President Donald Trump’s Liberation Day is living up to its name, though perhaps not in the way the administration envisioned. Thanks to last week’s sweeping wave of tariffs, technical analysts have sounded the alarm about the potential for a steep downturn reminiscent of the Great Depression. Adding to the anxieties is that precious few companies have been spared volatility, not even tech juggernaut NVIDIA Corp NVDA.

While the bulls are mounting a comeback effort on Monday, over the past five sessions, NVDA stock lost roughly 11%. Since the start of the year, equity has slipped 28%, reflecting a dramatic turn of events tied to the post-pandemic recovery. Throughout 2023 and especially 2024, Nvidia saw its valuation skyrocket thanks to demand for its graphics processors, which have undergirded the artificial intelligence revolution.

Unfortunately for the optimists, a combination of competitive pressures, new rivals in the AI ecosystem and unfavorable (at least for now) political frameworks have created a headwind for NVDA stock. As such, market makers are pricing in negative outcomes for NVDA options, which makes perfect sense. If analysts are mentioning the Great Depression, it’s safe to say that sentiment is poor.

However, the pessimism has gotten so rough that the risk profile in certain option spreads has become inverted, so to speak. This backdrop is creating an enticing proposition for clever contrarians.

How To Lose And Still Win With NVDA Stock

For the typical bull call spread strategy — especially one underlying a strong business enterprise like Nvidia — the target equity must rise above a breakeven threshold to be profitable. This makes intuitive sense because the trader is paying a net debit to hopefully realize a specific outcome.

On the other hand, sellers of call spreads are essentially betting against this outcome materializing. These folks start their position from a cash influx because they receive a credit (the debit the call buyer is paying). As such, call spread sellers aren’t necessarily hoping that the security falls in value. Rather, just moving sideways is often good enough for the seller to keep the entire premium received.

What makes the present circumstance unique is that the fear of volatility is so intense that relatively high-payout bull call spreads don’t require NVDA stock to rise. Instead, it just can’t fall too much, which is, frankly, a wildly compelling deal.

Take, for example, the 92/93 bull call spread for the options chain expiring this coming Friday. This transaction involves buying the $92 call (at a time-of-writing ask of $690) and simultaneously selling the $93 call (at a bid of $620). The proceeds from the short call partially offset the debit paid for the long call, resulting in a net cash outlay of $70.

Should NVDA stock stay at or above the short strike price at expiration, the maximum reward comes from the difference between the strike prices (multiplied by 100 shares) minus the cash outlay or $30. That’s a payout of nearly 43% — and NVDA doesn’t have to rise! Currently, the market price is above the short strike price, so NVDA can even decline and still qualify for the full reward.

Of course, the market fluctuates constantly, so exact parameters may change. But currently, because of the tariff turmoil, the risk profile in certain call spreads is inverted. Rather than a traditional debit structure, the aforementioned call spread acts almost like a credit spread—but to the benefit of the debit buyer.

The Compelling Math Behind the Risk Inversion

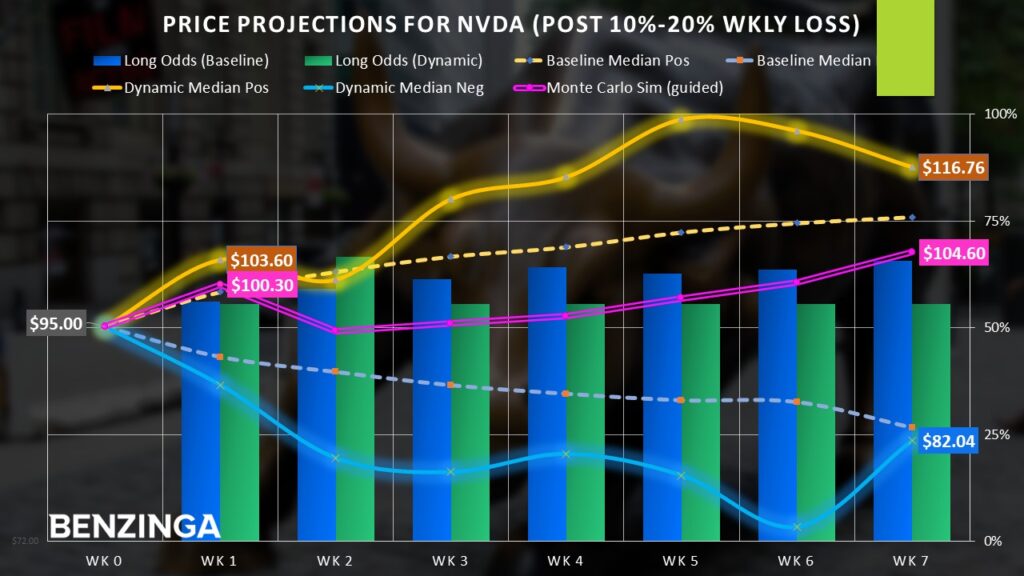

Based on pricing data since January 2019, the probability that any given week will be profitable is 56.13%. This is calculated by taking the number of up weeks divided by the total number of weeks in the dataset. As a baseline, then, the trader enjoys a house advantage when buying the aforementioned 92/93 bull spread expiring this week.

However, the question isn’t whether NVDA stock will rise this week or not. Rather, it’s the odds that NVDA will not drop below $93, the short strike price of the aforementioned call spread. Mathematically, traders spotted a 2% safety margin relative to the time-of-writing price of around $95. Therefore, the odds are focused on whether NVDA will at least do better than lose 2% this week.

On any given week, the chance that Nvidia stock will perform better than a 2% loss is nearly 72%.

Granted, this isn’t a pure arbitrage situation. There’s still risk involved and no guarantee that this call spread will be profitable. If another unprecedented event materializes, then NVDA stock may collapse beyond the magnitude provided by the safety margin.

Still, the bottom line is that the house is giving gamblers both a robust payout and some wiggle room. Such combinations don’t come around too often.

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.