Artificial intelligence (AI) has propelled stocks such as Super Micro Computer (NASDAQ: SMCI) and Advanced Micro Devices (NASDAQ: AMD) to astronomical heights in the past year, with gains of 607% and 101% respectively. But a closer examination reveals striking differences in the impact of AI on these companies’ financial performance. While one is experiencing a staggering surge in revenue and earnings thanks to AI, the other is grappling to establish its presence in this sprawling market.

Let’s dissect the prospects of these two AI stocks to identify the more lucrative investment opportunity at this juncture.

Super Micro Computer: Riding the AI Wave

Super Micro Computer (Supermicro) specializes in tailoring AI server solutions, including rackmounts, designed for deploying AI chips from industry leaders such as Nvidia, Intel, and AMD. Experiencing a meteoric rise in demand for its offerings, the company’s revenue soared by an impressive 103% year over year to $3.66 billion in its fiscal 2024 second quarter, with adjusted earnings leaping from $3.26 to $5.59 per share.

Executives attribute this remarkable growth to new customer acquisitions and robust demand from existing clients, driven by escalating orders for Supermicro’s optimized AI computer platforms and rack-scale Total IT Solutions.

Moreover, Supermicro is making significant inroads in the AI server market and now anticipates its fiscal 2024 revenue to range between $14.3 billion and $14.7 billion — a substantial uptick from its previous $10 billion to $11 billion estimate. Impressively, more than half of Supermicro’s total revenue is derived from selling server solutions in the AI sector, a segment projected to witness a compound annual growth rate of 30% through 2027, according to analysts at Gartner.

Seizing this opportunity, Supermicro is aggressively expanding its production capacity. Management disclosed that its new production sites will bolster annual revenue capacity beyond $25 billion. Encouragingly, analysts envisage an annualized 48% earnings growth for the next five years, indicating continued dominance in the AI stock realm for Super Micro Computer.

AMD: Struggling for AI Foothold

Despite an impressive 100% surge in stock value over the past year, AMD’s journey has been largely propelled by hype rather than substantive performance. The company’s fourth-quarter results and imperative signal that its AI business lags significantly behind Supermicro. Despite an optimistic surge in revenue forecasts to $3.5 billion from AI chip sales in 2024, Supermicro’s $14.5 billion revenue projection indicates that AI could drive upwards of $7 billion in annual sales for the server manufacturer.

However, AMD has augmented its AI-related revenue guidance for 2024 following robust initial reception of its family of MI300 Instinct accelerators released in December. CEO Lisa Su stated that they have progressed significantly with supply chain partners and secured additional capacity to fulfill soaring demand, raising hopes of surpassing revenue expectations in the AI domain. Nevertheless, AI remains a relatively minor component of AMD’s overall business, and the company confronts significant challenges in key areas.

Analysts forecast a 14% revenue increase to $26 billion in 2024, significantly slower than Supermicro’s projected growth. Although AMD’s revenue is anticipated to accelerate in 2025, with an expected surge to $32.3 billion, it still lags behind Supermicro’s expected 30% revenue leap next fiscal year. Thus, the scales tip in favor of Supermicro in harnessing the potential of AI compared to AMD.

Valuation: The Deciding Factor

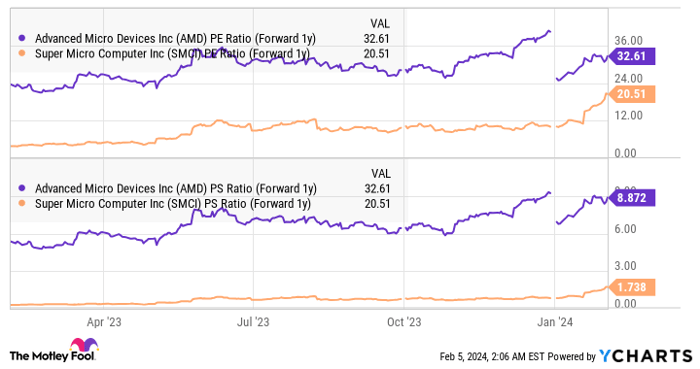

Supermicro’s rapid growth juxtaposed with AMD’s languid pace underscores a compelling argument. Sitting at a modest 3.6 times sales, Supermicro is a more cost-effective investment than AMD, which sports a hefty price-to-sales multiple of 11. Furthermore, Supermicro’s forward valuation multiples are cheaper than AMD’s.

AMD PE Ratio (Forward 1y) chart by YCharts.

Super Micro Computer: A Sleeper AI Stock to Buy Now

The Growth in AI Stocks

Investors seeking the next big thing in the tech sector are increasingly looking at artificial intelligence (AI) stocks, which have boomed in recent years. With the demand for AI-related hardware and solutions on the rise, companies in this space stand to gain significant attention and investment.

The Comparison with AMD

In this context, the comparison of Super Micro Computer with AMD is particularly intriguing. While AMD is a well-known player in the semiconductor industry, Super Micro Computer has quietly been making significant strides in the AI sector. The company’s server solutions have been in high demand, driving substantial growth.

Super Micro Computer as the Better Option

Super Micro Computer emerges as the better AI stock to invest in when compared to AMD. Not only is it attractively priced, but it is also delivering robust growth, fueled by the burgeoning need for its server solutions.

Investment Considerations

Before making any investment decisions, it’s essential to consider various factors. While Super Micro Computer may appear promising, investors should conduct thorough research and analysis before allocating funds. Consulting with financial advisors and considering one’s risk tolerance are prudent steps to take.

Expert Analysis

The Motley Fool Stock Advisor analyst team has offered their insights on potential investment opportunities. It touted 10 stocks as the best options for investors, but notably, Super Micro Computer did not make the cut. While this may give some investors pause, it’s important to note that opportunities for significant returns exist beyond the scope of specific recommendations.