Vanguard is making many investors happy these days. Forty-two of the 86 exchange-traded funds (ETFs) managed by the company have delivered double-digit total year-to-date returns. Sixteen Vanguard ETFs claim total returns of at least 20%. What’s the best-performing Vanguard ETF of 2024 so far?

Top contenders

You might be surprised by some of the top contenders in Vanguard’s family of ETFs. For example, the Vanguard Utilities ETF (NYSEMKT: VPU) ranked as the best-performing Vanguard ETF of 2024 throughout much of the past few weeks. Its total return as of this writing is 25.7%, enough to land it in the third spot among all Vanguard ETFs.

Utility stocks usually aren’t the most exciting performers. However, mounting anticipation that the Federal Reserve would lower interest rates and ultimately an actual rate cut by the Fed provided a nice tailwind for the utilities sector and the Vanguard Utilities ETF.

Image source: Getty Images.

The Vanguard Communication Services ETF (NYSEMKT: VOX) is the second-best-performing Vanguard ETF of the year so far with a total return of 27.3%. Nearly all of this total return is due to share price appreciation since many of the stocks owned by the ETF either pay no dividend or relatively small dividends.

Three stocks have been especially important to the Vanguard Communication Services ETF’s banner year. Facebook parent Meta Platforms makes up 23.2% of the ETF’s portfolio. Its share price has soared roughly 58% year to date. The class A and class C shares of Google parent Alphabet make up a combined 21.1% of the Vanguard Communication Services ETF’s total holdings. Both Alphabet stocks have jumped 21% in 2024.

The best-performing Vanguard ETF so far this year

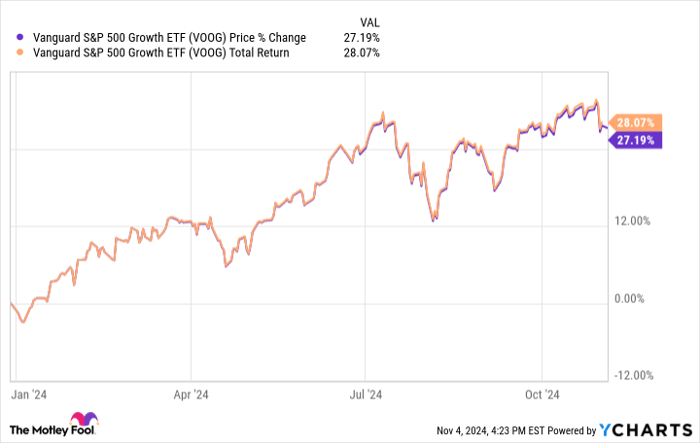

However, no Vanguard ETF is outperforming the Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG) this year. This ETF’s total return tops 28%. Its share price is up over 27% year to date.

The Vanguard S&P Growth ETF attempts to track the performance of the S&P 500 Growth Index. This index includes members of the S&P 500 classified as growth stocks based on sales growth, momentum, and the ratio of earnings growth to share price.

This Vanguard ETF currently owns 234 stocks. Its top five holdings are Apple, Microsoft, Nvidia, Amazon, and Meta. These stocks together make up around 45.8% of the ETF’s portfolio. Nvidia has been an especially big winner this year with its shares skyrocketing 175%.

Since its inception in September 2010, the Vanguard S&P 500 Growth ETF has delivered an annualized average total return of 16%. As is the case with most Vanguard funds, costs haven’t eaten into those returns much. The ETF’s annual expense ratio is a low 0.1%.

Is the Vanguard S&P 500 Growth ETF still a good pick to buy?

There’s no guarantee that the Vanguard S&P 500 Growth ETF can continue to generate such a high total return. The fund’s valuation could be its downfall with the stocks it owns having an average price-to-earnings ratio of 34.4.

Although its portfolio includes a large number of stocks, this Vanguard ETF doesn’t offer as much diversification as many investors might prefer. The ETF’s top holdings make up a large percentage of its total portfolio and tend to move in the same direction.

However, one major reason why the Vanguard S&P 500 Growth ETF’s top stocks have performed well recently is the ongoing surge in demand for artificial intelligence (AI) applications. If you believe that AI demand will continue to grow (which seems likely at this point), this high-flying Vanguard ETF should still be a good pick to buy right now despite its lofty valuation.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $22,469!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,271!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,970!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 4, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keith Speights has positions in Alphabet, Amazon, Apple, Meta Platforms, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.