising for future growth, may continue to impact profitability in the short term. Current valuations suggest limited upside potential until these investments begin yielding stronger returns.

Conclusion

While MercadoLibre maintains its leadership position in Latin American e-commerce and fintech, investors might consider holding current positions or awaiting a more attractive entry point ahead of fourth-quarter 2024 results. Despite strong operational momentum, near-term margin pressures from strategic investments and macroeconomic uncertainties in key markets suggest a cautious approach until these initiatives demonstrate clearer profitability improvements.

Just Released: Zacks Top 10 Stocks for 2025

Hurry – you can still get in early on our 10 top tickers for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2025. You can still be among the first to see these just-released stocks with enormous potential.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

MercadoLibre, Inc. (MELI) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report