Following China’s DeepSeek impact — an artificial intelligence model that could compete with Western models on capabilities and at a much lower cost — worries abounded regarding its potential negative effect on the tech ecosystem. However, Palantir Technologies Inc’s PLTR gangbusters earnings report helped to recalibrate the compass. Still, rather than chasing the hottest hand of the moment, thinking investors may consider a less-heralded opportunity with Seagate Technology Holdings PLC STX.

Let’s be real here — Seagate is unlikely to generate the buzz of a Palantir or an Nvidia Corp. NVDA in terms of AI relevance. Nevertheless, Seagate plays a critical role in machine intelligence by supplying high-capacity storage solutions that power AI workloads. Obviously, deep learning and other advanced models require enormous amounts of data and Seagate provides the drives that store and process this data efficiently.

Regarding STX stock, Palantir’s individual metrics — such as blowing past revenue and earnings targets — don’t mean much. Rather, it’s the broader implications for the innovation industry that matters. BofA Securities analyst Mariana Perez Mora stated that Palantir’s disclosure revealed that “2024 was only a dress rehearsal.” Mora further emphasized that “the company sees the world ripe for an AI and technology revolution.”

By logical deduction, an AI and tech revolution would lead to more data processing and storage requirements — and that plays right into Seagate’s hands.

Statistical Trends Favor a Bullish Outlook on STX Stock

Another element beyond the enticing fundamentals that favor a bullish outlook on STX stock is its statistical trends. Over the long run, the U.S. stock market features an upward bias. As a rule of thumb, investors will do well to consider individual names that also tend to rise over time. That’s exactly the case with STX.

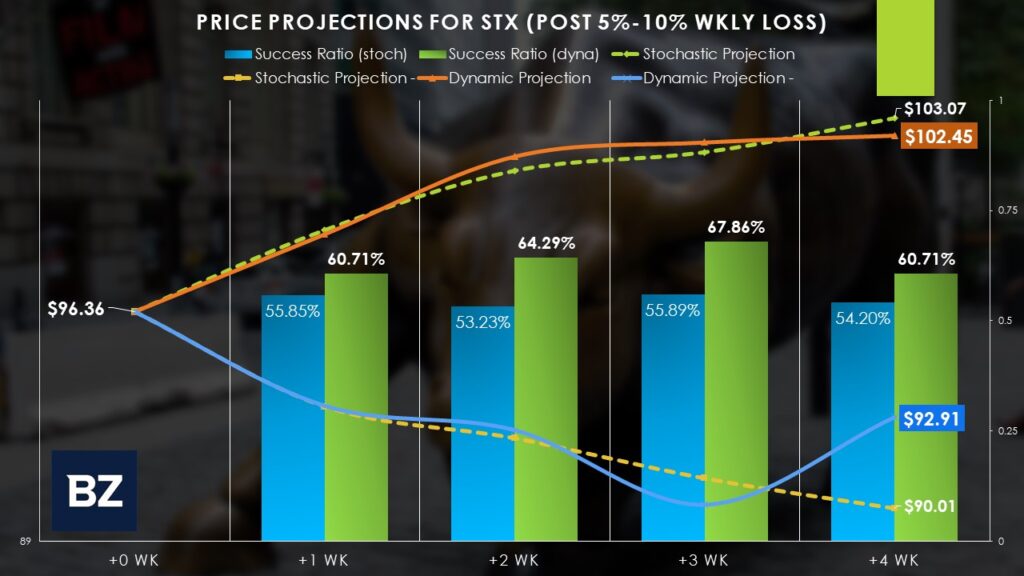

Over the past five years, against a stochastic view — that is, incorporating no other context aside from the temporal — the security has a 55.85% chance that a position entered at the beginning of the week will rise by the end of it. Extend this time period to four weeks and the upward bias only diminishes slightly to 54.2%.

In terms of magnitude of results, positive four-week periods feature a median return of 6.96% while negative periods incur a median loss of 6.59%.

However, the market can respond more vigorously based on unusual fluctuations of the fear-greed continuum. Last week, STX suffered a loss of 8.32%. That’s aberrant because over the past five years, the median loss under negative weeks sits at only 3.41%.

It’s worth noting that under dynamic conditions — in this case, following an extreme-fear event involving a one-week loss between 5% and 10% — the responding long odds improve over the stochastic framework. By the end of the fourth subsequent week following unusual volatility, STX has a 60.71% chance of rising. The median return under positive outcomes is 6.32%, while the median loss under negative scenarios is 3.58%.

Also Read: Coffee Prices Soar Over 100%, Near Historic Rally As Inflation Percolates Through Supply Chain

Plotting an Effective Options Strategy

To be honest, the idea of generating returns of a few percentage points here or there isn’t exactly enticing. However, with the power of multi-leg options strategies, the leverage can be enhanced significantly. One problem, though, is paralysis by analysis. Just how does one go about selecting an appropriate strategy?

With the market intelligence above, this process is much simpler. By the options chain expiring Feb. 28 (four weeks following last week’s extreme-fear event), there is a solid chance that under dynamic conditions, STX may rise to $102.45 or fall to $92.91. As such, an aggressive investor may consider the 95/102 bull call spread.

Under the bull spread, an investor buys a call option (the $95 call in the above case) and simultaneously sells a call (the $102 call). The credit received from the sale of the short call (which is $85 at time of writing) partially offsets the debit paid for the long call (which is $330 at this moment). Therefore, the net debit paid is $245, which also represents the most that can be lost in the trade.

Should STX stock rise to $102 or above, the trader picks up the maximum reward, which is represented by the difference between the strike prices (assuming the options multiplier of 100 shares per every option contract) minus the net debit paid. This comes out to $455 or a payout of 185.71%.

What’s more, the long call of $95 provides some downside protection. Should the trade go awry, traders may be able to salvage some value out of the bull spread, so long as STX stock doesn’t fall below $95. Less-aggressive investors may choose to consider lower long strikes (as well as short strikes) to improve the odds of success. However, such approaches will usually accompany a greater cash outlay and/or a lesser payout.

Read Next:

Photo: JHVEPhoto/Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.