While the rise to ultimate political power of President Donald Trump undoubtedly sparks a range of sentiments, among cryptocurrency investors, the consensus is largely favorable.

A vocal proponent of decentralized digital assets throughout the campaign trail, Trump previously signaled the intention to issue executive orders to foster a more conducive environment for crypto firms. It’s this fundamental catalyst that undergirds the longer-term narrative of blockchain miner Riot Platforms Inc RIOT.

From an economic standpoint, the digital asset market is exciting because of the introduction of a new frontier. With young workers increasingly investing in virtual currencies, the sector will likely continue expanding. However, due to the enormous energy consumption of blockchain mining protocols, this frontier doesn’t come cheap, nor is it free from sharp criticism. Therefore, it’s imperative that government bodies introduce favorable legislation.

To be fair, the emotions vested in Trump 2.0 create wildness in crypto pricing behaviors. Nevertheless, the president in prior interactions has a history of keeping his cards close to his chest. In the long run, a jubilant crypto market would help Trump secure the young voting base for Republicans. Politically, there’s every incentive to keep his blockchain-related promises — and that should be good news for RIOT stock.

Strength May Beget More Strength for RIOT Stock

Beyond the political realm, another factor that could smile on RIOT stock is the technical and statistical backdrop. Essentially, positive sentiment in RIOT tends to inspire even more optimism. Thus, positioning oneself in the current consolidation phase may turn out to be lucrative down the line.

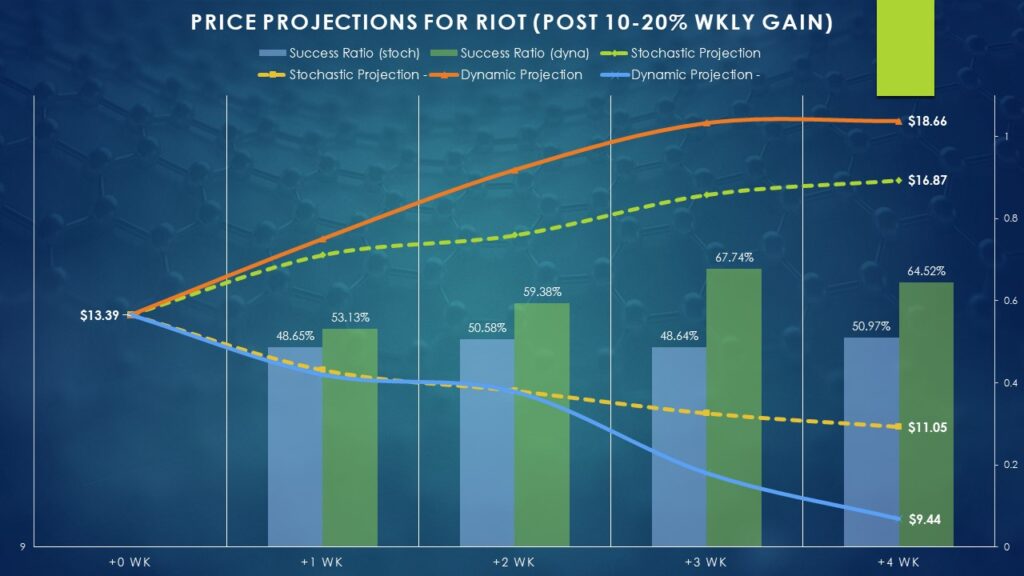

At first, circumstances don’t appear to be particularly promising for RIOT stock. When viewed stochastically or devoid of outside context beyond the temporal, RIOT features a neutral to slightly negative bias. On a week-to-week basis, bulls have a 48.65% chance (based on price action over the trailing five years) of seeing a positive return. On a four-week basis, the odds improve slightly to 50.97%.

However, the market is a conduit of human emotions. For RIOT stock, there’s a tendency for extremely strong performances to spark what is colloquially known as FOMO or the fear of missing out. Specifically, whenever RIOT prints a 10% to 20% one-week gain, there’s a 64.52% chance that by the end of the fourth subsequent week, traders will enjoy a positive return.

Interestingly, the median return during these positive outcomes is quite high at 39.38%. Ordinarily, such a robust projected target may draw skepticism and rightfully so. However, it’s interesting that at this moment, RIOT stock appears to be charting a bullish flag formation. If so (and it is a big “if”), the ensuing move could be explosive.

Also Read: Dogecoin Drops 6% After DOGE Department Removes Logo

Riot Platforms Effectively is a Binary Proposition

While the broader crypto ecosystem is wildly volatile, at this juncture, the narrative for RIOT stock appears to be net bullish. The political, fundamental, technical and statistical catalysts generally align favorably for the blockchain miner. However, when it comes to the forecasted output, RIOT is effectively a binary proposition.

There’s really no way around this point. If RIOT stock is to rise, it will likely do so explosively. If it’s going to fall, it’s jumping without a parachute. Understanding the stark contrasts, aggressive traders may consider an options strategy known as the bull call spread. A multi-leg transaction, the bull call spread involves buying a call option and simultaneously selling a call at a higher strike price (for the same expiration date).

The idea behind this debit call spread is for the target security to rise to the short strike price, thereby triggering the maximum reward. To be fair, the payout is capped at the short strike. However, the main benefit is that the credit received from the short call partially offsets the debit paid for the long call. Therefore, the trader receives a discount for a net bullish position.

With the intelligence gathered earlier, there’s a solid chance that by the close of Feb. 14, RIOT stock may reach $18.66 (which is 39.38% above last Friday’s close of $13.39). Admittedly, that’s a high benchmark. Smart traders can still potentially pick up a big payout with a 13.50/15.00 bull call spread (buy the $13.50 call, sell the $15 call).

This way, RIOT only has to rise 12% from Friday’s close over the next three-and-a-half weeks. Given the historical price action and behavioral tendencies, this strategy is risky but rational.

Read Next:

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.