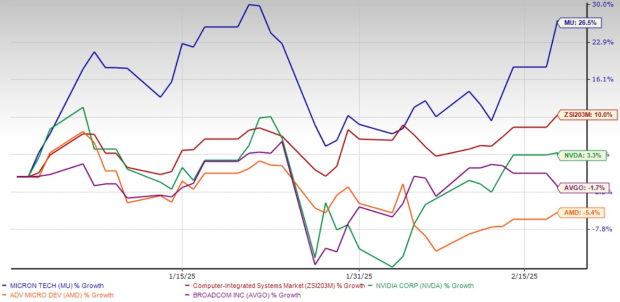

Micron Technology, Inc. MU has been on a strong rally in 2025, with its stock soaring 26.5% year to date, significantly outperforming the Zacks Computer – Integrated Systems industry and major semiconductor players like NVIDIA Corporation NVDA, Advanced Micro Devices, Inc. AMD and Broadcom Inc. AVGO. This impressive surge has been fueled by AI-driven demand for high-bandwidth memory (HBM) and positive news surrounding its strategic partnerships.

YTD Price Return Performance

Image Source: Zacks Investment Research

However, short-term risks — including margin contraction, weakening consumer demand and geopolitical uncertainties — suggest that now may be the right time to book profits rather than chase further upside. Despite the long-term potential, Micron’s near-term challenges could lead to volatility, making selling the stock a prudent move for now.

Micron’s AI Tailwinds Have Driven the Rally

Micron’s rally has been fueled by multiple positive catalysts, particularly in the AI and HBM markets. A major boost came from NVIDIA’s announcement during CES 2025, confirming Micron as a key supplier for its GeForce RTX 50 Blackwell GPUs. This partnership solidified Micron’s positioning in the HBM market, driving increased investor confidence.

Additionally, Micron revealed plans for a new HBM advanced packaging facility in Singapore, set to begin operations in 2026 with further expansions by 2027. This move aligns with Micron’s AI-driven growth strategy, ensuring diversified supply chains and increased packaging capacity for high-performance memory chips.

While these announcements bolstered sentiment, the stock’s rally now appears stretched, and recent warnings from Micron’s management on margin pressures raise concerns about near-term profitability.

Micron’s Q3 Margin Warning Raises Red Flags

Despite maintaining its second-quarter fiscal 2025 guidance, Micron’s CFO Mark Murphy recently cautioned that third-quarter gross margins would decline by several hundred basis points sequentially. This caught analysts off guard, as they had previously anticipated stable margins.

The expected margin contraction is driven by a shift toward lower-priced consumer products and underutilization of NAND production capacity. While Micron is optimistic about long-term demand, lower profitability in the near term makes the stock less attractive.

Reflecting these concerns, analysts have already started lowering their earnings estimates. The Zacks Consensus Estimate for third-quarter EPS was revised downward by 4 cents to $1.54, while full-year EPS projections for fiscal 2025 were cut from $6.90 to $6.83 over the past week. If margin pressure persists, further downward revisions could weigh on the stock.

Image Source: Zacks Investment Research

Despite the near-term profitability concerns, Micron has a strong history of beating earnings estimates. The company surpassed the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average surprise being 72.3%.

Micron Technology, Inc. Price, Consensus and EPS Surprise

Micron Technology, Inc. price-consensus-eps-surprise-chart | Micron Technology, Inc. Quote

Weak Consumer Demand Poses a Major Risk for Micron

Beyond AI and data centers, Micron’s business is still significantly tied to traditional consumer markets, including personal computers (PCs) and smartphones, both of which are seeing sluggish demand recovery.

In the first quarter of fiscal 2025, Micron’s Embedded Business Unit, which includes mobile memory, saw revenues decline 10% sequentially. The company expects low-single-digit growth in smartphone shipments and mid-single-digit growth in PC sales for 2025. These weak projections suggest that a full recovery in Micron’s consumer-driven segments is still far off, limiting the upside for its DRAM and NAND sales.

Additionally, major PC manufacturers are adjusting their memory purchases downward in response to softening consumer demand, which could weigh on Micron’s revenue growth in the coming quarters.

Geopolitical Tensions Remain a Major Threat for Micron

One of the biggest risks looming over Micron is its exposure to the ongoing U.S.-China trade war. The U.S. government, along with Japan and the Netherlands, has placed increasing restrictions on China’s ability to develop advanced semiconductors, and China has retaliated by limiting business with certain U.S. chipmakers.

Micron generates approximately 11% of its total revenues from China, making it particularly vulnerable to any escalation in trade tensions. If China further restricts U.S. chip imports, Micron could see a meaningful revenue hit, putting additional pressure on its financial performance.

While Micron has attempted to diversify its supply chain, these geopolitical headwinds remain an unpredictable and uncontrollable risk, making the stock inherently more volatile than some of its peers.

Conclusion: Sell Micron Stock for Now

Micron’s 26.5% YTD rally has been impressive, but the stock now faces multiple near-term risks that could limit further upside. Margin contraction, weakening consumer demand and geopolitical uncertainties all present serious headwinds, making it a good time to lock in profits before potential downside materializes.

While Micron’s long-term AI-driven growth prospects remain promising, short-term fundamentals suggest that the stock is overextended. Selling the stock now and waiting for a better re-entry point after a potential pullback is the most prudent strategy. Currently, MU carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report