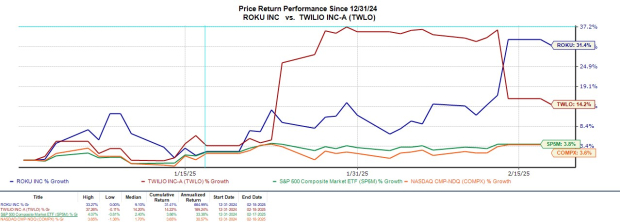

As we progress through February, investors may notice that Roku ROKU and Twilio TWLO have been two of the hottest stocks so far this year.

Year to date, ROKU has soared over +30%, with TWLO up +14%. That said, let’s see if it’s still time to buy Roku or Twilio stock after releasing their Q4 results last Thursday.

Image Source: Zacks Investment Research

Roku’s Q4 Review

As the leading TV streaming platform provider in North America, Roku’s Q4 sales increased 22% year over year to $1.2 billion versus $984.43 million in the prior year quarter. Surpassing Q4 sales estimates of $1.14 billion, Roku has exceeded top-line expectations for 10 consecutive quarters.

More importantly, Roku posted a much narrower-than-expected loss of -$0.24 a share, with the Zacks EPS Consensus calling for an adjusted loss of -$0.44. This was also a sharp increase from an adjusted loss of -$0.55 a share in Q4 2023. Roku has beaten earnings expectations for five straight quarters, with the company edging closer to profitability after going public in 2017.

Image Source: Zacks Investment Research

Twilio’s Q4 Review

Allowing developers to operate real-time communications within software applications, Twilio’s Q4 sales were up 11% YoY to $1.19 billion compared to $1.07 billion in the comparative quarter. Slightly edging Q4 sales estimates, Twilio has beaten its top-line expectations in every quarter since the company went public in 2016.

However, Q4 EPS of $1.00 did miss expectations of $1.02 despite spiking 16% from $0.86 a share in the prior period. Still, Twilio has exceeded earnings expectations in three of its last four quarterly reports with an average EPS surprise of 17.79%.

Image Source: Zacks Investment Research

Roku & Twilio’s Full-Year Results

Rounding out fiscal 2024, Roku’s total sales spiked 18% to $4.11 billion from $3.48 billion in 2023. Annual earnings were at a loss of -$0.89 per share from -$5.02 in 2023.

Pivoting to Twilio, total sales rose 7% to $4.45 billion. Twilio’s annual earnings soared 50% to $3.67 per share from EPS of $2.45 in 2023.

Tracking Roku & Twilio’s Outlook

Offering revenue guidance for FY25, Roku expects its total sales to increase 12% this year to $4.61 billion. Based on Zacks estimates, Roku’s sales are projected to expand another 13% in FY26 to $5.22 billion. Roku also expects its total gross profit to be $2 billion this year with adjusted EBITDA projected at $350 million.

Notably, Roku aims to achieve positive operating margins by 2026, with Zacks projections calling for EPS of $0.10 next year, and FY25 earnings currently projected at an adjusted loss of -$0.80. Reassuringly, FY25 and FY26 EPS estimates are nicely up in the last 30 days.

Image Source: Zacks Investment Research

As for Twilio, it offered guidance for the first quarter, with Q1 sales expected at $1.13-$1.14 billion, which would reflect 8% to 9% growth. Twilio expects Q1 EPS in the range of $0.88-$0.93 from $0.80 a share in the comparative quarter. Twilio forecasts total sales to increase by 7%-8% in FY25, with the current Zacks Consensus at $4.78 billion or 7% growth. Zacks projections call for Twilio’s sales to increase another 7% in FY26 to $5.13 billion.

For Q1, Twilio expects non-GAAP net income from operations to be $180 million-$190 million, with full-year expectations of $825 million-$850 million. These forecasts translate to the current Zacks Consensus calling for Twilio’s EPS to expand 18% this year to $4.33. Even better, FY26 EPS is projected to rise another 14% to $4.94. While FY25 EPS estimates are slightly down in the last month, FY26 EPS estimates have risen 8%.

Image Source: Zacks Investment Research

Bottom Line

Roku and Twilio’s expansion have remained compelling, with both stocks sporting a Zacks Rank #1 (Strong Buy) at the moment. Although their operating efficiency will need to be monitored, positive earnings estimate revisions for FY26 could extend the rally in ROKU and TWLO.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

Twilio Inc. (TWLO) : Free Stock Analysis Report

Roku, Inc. (ROKU) : Free Stock Analysis Report