Pulling back from the pullback buy

When it comes to the stock market, buying pullbacks might sound like an easy feat, yet it proves to be a different beast in reality. Timing these pullbacks accurately and wading through emotional swamps in the form of fear and uncertainty can be quite the challenge. Despite the murky waters, those with a discerning eye for opportunity can reap significant rewards. It is crucial to consider the following factors when seeking these pullback opportunities:

The Might of the Prior Uptrend

Buying into stock dips after a robust prior uptrend dramatically heightens the prospect of success, as stocks typically exit consolidations in the same direction they entered. This factor is crucial in distinguishing between buying weakness and a legitimate pullback within an uptrend.

A Balanced Pullback

Not all pullbacks boast the same appeal. The most attractive pullbacks are those that retreat in a controlled and uniform manner. Such retreats not only provide a clear entry point but also indicate that any selling is merely profit-taking, rather than a sign of a stock peak.

A Sturdy Moving Average

A moving average acts as a valuable tool for investors, smoothing out price fluctuations over a set period. It offers a clearer perspective on trends, serves as a risk management tool, and provides a reference point for making informed decisions.

Dry Up of Volume

A decrease in volume during a pullback should be considered bullish, indicating weak selling pressure and a lack of conviction among bears. Investors should look for diminishing volume during pullbacks and a resurgence of volume when the stock attempts to ascend.

Impactful Catalysts

Fundamental catalysts are the main stimulants behind stock and index movements. Investors are best equipped to identify catalyst-driven instruments and time their investments using technical analysis to gain every possible advantage.

Real-Life Lessons from 2023

Explore the application of these factors through three illustrative examples from 2023:

A shining beacon amidst the 2023 market dynamic was the performance of CVNA (Carvana). This used car operator underwent a significant growth phase before experiencing a pullback, rewarding patient investors who capitalized on this temporary decline.

Image Source: Zacks Investment Research

Carvana’s bullish catalyst stemmed from a significant influx of funding, a much-needed boost for a company grappling with cash flow.

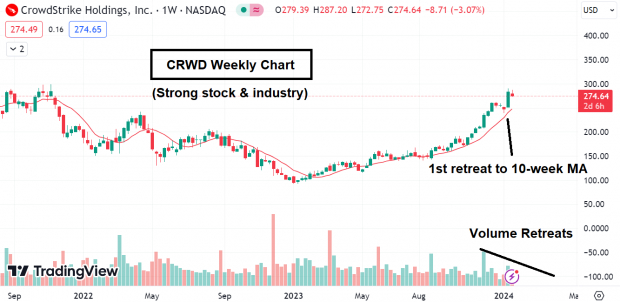

Another standout was CRWD (CrowdStrike Holdings), a leading performer in a top industry group. The company exhibited triple-digit earnings growth in the previous quarter, attracting more companies to avail of its cybersecurity services. Investors were presented with a pullback opportunity when CRWD retreated to the 10-week moving average, providing an advantageous entry point.

Image Source: TradingView

Advance Micro Devices (AMD) benefitted from a surge of bullish catalysts, including growth in AI, new product launches, and strong top and bottom-line performance. Earlier in the year, the stock retracted to its 200-day moving average before a vigorous ascent, catapulting it into the echelons of top market performers.

Image Source: TradingView

Stock Research Opportunities:

Get a comprehensive overview of our picks for just $1!

Several years ago, our members were astounded by our offer of a 30-day access pass to all our picks for just a dollar. No strings attached. While thousands seized this opportunity, many hesitated, suspecting a catch. It’s simple, really; we want you to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more. As of 2023, these services have already closed 162 positions with double- and triple-digit gains.

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Carvana Co. (CVNA) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report